Asmodee (SE:ASMDEE)

IPO tabletop games specialist

Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Key data

Special IPO situation.

Leading company in its niche market with unique characteristics.

MOAT: scale, unique upstream/downstream relationship and light capital model.

Organic growth, M&A and margin improvement over the next 3 years.

Company overview

Asmodee is a company that publishes and distributes tabletop games such as board games and card games and is present in more than 100 countries.

Founded in France in 1995, the company has grown from a small local business to a leading player in the industry.

Business model

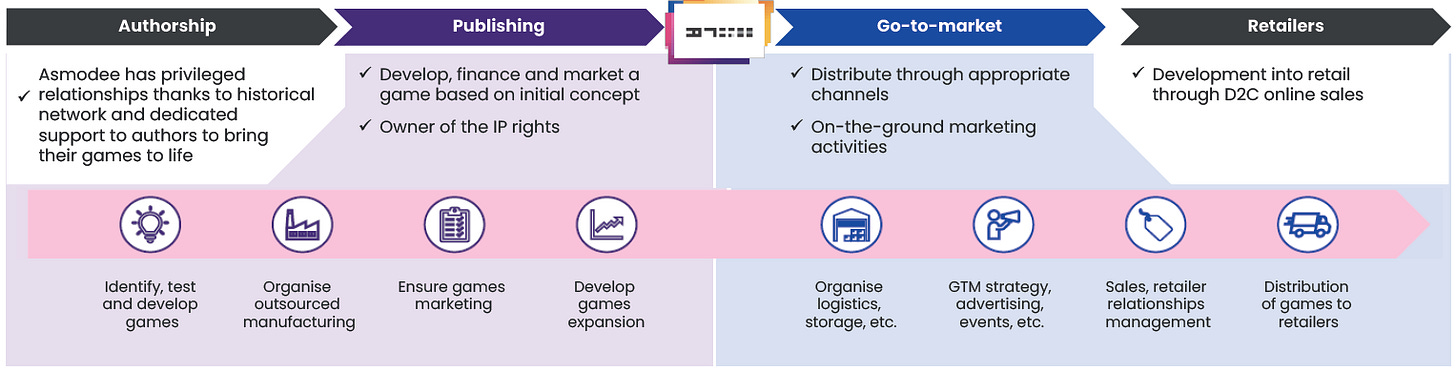

Asmodee's business model is based on a relational ecosystem within the supply chain. It acts as the linchpin connecting a fragmented market of creators (publishers), retailers (independent, mass and online stores) and customers (sporadic, families and fans).

Asmodee reminds me of the old record companies before the Internet. If you wanted your product to reach consumers, you had to go through them. And why? Because they have all the resources you don't.

The company has a unique business model in that it publishes games from its own studios, but also helps third party studios distribute their products. There are many such studios all over the world, and while they may be very good at coming up with ideas and creating game mechanics, they are not able to reach the end user, nor are they able to market effectively, nor do they have the scale to be competitive by manufacturing the product for a third party company.

This is where Asmodee comes in.

If we look at the other end of the value chain, the shops and stores that sell to the end consumer, Asmodee is able to add value that feeds back to them. From a logistical, marketing and support point of view, it adds value to the retail side, but the most important thing is that Asmodee's products are well known and in demand in the market, so that the shops are motivated to continue selling their products and are open to expanding their range to the end consumer.

Some of the most popular games developed in the Asmodee studios, such as Catan, Splendor, Ticket to Ride, Dixit, 7Wonders, Dobble or Exploding Kittens, have found a place in the minds of the general public.

It takes about 2 years to develop a game, but it is very cheap to produce as it only requires people who specialise in creating games and graphic designers. Once one of these games becomes known to the market, it stays in the market's mind forever, making it an extremely lucrative business. Think of Hasbro's Monopoly, how much did it cost to produce compared to the volume of sales over so many years? Well, 0.

