Installed Building Products (US:IBP)

Serial acquirer niche building products

Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Key data

Serial acquirer since 1999

ROE 34%

ROCE with goodwill 24%

Boring business and no technological disruption

CEO & founder with 16% of shares

Company overview

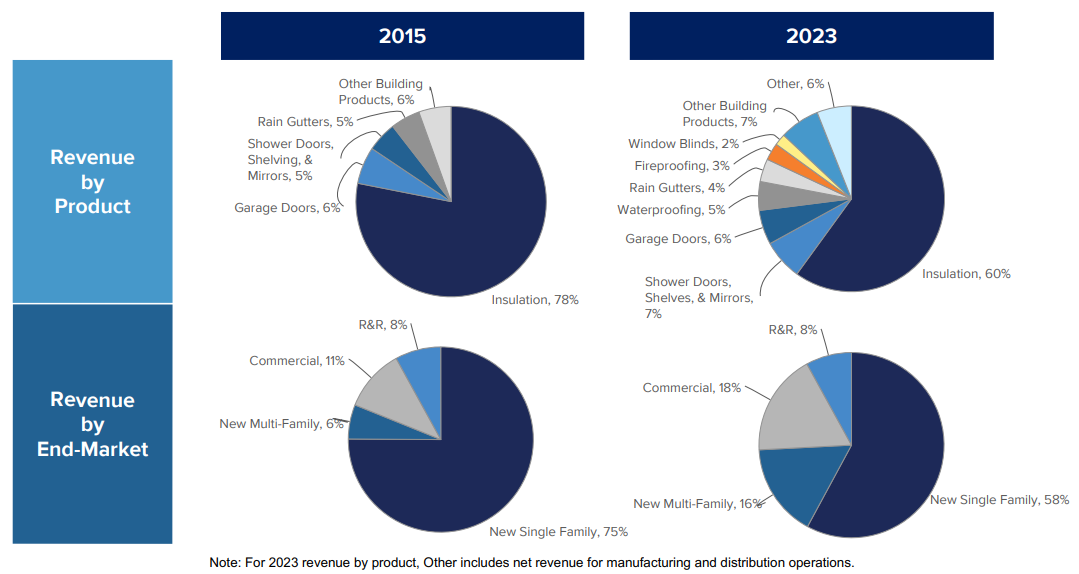

Installed Building Products (IBP) is one of the largest installers of insulation for the new residential construction market, as well as complementary building products, including waterproofing, fireproofing, garage doors, gutters, shower doors, closet shelving and mirrors, throughout the United States.

Founded in 1977 and headquartered in Columbus, Ohio. Listed since 2014.

What does the company do?

It operates in three different segments related to building materials and especially thermal insulation:

Installation

Distribution

Manufacturing

The Installation business is the core of the company and accounts for 94% of revenues. Most of the work is focused on insulation, although it can also install other complementary building products. Its clients are typically national, regional and local construction companies of different sizes in new construction projects of single and multi-family homes, commercial and refurbishment and repair (R&R).

Distribution segment represents 5% of sales and works with two distribution platforms:

AMD: has eight locations and serves several states throughout the Midwest and Mountain West using distribution platforms and warehouses. Its operations focus on buying insulation materials and installation tools from large manufacturers, storing them and distributing locally to its customers of varying sizes.

CAS: manages the supply of gutters and other accessories from five different locations used in existing or retrofit construction projects across the Northeast and Mid-Atlantic regions.

Finally, the Manufacturing (1% of revenues) business dedicated to the production of cellulose insulation and speciality industrial fibers. It sells its products to a wide range of customers including distributors, retailers and insulation contractors.

Business model

IBP's business model consists of positioning itself in the middle between material manufacturers and many end customers. In other words, IBP centralises the entire purchasing volume of its customers in a few manufacturers and this allows the company to have great bargaining power vis-à-vis its suppliers.

This simplifies the production chain as the manufacturer only has to interact once with IBP to sell to many end customers. On the customer side, the customer does not have to front the money or worry about purchasing, storing and taking care of this material.

IBP could be seen as a cyclical business as its customers are engaged in new housing construction. However, IBP's business model is very flexible and it can adapt its costs to the cycle as it does not have large fixed costs or Capex needs. On the other hand, thanks to its mix of products and end customers and projects, this cyclicality has tended to stabilise.

IBP has approximately 250 locations serving all 48 continental states and the District of Columbia. They serve a broad group of national, regional and local homebuilders, multi-family and commercial contractors, individual homeowners and repair and remodelling contractors. Their top ten customers, primarily a combination of national and regional builders, accounted for approximately 15% of net sales.

It is interesting to know that the installation of insulation in a construction project is a critical part of the process and has a low cost compared to the total budget. It is also elementary to do this installation as it will be one of the biggest energy savers in the future house/building.

