Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Summary

IPO February 2021.

Growth organic & acquisitions strategy.

85-90% recurring revenue.

EBITDA margin >40%.

Co-founder as Executive Chairman.

The Stock

Market: London Stock Exchange.

Ticker: FSG.

Market Cap: £450M.

Liquidity: illiquid.

Dividend: payout of 60%.

A company with venture capital DNA

The company defines itself as follows:

The Foresight Group is an award-winning infrastructure asset and private equity investment manager that specialises in providing investment opportunities in difficult-to-access private markets to both institutional and retail investors using ESG-oriented strategies.

Co-founded by Bernard Fairman and Peter English in 1984 the company was born for alternative management, first privately and then by opening a new fund to the retail universe.

The group operates in three different divisions always with an ESG perspective combined with alternative private management:

Foresight Infrastructure, an infrastructure asset management team focused on the renewable energy and infrastructure sectors. Targeted in solar, onshore wind, waste and bio energy but also projects related to renewable energy enabling projects (such as flexible generation and battery storage), energy efficiency solutions, social and core infrastructure. (78% AuM).

Foresight Private Equity, a private equity and venture and growth capital investment management team focused on investment in UK regional SMEs. (10% AuM).

Foresight Capital Management (FCM), applied private market expertise in listed securities. (12% AuM).

Most of the Asset Under Management (AuM) is managed through various investment vehicles like Evergreen, LP, OEICs, VCTs, etc. and some of these products have financial advantages for the retail customer and, on the other hand, they have a greater or lesser degree of correlation with the market (such as Evergreen, which tends to be uncorrelated). The company's revenues are obtained through the fees it charges its clients for its services.

68% of clients are UK and international institutional investors such as pension funds, “blue chip” institutional investors, family office and high-worth and other private individuals that"needs" to be exposed to the transition that is taking place in Europe in search of a decentralised energy production model, low-carbon models far from the existing fossil fuel plants.

This good relationship with institutional investors is what makes Foresight's business model strong, and in recent years it has managed to turn its business model around to achieve a recurring profit of 85-90%. To get an idea of the average investment term of an institutional client who has invested in one of the investment vehicles (e.g. a mutual fund) keeps the money for a period of 12 years. This gives excellent predictability to the business for many years.

The remaining 32% of customers belong to retail which is obtained through a network of partners. In fact, the division that is growing the most is precisely Foresight Capital Management because of this "need" to be exposed to this clear trend between now and 2050.

If we look at the revenue per division we can see that curiously, the divisions that manage the least AuM contribute around 44%. This is due to the company's resilient product mix, while the Infrastructure division is focused on institutional clients with an average fee, the Venture division doubles the fee. On the other hand, the retail-focused FCM division has a very competitive fee but its growth is very high.

Another feature I like about the company is the distribution of the real assets it manages between the UK, Europe and Australia. The company recently made an acquisition with which it plans to grow further in Australia and also from there into Asia-Pacific.

ESG as a long-term growth driver

The company invests all the funds it raises from its clients in a sustainable manner. The first investment in renewable infrastructure was in 2007 when the renewable energy market was not yet really mature. Therefore, the global energy transition boom we are experiencing is not new to the company.

Since 2008 there has been a huge demand for infrastructure investment from US$38 trillion in 2008 to US$89 trillion in 2019, growth of approximately 15% YoY. In general, the infrastructure market is considered resilient and therefore a lot of capital has flowed into this market segment in recent years.

If we add into the equation the "pressures" with the introduction of ESG criteria (such as climate change and pollution, diversity, data protection and bribery and corruption) in the financial and corporate world; we have a pressure cooker as far as the flow of capital towards these thematic projects is concerned. According to sources at Deutsche Bank, Global Sustainable Investment Alliance, zeb research , by 2028 global AuM invested in ESG mandates is expected to exceed $100 trillion.

To our nice equation we can also add the agenda until 2050 to decarbonise Europe or the pressures for model change that have further accelerated the trend after the Covid 19 crisis and the war in Ukraine.

It is estimated that by 2050 70% of energy generation will be renewable. According to Bloomberg New Energy Finance, US$15 trillion is expected to be invested in new power generation globally between 2020 and 2050, with 73% of this investment expected to go into renewable energy sources.

Europe is leading this evolution most ambitiously and by 2040 it is estimated that 75% of its energy production will come from renewable, led by solar and wind power generation.

Foresight is uniquely placed to capture some of this long-term investment. Thanks to its alternative investment philosophy, it is also able to capture capital flows from increased investor appetite for higher return products that are more decorrelated to the market and illiquid. In addition, the alternative investment sector does not experience downward pressure on margins due to the higher returns to its clients.

Foresight competitive advantages

The group's main competitive advantage is its active management of the investments it makes. It can sometimes be involved from the very inception of the project, design its financing, build, manage and optimise it and finally sell it at an attractive multiple.

In the Venture division the company is looking for opportunities outside the London environment, in £1-5M investments, which is the niche market where it specialises. Once landed, Foresight applies its own methodology to help management grow and strengthen the business in a way that extracts maximum value. Once the process has matured, it sells its stake to another investor.