Asmodee has a catalogue of over 400+ IP (intellectual property); an intangible and very valuable asset. Probably one of the best competitive advantages, the brand.

Market trend

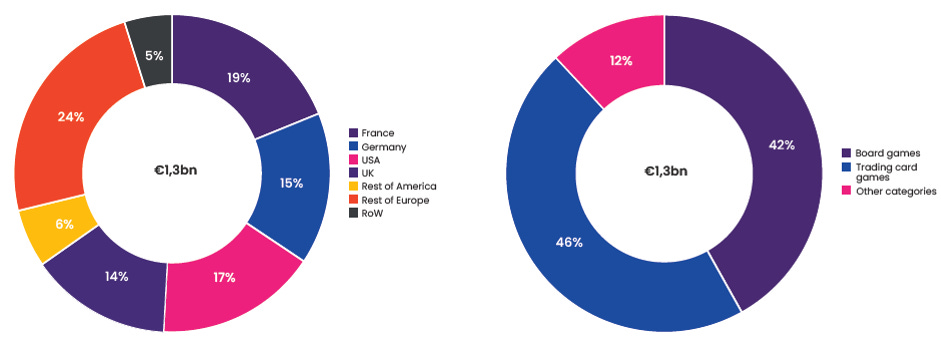

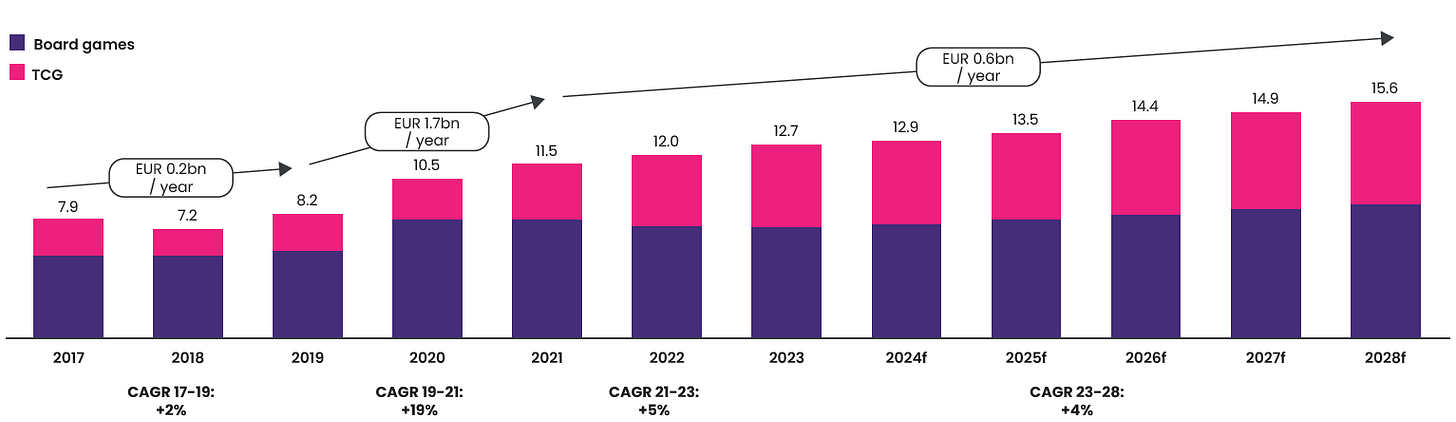

The overall market is expected to grow by 4% over the next few years, with total sales of €15 billion.

It is a crisis-proof market because people need entertainment and many of the games cost less than €20. It is a good investment for the consumer as unlimited games can be generated for little money.

The main drivers of the tablet market are a growing population and an increasing entertainment budget.

In this graph we can see the different phases of market growth, how from 2017 it went from a market that was not too strong to the pandemic years with double-digit growth. Currently, the market is in a stabilisation phase, with growth above that of the economy.

