deWol Industries (IT:SCK)

Italian largest operator in production of windows

Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Summary

Aggressive M&A

Largest operator in windows production

High growth sales, ROIC and EBITDA margin

Founder family owns >50% company shares

Huge TAM

Forward P/E 2x

Company overview

deWol Industries (formerly Sciuker Group) is the Italian largest operator in the design and production of windows and solar screen market and leader in green design and energy transition. The company was founded by Marco and Romina Cipriano in 1999 and its headquarters is in Avellino, Italy.

What it does?

The company produces windows and a wide range of accessories with the aim of improving the thermal and acoustic insulation of buildings. All this by putting eco-sustainability, innovation and industrial production at the centre.

It also offers a range of services for the renovation and adaptation of building equipment towards energy efficiency and improved comfort in the home.

As a curiosity deWol means: Design Way of Living.

Products and services

The most representative product brand is Sciuker as it combines patented technology, comfort, aesthetics and energy efficiency. In addition, only certified raw materials are used, reducing the use of materials such as plastics to a minimum.

Sciuker owns a total of 7 product collections, a wide range of solutions from entry level to luxury products:

Skill: this is a wood-aluminium window designed to respond to the demand for frames made of natural materials capable of guaranteeing high thermal insulation performance. It is the entry-level product.

Stratek: wood-aluminium window, characterised by a classic design, mainly used in the renovation and redevelopment of residential units in the area of the historic city centres.

Isik: window made in both the wood-aluminium and structural wood-glass versions.

Exo: to respond to the demand for a window with an essential and unique design accessible to the medium market segment.

Offline: this is the company's luxury product to satisfy the most demanding segment of the market.

Silk: 100% wood product, destined for the large-scale retail market.

Velt net: extremely energy-efficient wood-aluminium window system specifically designed for building renovations.

On the other hand, through the general contractor Sciuker Ecospace, the company sells services for seismic and energy upgrading works to improve and renovate comfort in the home. The catalogue of services provided by this part of the company is as follows:

