Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Summary

Growth of 25 - 30% in the next 5 to 10 years

Quality organic growth strategy and acquisition of niche companies

Founders remain at the forefront with a high % of shares

Well positioned in a disruptive, high-growth market for years to come

Stock

Market: borsa italiana

Ticker: CNS

Market Cap: €115M

Liquidity: illiquid

Dividend: yes

Company

Civitanavi Systems is one of the main players in the sector of high-tech inertial navigation and stabilisation systems. The company design, develop, produce and marketing of navigation and inertial stabilization systems used in:

Aerospace and Defense (space, land, aeronautical and naval)

Industrial (mining and Oil & Gas) for the construction of tunnels (tunnelling) and horizontal tunnels (horizontal drilling) sectors.

The company is a vertically integrated supplier of highly accurate systems with proprietary methods, techniques and algorithms, based on both FOG (Fiber Optic Gyroscope) technology and MEMS (Micro Electro Mechanical Systems) technology, possibly also integrated with other satellite navigation devices (GNSS, air speed data, odometers, etc).

The inertial navigation system makes it possible to accurately calculate the speed and direction of the mobile device on which it is installed, even in the presence of unfavorable conditions and without external data input.

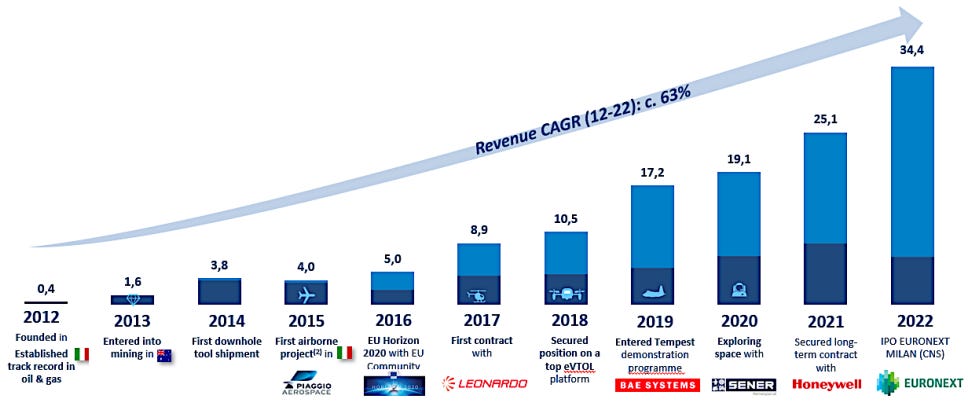

Founded as a start-up in 2012, the company operates from its headquarters in Pedaso and three further sites in Ardea, Casoria and Turin, with a staff of about 160 employees working throughout Italy. In 2022, was established the subsidiary Civitanavi UK LTD in the United Kingdom. On the other hand, the company exports its technology worldwide although 80% of its turnover is in EMEA.

The founders of the company who are still in charge today have a high percentage of shares in the company. The key to its high past and future growth is the extensive experience in this sector of its management who know how to position these niche products better than their competitors from three key points of view:

Extensive knowledge of inertial sensors (accelerometers and gyroscopes)

Navigation algorithms

Software

As can be seen above, the board, being a small company, is able to relate to important defence companies such as Leonardo or BAE, leading engineering companies such as SENER or industrial companies such as Honeywell.

Trends and market

First of all, we must introduce the meaning of ITAR-FREE as it is one of the key aspects of Civitanavi's competitive advantage. According to Wikipedia:

International Traffic in Arms Regulations (ITAR) is a United States regulatory regime to restrict and control the export of defense and military related technologies to safeguard U.S. national security and further U.S. foreign policy objectives

As you can deduce, being subject to ITAR means having a high complexity to export your products as it is a hyper-regulated issue that could be an impediment to sell your products outside Italy.

Fortunately, the company has 99% ITAR-FREE products which means that with a very specific component strategy it avoids this regulation making its end products more attractive to the end customer.

That said, the company estimates its market potential in 2027 to be around 4.5B in aggregate. The company believes that ITAR-FREE products will have a higher growth rate than the overall market growth rate of 6.5% CAGR.

If we talk about the company's competence, we have different profiles and in different geographical areas. Dominated by a few large operators and in which the part not covered by these is divided among smaller companies. The Civitanavi main competitors are the US companies Honeywell and Northrop Grumman, the French companies Safran and Thales, and the Israeli company IAI (Israel Aerospace Industries Ltd.), iXBlue SAS, KVH Industries Inc. and EMCORE Corporation.

The fact is that it has some very strong competitors but we have seen before that it has commercial agreements and joint product launches, for example with Honeywell. I like this type of competition because it is understood that both "competitors" have common interests, so perhaps instead of "fighting" they will tend to cooperate.