One interesting effect is that after being housebound, some people's habits have changed and they are prioritising physical activity. In fact, the high level of screen exposure in today's world is causing people to look for alternative ways of not being dependent on screens, such as board games.

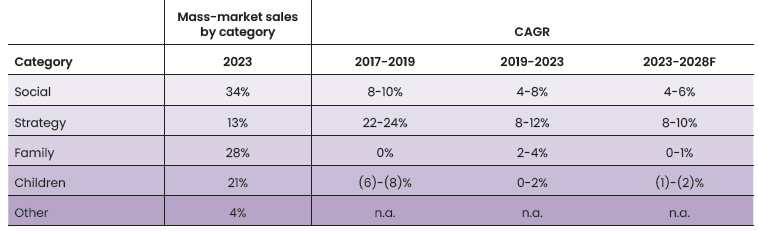

Interestingly, the categories that will grow the most over the next few years are Social games and especially Strategy. The latter category is represented by very loyal players who are repeat spenders and willing to spend more than the average.

Growth strategy

Asmodee's goal is to have games distributed by them in every home in the world (similar to Walt Disney's dream).

In order to achieve this, they will follow a strategy of increasing the visibility of the Asmodee brand so that the end customer (the user) knows it and orders from the shops he or she trusts. This means that the points of sale will continue to be interested in selling the products because the end customer will ask for them.

Another interesting strategy they will continue to use is to position their potential IPs to become a true saga. Games like Dixit, Ticket to Ride, 7Wonders, etc. are already brands that the customer recognises; they have earned a mental space in the customer's mind. This is very powerful, because from this intangible positioning, new games related, expansions, TV series, movies, video games, etc. can continue to be created at a reduced cost, because all the marketing has already been invested in the past; with 'old' money, and now it is just a matter of reaping the rewards.

Finally, the M&A strategy and, in particular, targeting the fragmented market of game developers and IP owners. If one of the games can be positioned in the minds of the end consumer, it is worth the investment because it means that a new saga has been born and it is difficult for competitors to compete with it.

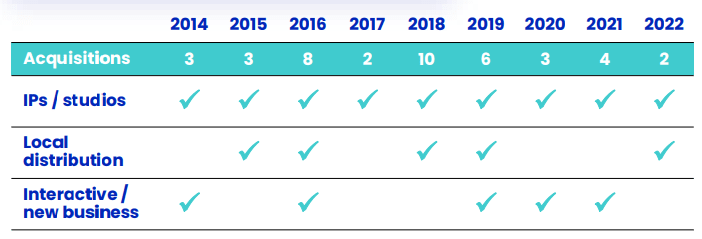

On average, the company makes about 5 acquisitions per year, which gives an idea of how fragmented the market is. Every year, new studios are born with new ideas that only a company like Asmodee can add value to through its power in the value chain.

Competitive advantage

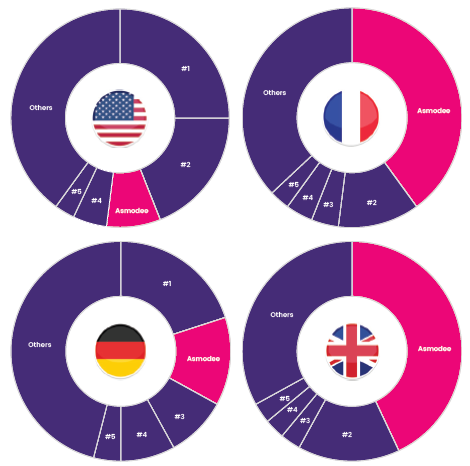

Asmodee controls 8% of the global market. In some countries, such as the UK and France, it has a clear dominant position with 40% of the market. This is important as Asmodee demonstrates that its business model tends towards what all good businesses want to become, a business with unique characteristics.

On the other hand, in countries as important as the United States and Germany, the company has a huge opportunity ahead of it with years and years of growth as both countries are among the largest markets for board game sales globally. In the graph below we can see that Asmodee does not yet have a dominant position, although it is on its way.

