Gamma Com plc (UK:GAMA)

Leading communications in Europe

Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Summary

Company with strong balance sheet.

Organic and inorganic growth (~13% YoY).

Market tailwinds for the coming years.

Progressive increase in margins.

Dividend and share buyback policy.

Company overview

Gamma provides communications across the UK and Europe, specialising in business-to-business (B2B) products and services ranging from telephony, broadband connectivity, chat and video conferencing to network and asset management and call centre infrastructure.

It was founded in 2002 and is headquartered in Berkshire, the United Kingdom.

What it does?

Gamma covers cloud-based telephony and communication systems, voice enablement of collaboration platforms such as Microsoft Teams, connectivity, mobile, networking and security. It offers a wide range of services on these technologies, including design, implementation, management and support, with extensive expertise and experience.

The company specialises in the niche market of small and medium-sized (SME) customers and serves through an extensive partner network. However, in recent years it is gaining notoriety among larger customers and the public sector.

Key products and services

Gamma is based on the technology offered by large companies such as Microsoft, Amazon or Cisco, and adds value by enhancing their offering with its own technologies.

The products and services offered can be divided into the following main blocks:

Unified Communications as a Service (UCaaS) Solutions, allows enterprises to combine multiple types of communications into a single service that is delivered in the cloud and can be accessed wherever they are needed.

Voice Enablement, telephony-related services to receive calls based on Cisco technology. It enables other application providers, such as Microsoft Teams, to make and receive calls using phone numbers that use the Gamma core voice network.

Connectivity, modern voice services require data connectivity to operate. Gamma offers a full range of connectivity and services over fixed and mobile.

Take a look at this video to understand what the technology UCaaS is by Nextiva.

Business model

Gamma is able to provide communication services to 20 countries in Europe, particularly the UK, Germany, the Netherlands, Spain, Belgium and Ireland.

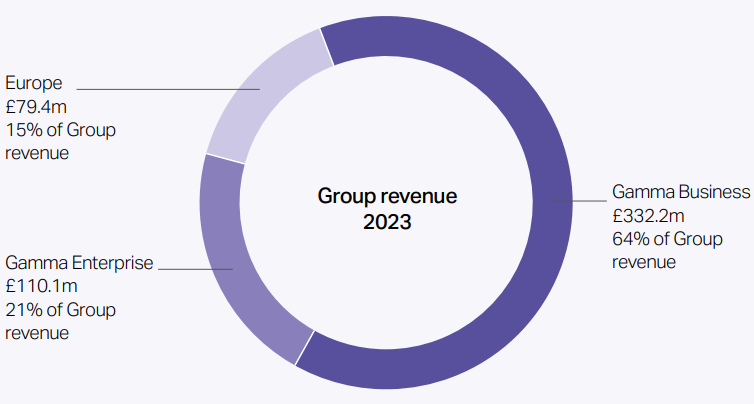

The graph above shows where the income comes from. Most of it is from “Business” or SMEs in the UK; followed by “Enterprise” or large companies and the public sector and finally “Europe” the revenues obtained in Germany, the Netherlands and Spain.

Gamma grows organically using direct sales but mainly achieves sales through its partner network of more than 3,000 members. It also has the network effect; the more users use it, the higher the value of the products and services offered and the more partners will be encouraged to offer these products to their customers.

On the other hand, 90% of revenues are recurring, thanks to the multi-year contracts they sign with their customers, providing high short and medium-term revenue visibility and consistent cash generation.

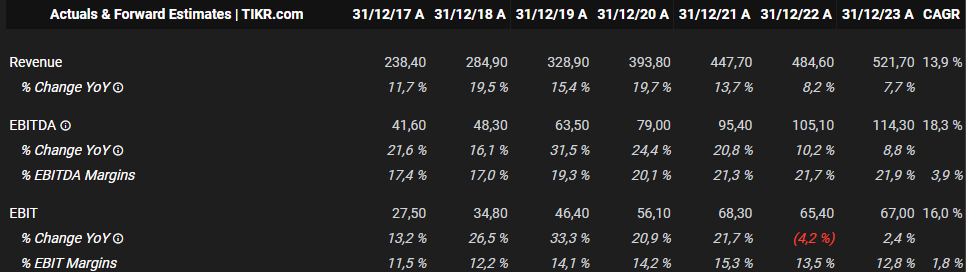

The table above shows the company's ability to generate FCF. With these resources the company will acquire other companies in order to enter other markets, new customers or complete its product portfolio.

During the worst of 2008 to 2011 the company continued to generate uninterrupted FCF. Although technology has advanced enormously since then, its mission remains the same: to provide reliable communications to its customers. It is therefore a crisis-resilient company because the service it provides is critical and indispensable.