Let's look at the company's most similar and publicly traded competitors. Fortunately, we have two competitors with these characteristics. Very briefly, if we make a comparison of historical and future EPS progress, we can see that Civitanavi has a (short) track record of constant growth while its competition has a great variability, making it difficult even to make money. In terms of cash flow, Civitanavi is the only one in its segment with a positive cash flow.

Finally, the company is able to grow at high multiples while stealing market share from its competitors. During the last period 2018-2022 the company grew revenues by more than 30% CAGR while the market is growing at a significantly slower pace.

So far we have seen the market where the company has historically moved, but there are still some additional surprises. Let's move on to the emerging electric vertical take-off and landing (eVTOL) market: electric vertical take-off and landing aircraft that can be piloted by a pilot or self-driving.

This market represents a great opportunity for manufacturers of high-end inertial sensors and promises numerous applications both in the field of people transport and in the field of goods logistics. During 2020, the total investments, in venture capital, R&D financing and mergers with SPACs announced relating to the eVTOL market reached a value of approx. $2.9 billion.

The new market, it is possible to divide the eVTOLs into city-to-city aircraft (i.e. means of transport that cover long distances and with greater energy autonomy) and intracity aircraft (i.e. means of transport covering short distances within metropolitan contexts). It is estimated that approximately two-thirds of the market will be dedicated to the intra-city sub-segment (within the same city), with the remainder relating to city-to-city aircraft (from one city to another).

By 2035, this new market is forecast to be $21 million globally, split 45% APAC, 30% Americas and 25% EMEA.

Civitanavi has launched a project for solutions aimed at the emerging eVTOL (electric vertical take-off and landing) urban mobility market with the aim of proposing integrated and customizable products for stabilization and navigation using the SWaP-C parameter (Size Weight and Power – Cost), i.e. summarizing the characteristics of electronic systems through the analysis of their size, weight, consumption and cost.

Strategy

We will now look at the strategy for growth and positioning in the market and why Civitanavi has sufficient competitive advantages to achieve this in the medium and long term.

The main advantages underpinning its strategy divided between Organic / External growth.

INTERNAL GROWTH

Achieving economies of scale: increase in production capacity combined with a greater international presence is expected to bring important benefits to Civitanavi. In particular, an increase in sales, greater economies of scale, as well as an increase in the level of customer service.

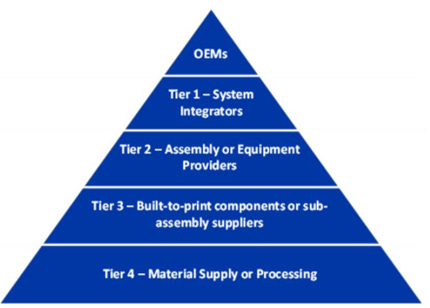

Vertical integration: they operates within the reference market as a Tier 2 supplier and aims to consolidate this positioning by developing both new technologies and basic components, in order to achieve a greater level of vertical integration in the production of strategic supply. At the same time developing to achieve the role of Tier 1 supplier of integrated systems with particular reference to the emerging market of Urban Air Mobility.

Production process efficiency levers:

Automation of production lines in order to ensure scalability, process control and reduction of the incidence of personnel costs. Practically all materials are manufactured and assembled by the company, except for some very specific processes, which are subcontracted to specialist suppliers.

R&D aimed at creating and consolidating proprietary technologies to have control of the product value chain and to be able to use these technologies in next generation products.

Innovation and marketing of new products: to improve its products in terms of accuracy, size, weight and power.

Entering emerging markets with high potential: consolidate its market positioning by expanding the current customer base and acquiring new customers in new regions and defining partnerships with market leaders.

EXTERNAL GROWTH

By acquiring new niche companies, they can gain access to new technologies, customers and complementary markets that strengthen their value proposition to existing and potential customers.

Civitanavi has recently acquired a 30% stake in PV Labs, advanced imaging solutions company specializing in the design and development of turnkey aerial imaging systems.

One of the keys to the good performance of these products are the inertial sensors that are provided by Civitanavi.

Competitive advantages

Civitanavi competitive positioning is first and foremost characterized by the combination of strong attention to technology and quality and strong competitiveness in terms of price. Indeed, Civitanavi supplies high-end inertial sensors and systems with predominantly FOG technology, using technologies deriving from economies with greater economies of scale (including telecommunications, automotive and

consumer electronics) to achieve high competitiveness in terms of price. Other distinctive elements of the company are the ability to provide a high-level service quickly and flexibly, the product-oriented approach in each design phase and the multidisciplinary approach in design review.