Scale is important in this market because the cost of creating a game is not the creation itself (just people), but being able to have a winning position in the value chain. Thanks to its size, Asmodee is able to produce more cheaply, with the best suppliers, and also has bargaining power in negotiations. One of the features that differentiates Asmodee from its competitors is its ability to distribute third-party games. This is because Asmodee is in a unique position to manage the relationship with its distribution chain both upstream and downstream.

Finally, the intellectual property of some of the successful games is owned by Asmodee, which means that they have one of the highest barriers to entry a company can have, a 'patent' in the form of a trademark. If you want to play 7Wonders, you have to go through Asmodee in some way.

Management

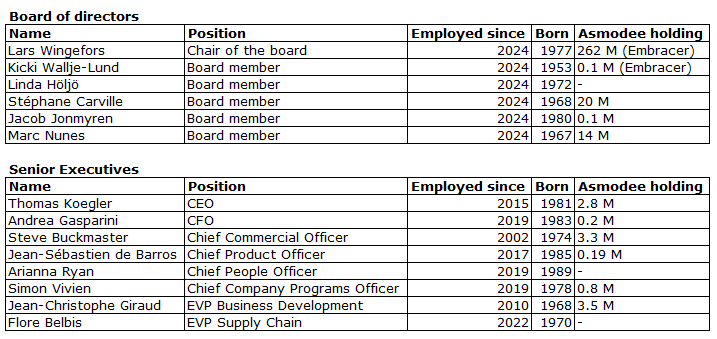

Asmodee is not currently listed on the stock exchange as it is part of Embracer. However, Embracer has announced its intention to split the company into three parts, including Asmodee. Asmodee's IPO is scheduled for Q1 2025.

In the future structure of Asmodee, the founder of Embracer (Lars Wingefors) will be present as Chairman of the Board with approximately 20% of the capital. Another interesting point to note is that Marc Nunes (founder of Asmodee) will also be present among the board members.

The presentation brochure for the future Asmodee states that approximately 5% of the shares are held by current or former management. Although it would be good to see more management alignment, we can see that Lars Wingefors and Marc Nunes, who are key players, own a good handful of shares.

Another interesting point is that the management team is relatively young, with an average age of 45. This seems positive as they have a lot of work ahead of them!

Final thoughts

Asmodee is an interesting company because of its market position. A market that is resilient to crises by the simple fact that it is entertainment at a competitive price and this is a great feature to navigate in all economic environments.

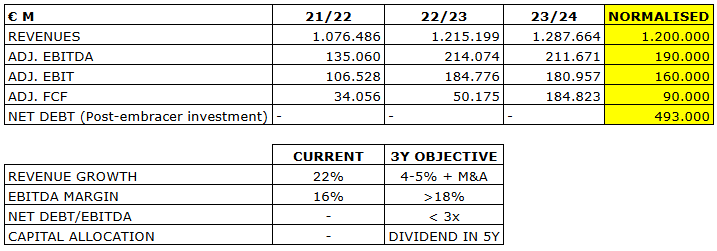

On the other hand, it has a capital-light model (its objective is to invest 2-3% of sales in capex) where the only physical reinvestment is in its own distribution and logistics centres. The rest is outsourced to third parties (e.g. physical game production).

Asmodee's competitive advantage is the possession of important IP (patents), its indispensable position in the value chain of this market and the unique relationship with third party IP (Lego, Disney, etc.).

Possible catalysts for extracting value from this upcoming IPO would be the volatility of the first weeks of trading, improving EBITDA margins and positive surprises in sales growth.

I hope you liked it, your comments/thoughts are always welcome!

Hi Robin - thanks for the article on Asmodee. We featured it in our weekly newsletter to friends and business partners --> https://278773.seu2.cleverreach.com/m/15884465