Venture Capital firms have something special and that is that when they specialise in a niche for many years and because it is a private market, information does not flow as it does in the public market. This generates enormous barriers to entry for new competitors, as this information is privileged and generated based on the experience of carrying out many transactions over the years.

Foresight reviews hundreds of companies annually but only a small percentage are actually acceptable for investment (<5%). An extensive knowledge network is used in the idea elicitation process including developers, construction contractors, lending banks, strategic partners, land owners, manufacturers, power companies and lawyers, as well as gain access to on-market investments through investment bankers. The image and prestige gained over decades of work results in another new barrier to entry for other competitors, especially in the UK.

Growth strategy

The company uses the organic route and the acquisition of other complementary businesses to grow.

In this business, the most important thing is to raise new funds and obtain positive capital flows. The company has the ability to keep the fees it charges in a predictable manner without further pressure. Therefore, the ingredient for success and further organic growth is to obtain and cultivate a network of local relationships with institutional and retail distributors.

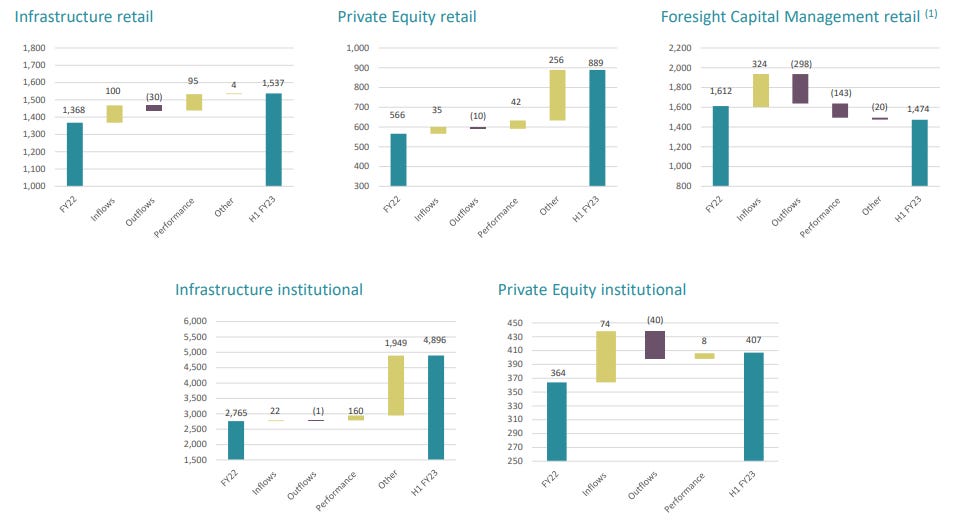

For the time being, this objective is being achieved well despite a demanding and highly uncertain scenario that is testing the resilience of the business. During H1 FY23 the product/customer mix that did worst was FCM which is precisely the product that is most similar to the rest of the most popular indices or products that we can find in the market and where we can find the most competition. On the other hand, the rest of the product/client mix continued to raise capital under management and even increased thanks to the performance obtained with a certain decorrelation from the market.

On the acquisition side, the company seeks to accelerate its growth by finding good businesses that can fit with its philosophy and extend its network of contacts and product sales. The latest acquisition was in Australia to increase the infrastructure division acquired for a multiple <8x EBITDA. With this acquisition paid 50% in Cash and the other 50% with the issue of new shares, the company intends to expand in Australia and also to access the APAC area with the contacts and relationships it can develop there locally.

Risks

The most prominent risks can be summarised as follows:

The development and implementation of a new renewable energy model is highly regulated, changes in government policies or agendas can affect the future return on investment in the long term.

High competition from other fund managers attracted by high expected capital flows in the short, medium and long term.

In the Venture Capital part of the business, the company invests in early stage start-up businesses with a high return but also a higher risk.

Loss of key managers that may affect the relationship with institutional clients or damage the company's image and credibility.

It has very little track record in the stock market.

It is necessary to monitor that the purchases they make are at attractive prices and without getting into too much debt.

Final takeaways

It is a stock that meets many of my favourite investment criteria:

Simple and clear business model, with a mega trend of growth behind it for many, many years.

Asset light with virtually no reinvestment in the business and the advantage of being an operating leverage business.

In fact, the company is very insistent on rigorous cost control.

It also does not pay out large amounts in stock options and seems to be geared towards returning money to shareholders.

The co-founder of the company remains at the helm and owns ~28% of the shares.

AuM growth target of 20-25%, recurring revenue of 85-90% and pay-out of 60%.

I believe that if the company demonstrates that it is able to grow sustainably and expand into new territories while maintaining its competitive advantage, it can deliver value for many, many years with high predictability.

I hope you liked it! Don't forget to leave me comments! Thanks

Thanks for this comprehensive piece on Foresight. I too feel that it is being unfairly overlooked by the market but perhaps the management should get out there and raise its profile with retail investors?