Fixtures

Thermal insulation

Heating systems

Photovoltaic systems

Charging stations for electric cars

Solar thermal systems

Home automation

Seismic upgrading

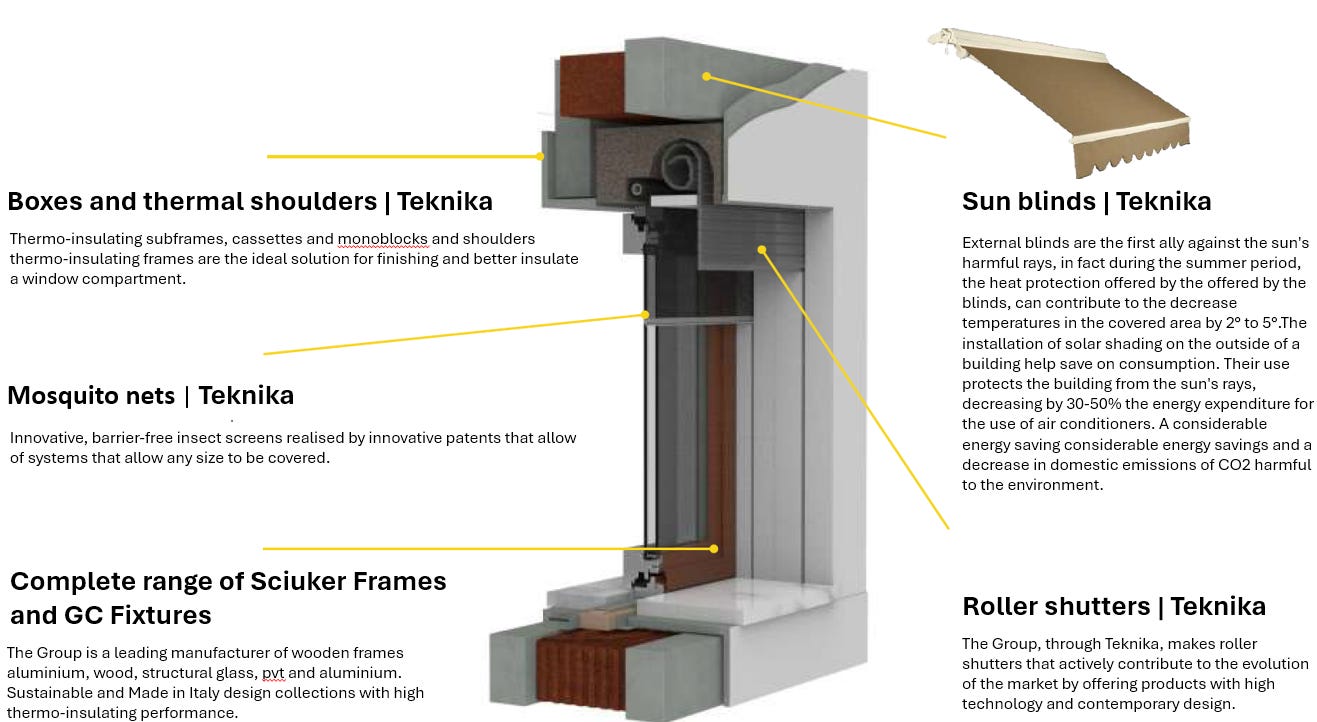

Finally, the company also designs, produces and distributes PVC and aluminium windows and doors and multiple accessories such as mosquito nets, roller shutters, thermal insulating monoblocks, external curtains and bioclimatic pergolas.

Business model

As we have seen above, the business model consists of a main activity of Industrial hub production and, on the other hand, an activity more focused on building renovation Services. Approximately % of income comes from industrial activity.

Industrial hub

The company controls the entire value chain of the product, from conception, development, distribution, sales and after-sales phase.

The production activity is carried out at the plant where, in an integrated work centre, all the processes on the window and door are carried out, from the production of components to assembly. The production cycle lasts on average 6-8 weeks and varies depending on the collection and the specific characteristics of each order.

On the map we can see how Sciuker brand is strongly positioned in the south of the country, especially in wooden windows. Meanwhile in the north has production more specialised in other materials such as PVC and aluminium and accessories for windows. Therefore, the company physically covers the whole country in different market niches.

On the sales distribution side, the company sells to the public sector, the private professional sector as well as to the general retail public. The sales channels of the products are carried out:

Through a partner network of more than 1000 points of sale covering the entire country.

SCK Stores (direct to customer) with 9 retail outlets strategically deployed throughout the territory.

Sales agents representing the brand throughout the country.

Services

Under the Ecospace brand the company acts for the renovation and improvement of the home through energy efficiency projects. Both at European and at the individual level countries there are ambitious plans to reduce CO2 emissions, especially in cities. Therefore, different schemes and grants are launched to encourage homeowners to carry out renovation works to help save energy in the home.

In the case of Italy, this is done through the Superbonus 110% programme, which is a tax exemption of all costs incurred during the construction work for large and small property owners. deWol's goal with Ecospace is to take advantage of this mega-trend for the coming years by playing a role as a general contractor.

Competition

In general we can say that the Italian window market is fragmented. The top ten operators have between 20-30% of the Italian market under control.

The rest of the market is dispersed among hundreds of small companies with less than 1% of the market. This category includes workshops of artisans active mainly at a local level with limited resources. These companies, far from being competitors, could be seen as acquisition opportunities.

The main competitors that operate in the same market segment are companies territoriality concentrated within specific industrial districts, as well as companies of different sizes, generally single-product, specialised in a specific production process (wood, aluminium, PVC or mixed systems).

The most prominent competitors are:

Secco Sistemi

Finstral

Drutex

Oknoplast

Qfort

Unfortunately, none of these companies are listed on the stock exchange… but we have other companies outside the Italian market!

