Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Summary

Small-cap founded in 1999 and market research leader in Europe.

Growth combining organic development and targeted acquisitions.

EBITDA and EBIT margin expansion at a rate 5% per year.

The founder remains at the helm with ~10% of the shares.

Forward P/E valuation at 11x.

The Stock

Market: Euronext Paris.

Ticker: ALBLD.

Market Cap: €100M.

Liquidity: Illiquid.

Dividend: No.

1. The Company

Bilendi is one of the European leaders in technology and data collection, specialised in two market segments: technologies and services for Market Research and technologies and services for Customer Engagement and Loyalty.

The company has sales locations in France, United Kingdom, Germany, Switzerland, Spain, Italy, Denmark, Finland, Sweden, Belgium, Netherlands and Morocco. The group also has business activity in Austria and Norway. With 13 sale offices and 380 team members Bilendi is able to service its 1700 customers in 14,000 projects.

The group was founded in 1999 by Marc Bidou and Thomas Chatillon and was born to become the European leader in online loyalty programmes. After 18 years of marketing experience in groups such as Disney or Hachette Filipacchi Medias, Marc Bidou and Thomas Chatillon decided to create the loyalty platform Maximiles.com. Due to their functions, the two leaders travelled frequently around the world and had loyalty cards from many brands. This is how they came up with the idea of developing a multi-brand points-based loyalty program using the Internet as a marketing tool and as a lever for reducing costs.

2. The Product

The company's revenues are mainly generated from its online panel activity.

Wikipedia defines very well what an online panel is: “A custom online panel or Internet access panel is a group of pre-screened respondents who have expressed a willingness to participate in surveys and/or customer feedback sessions”.

Somehow, the panellists' responses and their data are the raw material for other market research companies and other organisations to work with. So we can say that the product offering is critical to its customers.

Currently they are proprietary of 13 panels in Europe and more than 2,5 million panellists and also access to a network of partners for the rest of the world.

The larger and higher quality the group of panellists, the greater the customer's loyalty and willingness to pay.

Recently, it has also positioned itself in the growing market of qualitative market research. Again Wikipedia definition: “Qualitative marketing research involves a natural or observational examination of the philosophies that govern consumer behaviour.”

In other words, it is the study of the factors that influence people's behaviour in a given market.

The company also generates revenues from other more or less recurrent services (CRM and Loyalty) but these are no longer as strategic as in the past.

3. On course for growth

To understand the company's history we can trace the different stages it has gone through from its creation, IPO, decline, renaissance and acceleration.

3.1 Born of the company

Maximiles was created in December 1999 by Marc Bibou and Thomas Chatillon raising an initial fundraising of €2,28 million from Sofinnova, Innovacom and the PPR Development Club. The site was launched on April 4, 2000 with 15 partners. Two months later, 24 partners and 22,000 members have joined the program.

In August 2000, a second round of fundraising for €9,15 million was organized with Sofinnova, Innovacom, CIC Capital Développement, SPEF e-Fund, GIMV NV and Emmanuel Brizard.

Things seemed to be going well.

In parallel with the launch of the loyalty program on Maximiles.com, the company is developing an offer of proprietary loyalty programs and customer relationship programs through the Maximiles Services activity, notably by acquiring SSII Elma SARL in December 2000. The first offer technology license in white label is marketed in May 2001. In the meantime, the group is also developing a database rental activity via Maximail.

In December 2000, Maximiles signed a major and exclusive 5-year partnership agreement with voyagessncf.com and opened up its capital to SNCF in exchange for a contribution in kind in February 2001.

In July 2002, the group acquired (operation financed with equity) its main and last major competitor on the French market for online multi-brand loyalty programs: Webmiles France SARL (subsidiary of the Bertelsmann group – later renamed Dateos) and won in November of the same year the call for tenders for the management of the UGC Unlimited card for France and UGC Unlimited for Belgium.

In April 2005, a new contract with voyages-sncf.com for a period of almost 4 years was signed. This contract renewal was accompanied by the signature for the same duration of a contract with GL Expedia, the travel agency part of the voyages-sncf.com site.

In July 2006, acquisition of UK-based Ipoints the No. 1 online loyalty provider.

Thanks to this latest acquisition, Bilendi has positioned itself as a leader in the French and British market of customer loyalty tools and customer relationship programs.

You may ask, what do loyalty platforms consist of?

The loyalty marketing principle was developed in the United States by oil companies to build customer loyalty at their service stations, as well as by airlines. Loyalty on the Internet follows the same principle of earning points or price reductions based on specific behavior on specific sites.

Earning points can be linked to different actions, the main one being the commercial transaction. Members are paid in the form of points which can be exchanged for gifts.