We can see that it has very solid double-digit revenue growth thanks to the fact that it is still a small company with an under-penetrated market. Also the EBITDA margin is gradually increasing like clockwork indicating that it is not suffering from cost pressure or competition. This indicate that it is a company with a competitive advantage.

Market trend

The global Unified Communication as a Service (UCaaS) market is forecast to grow from $36.33 billion in 2024 to $107.51 billion in 2032, at a CAGR of 14.5%.

Since UCaaS technology enables communication via video, audio, messaging and chat, it improves the organisation and productivity of companies as well as customer satisfaction. Furthermore, investment in cloud infrastructure over the last few years has also made it possible to provide these services to companies.

In addition, the use of not only computers for work but also mobiles, tablets and other devices is increasing the demand for connectivity and mobility. This, coupled with the rise of teleworking, further supports a more unified communications environment.

Growth strategy

The company is clear about what its goal is:

To be the leading provider of UCaaS services to SMEs in Western Europe and to be a trusted communications partner to large Enterprises.

How is it going to do this?

Develop multiple routes to market in each country in which they operate.

Develop a common pan-European product set for UCaaS and CCaaS for SMEs.

Become a trusted partner to large Enterprises across Europe, transforming their communications.

Create an organisation that engages all its people with a common set of values and goals.

An important part of the company's DNA in recent years has been to acquire new companies in order to complete its product offering. The environment in which Gamma operates is fast changing as technology evolves rapidly. The company's ability to identify and make the right acquisitions is vital to continue to build on the success of the company.

M&A

Gamma has a serial acquirer profile. We note that even in a year as difficult as 2020 it was able to make up to four acquisitions. In these times of high rates, it has also managed to continue acquiring new companies.

Unfortunately, the company doesn't share the details of the transactions, so we don't know at what price you're buying. However, I have calculated that its ROCE including goodwill from 2018 to date is on average 30%. This is very good and shows that the company is creating value with its M&A policy.

Competitive advantage

It is one of the few companies that are able to offer the product portfolio and can supply SMEs as well as larger companies and public sector. It is a competitive advantage that the company must take care of because the market is so changing and has become so complex that it may not be sustainable. It seems that over the last 7-8 years it has been able to.

I have been looking at some of the company's competitors and they are really quite poor quality like 8x8, Frontier or Maintel; are hardly able to generate a stable profit. Of course there are larger companies that also want to take over the market but they are not focused on the SMEs segment.

Management

Normally I like to see the founder at the head of the company and if not at least the CEO and management with a significant shareholding. This is not the case with Gamma.

Approximately the current CEO (Andrew Belshaw) has around USD 1.96 million in shares but if we look at the table above his salary in 2023 was GBP 1.2 million. If you do the math, he is more motivated to stay on as CEO than to grow the company.

However, management has a variable target to increase EPS by at least 8% annually so there is some motivation. It should also be noted that the company pays dividends -having made it grow progressively- and this year has initiated a GBP 35 million share buyback programme, so it is not all bad news.

Risks

The company includes an analysis of the associated risks in its financial statements and updates it annually.

It is clear that the company attaches a great deal of importance to this, as its employees are encouraged to report any new risks that they identify in their day-to-day work. Corporate culture can be a differentiating aspect as Gamma encourages its employees to be proactive in the management of the company.

Apart from those identified by the company in the table below, I would also highlight M&A risk because if the company is facing a strategy of accelerated acquisition of companies, it is important to make sure that it buys them at a good price, and on the other hand, it is preferable to make small strategic acquisitions that allow it to complete its portfolio. Repeated failures on this point could change the prospects of the business.

Final takeaways

I like the company very much because of the strength of the balance sheet over many years. It is not easy to have this consistency of FCF generation, sales growth and margin growth through the recent crises we have seen. It is a moderately double-digit growth business that does well in difficult times.

The market in which it operates has a lot of tailwinds, even though it only operates in a few European countries. The regulatory issue may affect the company in the future, but it can also be positive if the company manages to adapt, as it is a barrier to entry for new competitors.

The main growth driver is the UCaaS market segment, where it will grow at double-digit rates for many years to come. This means that new capital and competitors will be attracted to this market. However, as an established company that knows how to manage its relationships with partners and customers, its revenues are recurring thanks to medium to long-term contracts.

No stock is perfect, although I would like to see more share buybacks by the CEO as evidence of his commitment to the company. However, the increasing share payout and the recent share buyback are good signs that management is looking after its shareholders.

Thank you for reading me! I encourage you to comment so that we can all learn from the fantastic world of investing! See you soon!