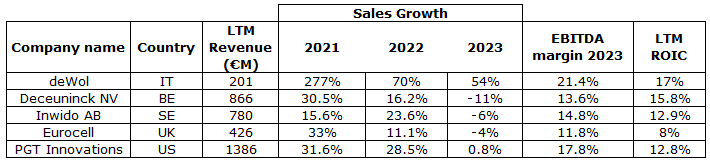

From this table we can see how other companies of a certain size have done really well in recent years and had a slowdown in sales growth in 2023.

Although deWol is the one with the lowest turnover, it is the one that has grown the most, with the best EBITDA and ROIC. With these three data we can get an idea that behind the management of deWol there is something that is making it different from the rest. It has competitive advantages.

Market trend

The main driver behind the investment thesis is the fact that buildings are responsible for 36% of greenhouse gas emissions and 40% of European energy consumption.

In Europe, all buildings to be constructed in the EU from 2030 onwards will have to meet the zero emissions target, a challenge that will be required of the entire building stock by 2050.

In Italy alone, there are 18 million households to be made efficient. In countries like Spain 80% of their building stock that is more than 40 years old. So we are talking about a huge potential market in Europe alone windows and door frames market is valued at € 80 bn in 2028 at a CAGR of 4.1%.

Although the window sector is closely linked to the construction sector, the fact is that most of the production is due to renovation rather than new construction; approximately 65% by renovations and 35% by new constructions.

The main reason to buy new windows are as follows:

Wear and/or malfunction

Protection against external noise

Energy saving

Aesthetic reasons

Overall redevelopment

Intrusion security

Well-being of the inhabitants

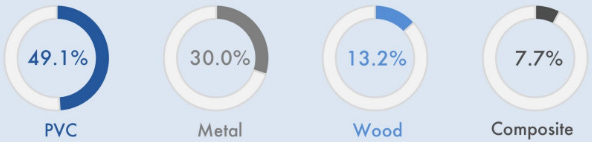

Finally, if we review the consumption by material in the main European markets (Spain, Italy, UK and Germany) we observe that PVC is the dominant.

With its recent acquisitions, deWol has positioned itself strongly in the PVC segment and, to a lesser extent, in the aluminium segment. Meanwhile, the wood material is already strongly positioned with the Sciuker brand, especially in the premium category.

Growth strategy

The company wants to capitalise on the subsidies and future demand for housing renovation from a re qualification energy efficiency point of view.

It does this through what they call a "Federation of companies", this is nothing more than creating an ecosystem where each piece has a specific function for the common good of the group: from manufacturing, distribution and sales to installation and after-sales at the end customer: company, public or retail.

In order to achieve this, the company growth is based on the following axes:

Product portfolio: integration of the mix of products and services and offering a value proposition to the general public.

Expansion of production capacity and review of production processes to make them more efficient.

Expansion of the reseller community, SCK stores, presence in the

contractors' segment (always with a focus on luxury flats), helping

public administrations to accelerate the transition of public buildings.

M&A: accelerate market penetration or expand product offerings that make sense within the company's objectives.

M&A

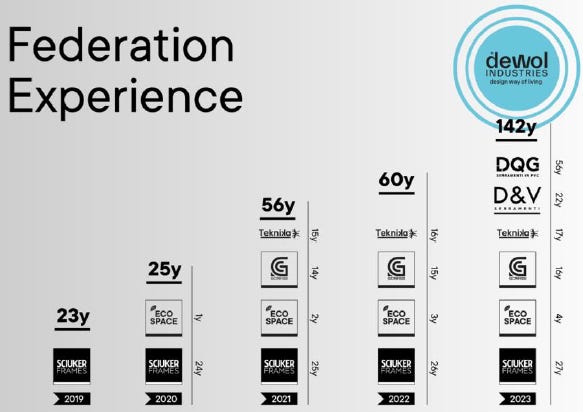

One of the most interesting things about this idea is deWol's ability to quickly acquire and integrate new companies into its network. These are horizontal acquisitions of businesses that complement and reinforce the original Sciuker brand.

Let's take a look the most relevant transactions:

2020

Acquisition of 80% of the general contractor Ecospace. With this acquisition the company enters a new market in order to take advantage of all the tax benefits related to energy efficiency interventions such as thermal insulation, including fixtures replacement, photovoltaic systems, addressed to both condominiums and single-family houses. In this way the company can also promote part of its industrial product portfolio and make this known to the general public. In the following years, it manages to buy 100% of Ecospace.