There are two main types of point-based loyalty programs on the Internet:

1. Proprietary programs: this type of program is most often developed specifically for a website according to the constraints and marketing objectives of the site. The solution is therefore personalised but has a higher management cost and does not generate new customers.

2. Shared or multi-brand programs: shared programs include several partner sites and are managed by an operator. There is most often a tacit rule of exclusivity by sector of activity to avoid competition between two partner companies of the same program. These shared programs are promoted by the operator.

3.2 IPO

In 2007, the company launched the IPO.

At that time growth was very high and the integration of Ipoints into the business model was going very well. They have 3 million members and more than 110 affiliated businesses in the multi-brand loyalty platform. During the year, this figure reached 3,5 million members.

At that time, the creation of online panellists began. They were recruited on the internet, on commercial and non-commercial portals, on external websites and campaigns contracted by the company (database exchange, banners, etc.). That year they also signed an agreement with Empruntis to enrich their database. Empruntis is a company focused on the world of Banking and Insurance.

At the time, the company stated that its main competitive advantage was its online panel for supplying information to researchers. At the time, online panel revenue was only about 10%, but it foresaw potential growth.

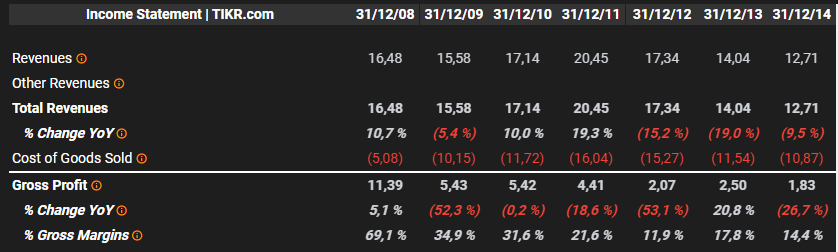

3.3 The downturn

In 2008, the decline of the company began, mainly due to the financial crisis.

During times of crisis, companies reduce their marketing budgets to some extent and postpone them for the future because of the uncertainties that arise. The niche of Loyalty platforms in such environments is highly affected.

This period lasted 5 years and the company took the opportunity to transform its business model.

Loyalty service is growing at a fast pace this year. With 4,05 million members as of 1 January 2008 in France, the UK, Spain and Italy, Maximiles.com has reached the 4 million member mark.

On the side of the companies participating in the platform, new clients are added such as Ask.com, Testetvous.com (psychologie Magazine), AssurOne or Evène (boutique); they also add automotive sector with Paru-Vendu and Auto IES.

It is 2009 and the crisis has already taken its toll on your clients' marketing budgets. However, this year it is buying 34% of a similar business in Morocco with good prospects for the future.

Nevertheless, the Loyalty platform continues to grow, reaching 7.1 million members ‘in 2010 and adding new partnerships with new companies. One of the company's objectives is to grow in scale and also to take advantage of synergies between its different businesses. Recall that in 2006 they made the purchase of Ipoints in the UK. During this time, they took the opportunity to definitively unify both platforms.

An important milestone was reached in 2010 with the acquisition of Panelbiz GmbH, one of the largest online panel players in Germany, Switzerland and Austria. With this transaction they are positioned to offer panellists in 7 different European countries including the 5 largest markets Germany, UK, France, Spain and Italy.

In 2010, the turnover from online panels reached 32% of the company's total turnover (100% CAGR since 2008).

In 2011, the company continues to increase its stake in its Moroccan subsidiary to 51% and acquires Badtech SAS. This company owns the Tellmewhere brand and Dismoioù, a mobile application based on geolocation. The company wants to accelerate and improve monetisation by adding more aggregated services. CRM and Loyalty will also benefit from this purchase.

In my humble opinion this demonstrates the quality of the management team with an incredible vision for the future.

During 2012 and 2013, the company really struggled. Turnover has fallen by more than 30% and uncertainty is growing.

What the company says in these years is that the CRM and Loyalty part is more sensitive to the economic cycle, while the online panel business has withstood the crisis well and is even growing. This is where the company realises that it must change the direction of its growth and plan the company's resurgence.

3.4 Renaissance and acceleration

From 2014 the company takes the helm and sets a new course, a course towards excellence and solid growth of a new company!