Market trend

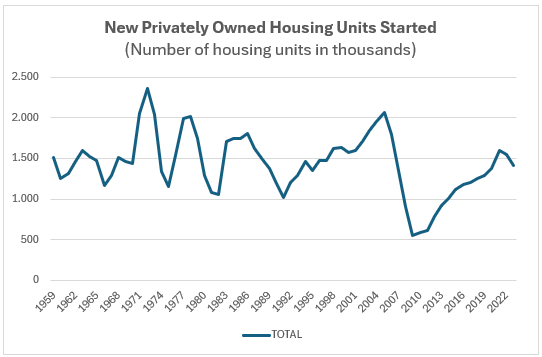

The residential housing construction market is highly cyclical and depends heavily on market conditions to initiate new projects. Elevated inflation, global economic uncertainty and the Federal Reserve's tight monetary policy affecting interest rates are expected to continue to impact the affordability of new homes.

There has also been an increase in spending on such projects in recent years, although the number of projects has not changed that much. This is due to rising costs and inflation in recent years.

However, if we isolate the cost increase from inflation in recent years, we can see that the market has not really increased the level of expenditure as fewer houses are being produced.

On the other hand, the availability and affordability of housing in the US has become increasingly difficult, especially after Covid, although since 2008 the housing problem has been worsening.

This is not likely to improve rapidly in the coming years.

Growth strategy

The company's strategy is to purchase and integrate well-managed installation businesses with good customer relationships and incorporate them into its network.

In fact, this company can be categorised as a serial acquirer. Since 1999, IBP has successfully completed and integrated over 190 acquisitions, creating significant scale and diversifying its product offering while expanding into some of the most attractive new construction markets in the United States. Therefore it is able to buy and integrate into its business an average of 8 companies per year.

Thanks to this high level of activity in adding new business to the IBP platform, the company has achieved a 30% market share of the insulation market to date.

What if the company is able to replicate the same model for the other categories still under development? It has interesting market shares in the rest of the installation products and therefore great potential for growth if it can maintain the same pace of acquisitions.

It should be able to continue this activity as the building products installation market is highly fragmented.

Competitive advantage

Power buying: this is undoubtedly the most important competitive advantage as it is one of the largest US purchasing platforms in isolation. This gives IBP bargaining strength against the four existing producers in the US market and allows it to achieve better timing, better planning and better prices. For suppliers, it is good news to have IBP as a customer as they place larger and more centralised orders than if they had to make small retail sales to each of IBP's customers.

Relationships and local presence: in the world of construction, the most important thing is to be reliable, to have a good relationship and, of course, to be competitive. Not all companies are able to achieve this, especially the smaller ones in times of economic difficulties or low demand. A strong company like IBP provides the financial muscle, support and systems so that local teams can work without other worries.

M&A activity: the company's ability to identify, agree with and quickly integrate the vendor into the IBP platform is spectacular. Especially in a boring industry with little innovation to apply. This strategy allows the company to diversify into products and geographies with little effort, and to consolidate its position with the major construction companies by offering its services in more and more parts of the map each year.

Local mini-monopolies: these types of companies work at the local level. As a local company, it is protected that other competitors from more distant areas can work because then they would not be competitive. This guarantees that companies in a specific area always have work. If we add to this good administration, financial support, purchasing power and time planning, IBP's business model is unbeatable for other companies.

Management

The company is headed by Mr. Jeffrey W. Edwards and is the founder of the company in 1999. He owns approximately 16% of the company with a market value of $1 billion.

In fact, the management takes good care of its shareholders by paying a small dividend and, above all, by buying back the company's shares every year since 2018. It has reduced the number of shares in circulation from 31 million to 28 million by buying back around 10% of the shares in circulation.

It is safe to say that he will be effectively aligned with shareholders.

What can go wrong?

Macroeconomic risks or a deep real estate crisis could affect the company.

Unfortunately, I could only find data up to 2011. I don't really know how it would have fared in the 2008 crisis, but looking at the net result for 2011 would give us an idea.

But we do know that it has survived one of the most difficult periods in recent times.

Final takeaways

Interesting company with an easy to understand business model. Boring sector where AI and technology will not compete.

The company has a long track record that can be seen in the numbers, revenues growing at double digits, EBITDA increasing progressively and EBIT as well.

As the company gains scale and centralises the costs of purchasing materials, trading, distribution, warehousing and administration, the company becomes more profitable.

As it grows, it becomes better known to contractors looking for a trusted partner to carry out critical, specialist work on a global and local basis in the US.

On the other hand, smaller companies involved in the installation of insulation and other solutions that are struggling with the difficulties of a cyclical business want to align themselves with a capable company.

This is the true value of IBP, which has been developing the ultimate business model for over 20 years.

As always a pleasure to write for my current and future readers. I look forward to your comments, don't be shy!

If you have liked or added value and would like to make a contribution to my work as an independent analyst, please click on the button below. Thank you!