2021

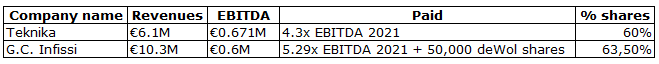

Two acquisitions are made:

On the one hand, 60% of the Italian company Teknika specialised in the production of mosquito nets, roller shutters, thermal insulating monoblocks. On the other hand, 63.5% of the company G.C. Infissi, which specialises in the production of PVC windows and to a lesser extent also aluminium windows. Finally in 2023 an agreement is reached to buy 100% of G.C. Infissi.

With these acquisitions, the company seeks to reach new customers faster, to make its product offering to the retail customer more complete, to generate economies of scale and to improve its competitive position.

2023

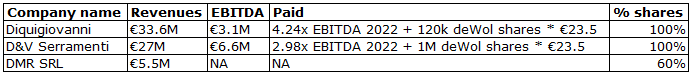

With these two new acquisitions, deWol industries is born as a federation of brands and a new leader in the window and solar shades manufacturing sector:

With these acquisitions the group of companies strengthens and starts to expand outside the Italian market and also its position in the public sector.

Management

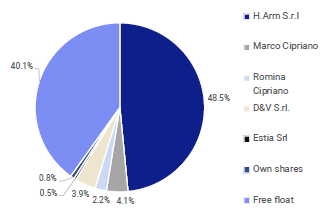

The Group is controlled by Marco Cipriano, founder and CEO, and Romina Cipriano, with a accumulated 48.5% stake through the holding H.Arm.

The company is controlled by the founding family and with the recent acquisitions of Diquigiovanni (Estia) and D&V Serramenti other entrepreneurial families have taken a total shareholding of 4.4% of the company.

Thus, we see that the wealth of the founding family is not their salary but how well or badly the action goes in the future. This gives us a layer of security that the people in charge of the company will do their best to grow the business and ultimately align themselves with the interests of the investors.

Risks

In my view, the main risk is that the company does not make the mistake of making too large an acquisition. It has taken a lot of momentum to grow inorganically but it takes time to consolidate and synergies all the businesses. Perhaps wanting to grow too much through acquisitions without a proven track record of years can be a strength but also a weakness if not handled correctly.

On the other hand, the public sector and aid in Europe for the energy re-qualification of buildings could slow down the company's growth plans over the next few years.

However, I consider this to be a minor risk as the company can take other actions to offset revenue losses.

Final takeaways

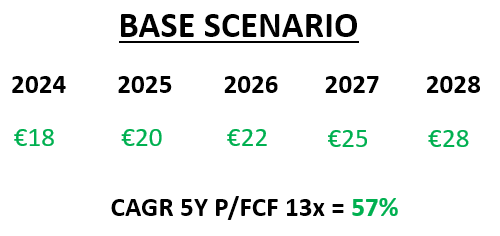

I really like this investment idea; I think it has great potential over the next 10 years because of the company's ability to add different parts to its network by gradually consolidating the market and trends in energy efficiency.

An important part is that the acquisitions it makes by introducing them into its model catapults sales and margins. As long as the company knows how to buy at an interesting multiple this strategy can work well.

For example, the latest acquisition (DMR) in the period of 2 years the company estimates that it can double its turnover and improve its margins by 30% thanks to the synergies achieved.

On the other hand, perhaps the most important part is the management team, which is undoubtedly the biggest competitive advantage it has. As it integrates companies into the model, it also integrates the management of these small businesses to make them grow together. I believe that this combined knowledge and joining forces is what will increase the project's chances of success.

As always, I would like to thank those of you who read and recommend the contents of the blog. I haven't been able to write for a while but now I'm back to work!

I think here is a number missing:

"Approximately % of income comes from industrial activity"

Note: According to newspaper reports, Ms. Meloni has discontinued the 110% super bonus program.