The company's CEO Marc Bidou declares:

“Changing the name is the logical outcome of the group's evolution. The name of Maximiles is linked to our loyalty activity which, although still strategic for us, is no longer the majority today within the group. By renaming ourselves Bilendi, we illustrate the group's new profile focused on the collection, management and enhancement of data at a time when the volumes, variety and speed of data exchanged are increasing exponentially. This new name also reflects our ambition to accelerate our development by combining organic growth, acquisition strategy and European deployment on a larger scale”

The company focuses its growth strategy on the following levers:

Technology

Innovation

International development

External growth

The company has a proprietary panel of 1,8 million panellists and access through its global network of up to 7.5 million panellists. Bilendi puts data at the center of its activities to be at the heart of the decision making process and assists the research industry in collecting data for market research purposes.

This activity notably offers services such as the sampling and programming of questionnaires, the recruitment of panellists, the passive measurement in digital media, the measurement of the effectiveness of online advertising campaigns and the ad-hoc development of mobile solutions (consumption diary, product tests, etc.).

So in 2015 the company put its strategy into action with the acquisition of M3 Research, a key player in the panelist sector in Northern Europe . The Danish company has a highly qualified panel of 300,000 people in Denmark, Sweden, Finland and Norway. The company is particularly recognised for the quality of its access panels and the experience of its teams.

They also acquire the UK-based company Springboard.

The company is currently among the Top 5 leading panellist companies in Europe and 60% of turnover is international.

During 2016, business began to accelerate, partly because previous years had seen a decline. But things are going well.

The CRM and Loyalty platform continues to grow, although it is no longer so strategic, and a new online dashboard focused on Healthcare is also being launched.

They also increase their offer with Bilendi Digital Audience Solutions to optimise advertising campaign spending. This complete offer allows to manage and measure the audience, the impact and the efficiency of a digital marketing campaign. Via a web interface, it provides access to multiple dashboards and allows the measurement of a campaign's exposure and demographic structure. Allow the memorability of post-test studies can be used to study the memorability of messages, brand awareness, or the purchase intention of the target of the target audience.

They open an office in Madrid (Spain) and in 2017 they make a new acquisition of iVOX Bvba leader online panels in Belgium. iVOX provides digital services to market research companies and is particularly renowned for the size and quality of its access panel (150,000 active members). The teams at IVOX, predominantly comprising experts from the University of Leuven, are well known for their innovation in new modes of digital surveys.

Marc Bidou declare:

“The various acquisitions made (M3 Research and Springboard UK in 2015) supplemented by the opening of sales offices (Cologne in 2015, Madrid in 2016) have enabled cost synergies (size effect, marketing, technology) and revenues (cross-selling panels, extension of the service offer, deployment of technological innovations, etc.”

We reached 2018, a year in which the company has taken off with 12 consecutive quarters of sustained growth. Turnover multiplied 2x in five years, EBITDA and EBIT margins expanding.

They already have proprietary panels in 12 countries, 10 sales offices and 2,2 million qualified panellists and are able to cover 90% of the European market.

The year 2019 opens with of Via! It has a panel of 60,000 high quality people to provide online marketing research services.

These acquisitions allow especially smaller companies to access Bilendi's platform and its panellists, bringing added value to all.

During 2020 and for the first time, the world of data science, studies (Ekimetrics, datacraft, BVA and Bilendi) and academic research (Sorbonne University, CNRS and Bilendi) and academic research (Sorbonne University, CNRS, Collège de France) are joining forces around a joint national project.

This participation in a top-level European project in a crisis as important as the pandemic is a reward for the constancy and good reputation that the market observes in Bilendi.

Having overcome the Covid crisis, in 2021 the company already sees itself among the Top 3 leading panellists in Europe. Here the competitive advantages’ company:

A position as a leading player in online panels in Europe (3rd largest operator).

A highly leveraged business model that benefits from reaching a critical size.

A strong international footprint with a commercial presence in 12 European countries.

Qualified proprietary databases with over 2,2 million active panellists in Europe (and access to global coverage via a network of partners).

A proprietary technology platform to collect, process and leverage data.

A diversified and loyal portfolio of clients (research institutes, agencies, consulting firms).

This year, the company HumanizeeSAS and its Discussnow platform specialises in real-time multi-channel conversations that can cross-sell to its customers.

Discussnow collects and analyses large volumes of data obtained from conversations between invited participants on frequently-used messaging applications such as WhatsApp, Facebook Messenger, Slack or email and in more than 10 languages. The client can choose to let the platform monitor the conversations autonomously or to do that manually in the “Do It Yourself” mode. Marketed using a SaaS model, Discussnow has already signed contracts with more than 20 clients since its creation, including: Kantar, Publicis, Accenture Interactive, Fnac-Darty, Samsung, Eurosport and IFF.

A technology-based response to support the growing online qualitative research market.

The Covid-19 pandemic has accelerated the migration of market research activities from offline to online, particularly for qualitative studies, which represents approximately 20 to 25% of the research market. It has been impossible to organise face-to-face meetings for much of the last year and an increasing volume of qualitative studies have moved online.

