Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Key data

Founders at the helm with the majority of shares held by them.

Sales growth of 15%.

Niche market with high barriers to entry.

Possibility of extending the business model to other sectors.

Company overview

ALA is a leading supply chain integrator for the aerospace, defense, power generation, rail and high-tech industry.

Headquartered in Naples, Italy, ALA has over 35 years of experience.

Products & services and markets

ALA manages a highly specialised range of products for its customers, including electrical and electronic components, fasteners, hydraulics and other materials.

There is also a focus on a number of niche markets which are:

Aerospace OEM & MRO, provides its services to both the end customer and its supply chain. ALA products are used to build engines, air frame, equipment, systems and cabin interiors.

OEM: Original Equipment Manufacturer.

MRO: Maintenance, Repair and Overhaul.

Defense, is a partner in the most important defence projects and is certified to distribute products for the manufacture of military ground vehicles, naval vessels, military aircraft, weapon systems, fire control systems and tactical communications.

Space, is involved in supplying C-Class components, hardware, and technology to the space mission and satellite launch industry.

Screws, nuts, bolts, and washers are all C-parts. Though these fasteners are small, low-cost and often overlooked, they make up a substantial amount of most companies' inventories. Source: Bossard.com.

Power generation, provider of products for a variety of sectors; on and off-shore, pipeline & distribution, floating production storage & offloading unit (FPSO), refinery, petrochemical, and power generation.

Rail & industrial, supporting production & maintenance requirements of high-speed trains, metro trains, and railway systems. It is also certified to operate industrial automation systems, machine tooling, windmills, etc.

Business model

In 2009 ALA was born from the merger of experience between Franco and Fulvio Scannapieco (AVIO Import) and Vittorio Genna (AIP Italia). Both specialise in material distribution and logistics solutions for the aerospace industry to become a national and international champion.

Essentially, the company takes care of the entire supply chain management of some less strategic but equally necessary and critical materials for its customers.

For its customers, managing these smaller materials, such as screws and other electronic components, is critical to their manufacturing, but their cost in the final product is relatively low and large quantities are required. If an end customer wants to manage these materials, it requires a lot of resource and effort.

What ALA does is take the part that nobody wants and add value by being highly specialised and close to its customers. ALA can save up to 30% of the total cost of ownership (TCO) of managing these categories of materials.

Total Cost of Ownership (TCO): is the purchase price of an asset plus the costs of operation. Source: investopedia.com.

The company generates revenue primarily from two services:

Service provider, manages aerospace materials on behalf of the world's leading manufacturers of structures, components and engines, providing "just-in-time" service. The tasks of the service include: sourcing, demand planning, supplier management, quality control and warehousing activities.

On the other hand, there are the Distribution activities, which consist of trading materials for the major aircraft manufacturers (OEMs) and their numerous first and second level suppliers of parts and assemblies. It also distributes materials to leading customers in the oil and gas, rail and marine sectors.

To carry out all these operations, the company has 20,000 square metres of warehouses and operations centres in 8 countries and a network of around 1,300 suppliers. The company enters into contracts with its customers for 3 to 5 years, which ensures revenue visibility, and with its suppliers for 2 to 3 years. ALA includes clauses to ensure that the materials it buys from its customers are ultimately purchased by them and, with its suppliers, clauses to maintain prices. In this way, in times of inflation, both the customer and the supplier are protected in the short to medium term.

Customers cannot randomly choose any one supplier because a supply cut in these material would stop their production plants and make them lose money for every minute they are down. Therefore, it is imperative that the partner they select is highly credible and functional. It is not by chance that ALA has come to have business relationships with most commercial and military aviation manufacturers.

Market trend

The passenger transport market has grown steadily from Covid to the present day, virtually making up for all that was lost.

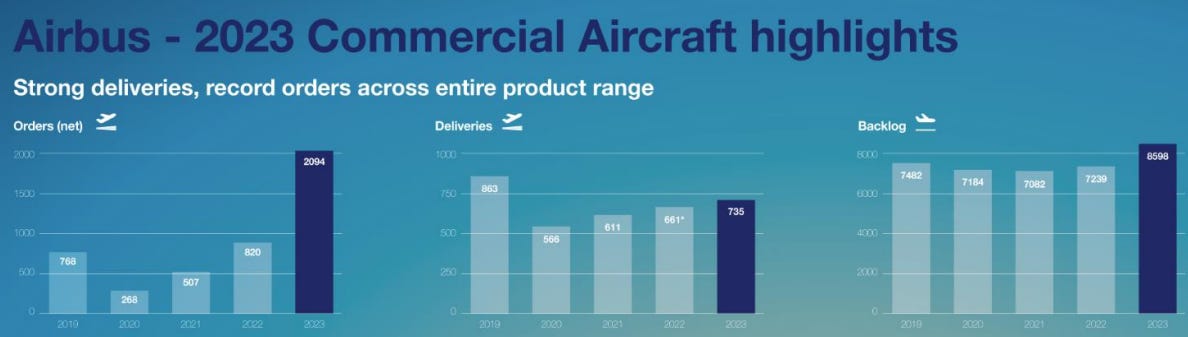

Meanwhile, manufacturers Airbus and Boeing continue to increase their aircraft deliveries and order backlogs, confirming the strong recovery in the sector.