The main competitive advantages of the company would be:

ITAR-FREE: the products, with one exception, do not include components classified as ITAR (International Traffic in Arms Regulations), i.e. components subject to international regulations on arms trafficking, nor components produced in the United States whose economic value exceeds 25% of the sale price and generally do not impose obligations to request authorization from the US authorities.

The inapplicability of the ITAR constraints represents a significant competitive advantage, allowing the company to market its products globally without having to acquire authorizations in advance from the US authorities, the release of which usually takes average times on the order of 12-24 months.

Global supplier: broad and diversified global market demand growing at a rapid paces well positioned with respect to the emerging trends of the sector such as that of urban air mobility, a sector expected to grow in the coming years and reach a significant dimension.

Versatility of the technologies used: support very complex development programs, as well as to serve a large number of final applications (from defence, to aerospace, to use in the civil sector). Part of the success consists in being able to offer products that can be used in a variety of application areas.

Highly customizable solutions: flexible solutions that can be adapted to the diverse and varied needs of customers, thus being able to develop a highly personalized final product based on the specific needs of the customer, with reduced delivery times compared to the standard ones of the reference market.

Integrated and flexible organizational model: the company has an agile organizational model and a vertically integrated and flexible design and production structure which oversees all the value-added phases of the production process and which combines the need to control the entire production chain, in order to ensure product quality, with that of making the production and distribution phases efficient for customer satisfaction (delivery times and product development cycle). Civitanavi internally designs the inertial systems that it markets and ensures product control (in terms of quality and support) and outsources, through highly specialized and qualified suppliers, all processing phases which do not add value, such as the creation and assembly of electronic boards, mechanical parts and wiring. The products marketed are mainly made through the use of so-called off-the-shelf components, i.e. readily available on the market, of industrial origin, especially from the automotive and telecommunications sectors. These components are characterized by a high degree of reliability, low cost and rapid availability, these elements represent an important added value for the company guaranteeing a so-called capex light approach, i.e. characterized by a lower use of capital investments.

Risks

As we have seen above, the company is in an interesting position to conquer and expand its market niche in a potential high-growth market for the next 10 years. However, part of the company's strategy is based on growing in the immature eVTOL market, which may hold many surprises in the future.

I have compiled here a list of the most relevant risks of this investment:

Extremely complex regulated sector: the company's products are generally subject to the application of dual-use legislation (Regulation (EU) 2021/821) which requires obtaining a specific authorization for the purpose of exporting products and services intended for application both in civil and in the military sphere outside the territory of the European Union. On the other hand, it should be noted that some products specially designed for military use, which may also include ITAR components, are subject to the application of the Italian legislation on the export of military materials (Law 185 /90) which expressly provides that the export, import and transit of military material as well as the transfer of the related production licenses must comply with Italy's foreign and defense policy.

FOG systems technological obsolescence: Civitanavi's technology is largely FOG-based and therefore exposed to technological disruption from small and large companies that may innovate in this niche market. There is a risk that this technology could be replaced by another that improves its technical performance and cost.

Client concentration: The company has a very high concentration of customers, with the first customer accounting for around 30% of turnover and the top 5 accounting for 80-90% of turnover. This is probably the biggest short term risk that the company could face as the whole thesis could go bust at this point.

Little track record in the stock market: the company has very little track record on the stock exchange. This is both an advantage and a disadvantage as it is an unknown high-growth company, but at the same time we do not know what the management policy will be, whether it will take on a lot of debt or not, whether it will issue more shares or not, or how it treats the shareholder. Likewise, we do not know how it will handle any new acquisitions it might make in the future.

Final takeaways

In this chart you have my projection of the return on investment taking into account a PER 20 valuation as it is a high growth but unknown company, in the Italian market and with a capitalisation of just over €100M.

I have taken into account revenue growth of 25% YoY with an EBITDA margin of 30% and EBIT 27% (both figures adjusted).

I have taken into account a dilution percentage of 10% in the total of the 5 years to finance its growth and net debt throughout the period.

In this projection I have not taken into account the distribution of dividends that would have to be added. Maybe an extra 3% return.

If we take the worst case, you can probably lose money due to the risks previously exposed. The danger of a great dilution is there. On the other hand, the founders have more than half of the shares of the company so they could keep it at a very low price. In other companies you might think that even in the worst case you could get some profitability but in my opinion not in this one.

In the best possible scenario, the company would grow a lot, doubling its turnover every 2 or 3 years by positioning itself strongly in the eVTOL market, or it is bought at an attractive price in a period of 1 or 2 years where we could obtain interesting profitability.

Please do not take this last part of the investment idea as a buy or sell recommendation.

I hope you enjoyed this new unknown idea.

Remember to leave your like or comments! See you soon!