This new method of data collection will develop strongly due to:

Being carried out on existing digital media which is already in wide-spread use.

The ability to connect populations that would otherwise be unable to meet physically, due to - geographical constraints, availability, personal choice, etc.

Enabling projects to be implemented within very short timelines.

Costs being considerably lower than offline.

This acquisition will enable Bilendi to:

Integrate the insights collection and "qualitative study" segment into its range of products, offering a complete solution to its clients.

Acquire innovative technology, using the SaaS model and generating recurring income.

Expand its offer to this strongly growing new market segment.

Provide a response to players who now wish to operate projects themselves, in complete autonomy, via DIY tools.

Finally this year they acquired Respondi, a European player in data collection for market research.

“Respondi has an established reputation in the sector, with highly qualified panels and a portfolio of over 550 clients, including universities and scientific research centers, where it has a leading position with over 200 clients. In 2021, Respondi expects to generate revenues of €15 million (+17%) and an EBIT of €1 million.”

4. Market size

The online panel market has an annual worldwide volume of €1.5B.

In Europe the volume is estimated at around €600 million and expected grow of 7% by 2026.

Bilendi’s revenue for 2022 was €61,5 million and the guidance of the company is to reach sales of €100 million by 2026.

The market in which Bilendi operates is highly fragmented and is a real opportunity to make small acquisitions and consolidate the market. Mostly the company uses cash to make acquisitions and sometimes also relies on debt and equity issuance.

5. Competition

There are many companies that specialise in online market research. You only have to do a quick google search to see for yourself.

The closest comparable company listed on the stock exchange is Cint. This Swedish-based company aims to lead the way in the programmatic research platform that provides access to first-party survey data with respondents globally.

Bilendi does not do exactly this, but it could be useful as an exercise. Cint puts more focus on the technology platform and connecting many online panel providers with many customers in one place creating a scalable business. Its operations span the globe and it has a significant share in the United States and Europe.

The company made its IPO in 2021 and in a very short time made two takeovers, one of which was of considerable size and thus almost doubled its turnover from one year to the next. As the company has not yet managed to make its business profitable, it does not make much sense to compare indicators, although it does aim to grow the business at 25% over the next few years with an EBITDA target of 25%. It is very similar to Bilendi's 2026 targets.

This could tell us that in the research market we do not compete on price but on reputation and technological platform, thus creating an environment of sustained growth for the leading companies in the sector.

6. Risks

The main risk in this market is the fraudulent responses that could be registered by online panellists.

There is a % of responses that are answered quickly and randomly making the quality of the data poor. That is why in this market it is important to maintain the maximum quality assurance of the online panel to preserve its prestige.

Fortunately Bilendi has mechanisms in place to detect fraudulent responses as well as being certified by the international standard ISO 20252: 2019 to satisfy its customers as much as possible.

7. Investment case and takeaways

It is time to sum up this investment idea!

If we take a look back at its transformation in 2014 and orientation to online market leader in the market research panel market, we can see that Bilendi is a well-oiled machine that is constantly moving forward.

Let's look at how revenues, EBITDA and EBIT margins evolve. Not a single year goes wrong, no matter what happens at the macroeconomic level. The company is executing its plan perfectly and sustainably.

We can see that the EBITDA margin is growing at a higher rate than revenues. This indicates that the company has a competitive advantage.

The company does not pay out dividends but in exchange for cash flow generation it buys other businesses and to a lesser extent uses debt or share dilution. Since its inception, the company has bought a total of 11 other companies which, judging by the numbers, it has been able to turn around quickly. In general, it makes small acquisitions without taking big risks.

The business model is asset light and there is virtually no reinvestment in the business approaching 0. That is why its ROCE is 18% on average. Meanwhile its ROE is on average 13% which is a bit low but expected to improve as the scale of the business increases.

The company's management team is aligned with shareholders' interests thanks to Marc Bidou's leadership since the company was founded 24 years ago. The management team owns at least 10% of the company's shares.

In my opinion, one of Bilendi's competitive advantages is its management and quality assurance in its operations. In fact, they are listed in the main organisations and associations, the most important at European level being ESOMAR.

To conclude this investment idea, we believe that the company is well positioned to support the move from the offline to the online model of market research.

The company maintains its outlook to reach €100m turnover and €25m EBITDA by 2026. On 2 out of 3 occasions it has given guidance the company has been right.

If the company pursues its growth strategy at the same pace and manages to jump into North America where the market is very strong or even in the APAC area where the market is very fragmented, it could become the undisputed leader in an unregulated market.

Thank you very much for reading and I look forward to your comments!