Both companies have recently been working to develop better and more efficient products offering in order to compete for leadership in this oligopolistic market. For example, Airbus already offers the A320 NEO, which is capable of saving 25% on fuel.

However, in recent times Boeing has had technical problems with some of the new models it has launched on the market.

Regarding the Defense sector the order books of the world's largest defence companies have grown by at least 10% over the past two years and are now at record levels. This market with a size in 2024 of more than $2.24 trillion is expected to grow of 3-4% CAGR for the coming years due to the geopolitical complexity of the current scenario.

In the meantime the MRO market is interesting as first $40.1 million flights will be available in 2024 (3% more than 2023) and then there are expected to be fewer retirements of older aircraft due to current supply chain difficulties, problems with some new aircraft models and other components that will delay the delivery of new aircraft.

Finally, it is important to highlight the long-term trend in the sector towards net-zero emissions by 2050. There are undoubtedly major changes on the horizon in terms of engines and fuels, electric propulsion and hydrogen, which will certainly require investment in new technologies and development for the companies involved.

Competition

ALA's competition in the component distribution market is really consolidated.

Two players alone account for 57% of the market and they are followed by six companies with 22% of the market. Finally, there are a large number of companies with revenues of less than $100 million, which account for the remaining 21%.

Looking at this graph, I think that ALA is less likely to be able to consolidate the aviation parts distribution market as it is already an oligopoly of two dominant companies. On the other hand, there are very few competitors that already dominate 79% of the market, so there could be high market barriers to entry for new competitors.

It is worth noting that none of these companies or divisions are publicly listed, with the exception of ALA. However, I have carried out a comparison with one of my preferred C-Parts distribution companies, Bufab and Bossard, which specialises in fastening elements.

It is interesting to see how ALA matches or outperforms on most indicators Bufab and Bossard which are two much larger, well-managed, quality companies with much greater scale.

ALA, being more concentrated in a certain market segment with higher barriers to entry, achieves excellent performance.

Growth strategy

The company focuses on three pillars to grow over the next few years by:

1) Growing within existing customers and especially to move from being a simple distributor to a supply chain manager.

2) Acquiring new customers by entering new markets/regions/products and

3) Doing M&A to accelerate entry into new customers and broaden the product mix. It is well known that it is much quicker to gain customers through acquisitions than to build them from scratch. However, as there is a large part of the market, I believe it will be possible to make these strategic acquisitions in the aerospace and defence sector.

M&A and Expansion

Regarding M&A and expansion activity over the last few years, it has been accelerating in order to gain ground and also to position itself strategically close to its customers' production sites. The US, together with the UK and FR, are particularly relevant.

Competitive advantage

The market in which ALA operates has high barriers to entry. This is because many parts are needed to gain access. We have already noted that one of the key players is XPO Logistics, the only company outside the specialist sector to join this select club.

Perhaps what we could argue is that ALA has a long-standing relationship with its customers and this cannot be measured or bought. You gain this through many years of work, especially in a strategic sector.

Management

The company is 73% owned by its founders (through AIP Italia SpA), which is something I tend to like. Currently that stake is worth $150 million.

The management team is paid a total of around €835 k, which in my opinion is quite modest. I have thoroughly searched for stock-option payments or variable pay for targets achieved but have not found any.

What can go wrong?

My main concern is where the company is heading.

Now the company is small and can easily grow by taking market share away from its competitors, but in 5 years' time, when it is a bigger player, it will be necessary to see how the other participants will react. Will there be a price war with the two dominant suppliers?

However, as it expands into other similar markets, will it have the same margins or will it have to fight more on price? If they are able to develop a strategy towards other segments while maintaining their current MOAT, it is a good idea. In other segments such as Rail, Industrial or Power Generation, my feeling is that it is not so easy to maintain that competitive advantage as there are more companies that can access.

The company has only been on the stock exchange for 4 years and we have little insight into how the management team operates. Now if we look at the charts we see an acceleration in sales and margin but this is only 2 years of recent history.

Ideally we would like to have a track record of 8 to 10 years but no stock is perfect!

Final takeaways

On this occasion, I have used 13% sales growth to calculate performance, which is slightly lower than the historical rate to be conservative. If the company performs well over the next few years, the P/E could rise to 15-17x as the company becomes larger and better known. The company has a growing dividend policy, so in an optimistic scenario this would also mean an extra yield.

Looking at the data, the company's history and its fundamentals, I think there is more upside than downside at the moment, but as a newcomer to the stock market it needs to be watched closely.

I hope you enjoyed this case and see you next time!

Don't forget to comment especially if you don't agree with any of the points of view so I can improve the thesis, I would appreciate it!