Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Key data

Business resilient to all economic cycles.

Founder at the helm since 2003 with >17% shareholding.

Organic growth >10%.

Fragmented market and cross-selling opportunities.

Company overview

The Johns Lyng Group is Australia's leading integrated building services company, providing construction, restoration, strata and essential home nationally and internationally.

The company has been on the stock exchange since 2017 and is based in Doncaster, Australia.

Services

The company provides two main types of services:

Business as Usual (BaU), focus on day-to-day operations including emergency response and targeting insurers and their clients in commercial, industrial and individuals:

Insurance Building and Restoration Services (IB&RS), building fabric repair, contents restoration, disaster management and hazardous waste removal.

Strata Services, day-to-day property management.

Essential Home Services, provide fire, electrical and gas compliance, testing and maintenance services.

Catastrophe (CAT), providing immediate response and medium-term reconstruction in disasters with a government client focus:

Disaster Response Services (CAT).

Disaster Management (DMA), crisis response, recovery and reconstruction solutions, supporting communities to recover following bushfires, floods, cyclones and storms.

How works the insurance market?

Business model

Johns Lyng's business model is to carry out property-related work for their clients. These assignments are often unpredictable, so we provide an immediate response using their own resources and a network of geographically specialised sub-contractors.

Its clients are large insurance companies, insurance brokers, loss adjusters, commercial enterprises, local and state governments, corporations and private individuals. On the face of it, the end client would seem to be the policyholder, but in my opinion Johns Lyng focuses on the insurer and not the insured.

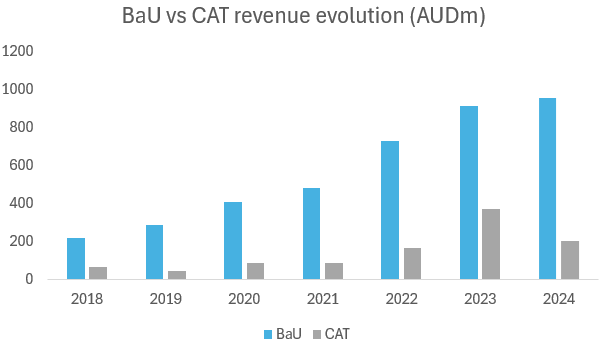

Revenue is earned per service provided. As we have seen above, there are two categories, BaU and CAT.

The services under the BaU umbrella are recurring services, the core of the business, with some organic and inorganic growth. These are everyday services, such as fixing the plumbing in a house, or even basic services such as installing a fire alarm. The customers are usually insurance companies or property managers.

Recently, Johns Lyng has been looking to grow in services where the nature of the services in which it is positioned generates a constant and predictable cash flow, such as alarms, gas or electricity inspections or strata services. All the services it provides are perfectly compatible with each other, creating synergies between all the business units it controls.

CAT services, on the other hand, essentially one-off services with immediate response times and national coverage. The company is well known in Australia as one of the leading providers of this service. The customer who orders these services is usually the government and local/regional authorities.

On the face of it, these services do not appear to be recurring, but if we look at the company's accounts, we can see that catastrophes from a few years ago continue to generate a steady income for the company. Each new catastrophe represents several years of income.

Market trend

The global home insurance market is valued at around $250 billion and is expected to continue to grow by 7-8% until 2030. In the US, the market is estimated to be $121 billion and is forecast to grow to $148 billion by 2028, with the catastrophe market historically adding an additional $30-110 billion in value each year.

Although home insurance is not compulsory in Australia or the US, lenders do recommend and make it compulsory to take out home insurance.

As time goes by, home repair costs become more numerous and costly for insurance companies. Therefore, it is safe to say that this market is neither cyclical non-discretionary.

The main drivers of market growth are linked to population growth, the rising cost of living and the likelihood and severity of special events due to inclement weather.

Interestingly, climate change is leading to an increase in natural catastrophes, which, although unpredictable when they occur, have a major impact on people's lives, making insurance indispensable to society as a whole. In Australia in particular, there are an average of 13 major cyclones per year, mainly affecting coastal areas where the population tends to migrate, so the number of households affected is expected to increase.

Growth Strategy

Johns Lyng develops long-term strategies both organically and through acquisitions. The most important strategies are:

Organic growth by improving its relationship with insurers and the entire vertical value chain to capitalise on this growth. It also aims to become the panel of choice for insurers it does not currently work with. On the CAT side, the aim is to continue to penetrate and improve the relationship with government and local authorities. Thanks to continued geographical expansion and the signing of new partners, it will be able to extend its response capacity throughout the territory.

Johns Lyng USA, in 2018, expansion into the US started through the opening of offices, agreements with third parties and partners, and the acquisition of companies. For the time being, the company is more focused on its core business (IB&RS and CAT), but with a view to replicating its success in Australia. Growth in the US can accelerate the company's plans, and if it can replicate the brand and build the right relationships, it has years of growth ahead in a huge market where floods, fires, hurricanes, tornadoes, etc. occur every year, and where the company is a leader in its home market of Australia.

M&A growth by acquiring companies in a highly fragmented market. The idea is to be able to make acquisitions in adjacent markets, thereby diversifying and achieving cost and cross-selling synergies, which makes perfect sense given the nature of Johns Lyng's business. For example, strata services with Essential home services and construction and restoration services. In fact, by integrating the entire value chain, they can provide a more agile service delivery point; at least in theory. Over the past few years Johns Lyng has been concentrating on acquiring strata businesses in Australia and the big acquisition in the US was in the IB&RS market with Reconstruction Experts (RE), which was definitely used to launch its bid for this large market. Interestingly, the company retains the management and also likes the fact that they hold a lot of shares in each other's businesses. So, a culture of entrepreneurship and what better than to be aligned by the same interests.

Competitive advantage

Scale is undoubtedly the biggest barrier to entry in this market, as insurers want to work with companies that have sufficient capacity to cover most of the territory and carry out all types of work available. Therefore, working methods have to be adapted to these large customers, who need a decisive partner with many resources.

Over time, this adaptation to the client (insurer) creates a relationship of trust, where Johns Lyng will improve according to the interests of both parties. By creating this unique relationship, so well adapted to each other's needs, it is very difficult to replace.

Last but not least, corporate culture is a differentiation. When the company makes an acquisition, it encourages the management to take a stake in the subsidiary, thereby promoting a decentralised approach and entrepreneurial spirit throughout the territory.

Management

Since Scott Didier bought the company in 2003, it has grown steadily. From a small local business to the giant it is today.

Interestingly, the management team has short and medium to long term financial incentives with key KPIs such as EBITDA, EPS and ROE growth.

The management owns an interesting package of shares, thus aligning the interests between the company and its shareholders. Scott Didier personally owns 17% of the shares with a market value of about US$121 million.

What can go wrong?

The company defines itself as a "defensive growth" company. I think rightly so, as the nature of the business is rather decoupled from the general economic cycle.

Perhaps the biggest weakness of the business is that the relationship with insurers will deteriorate somewhat. It is true that it works with several insurers, so the risk is spread.

As we have already mentioned, Johns Lyng's customers are mainly insurance companies. The policyholders are the end users where the work is done. Although this is not entirely scientific, I have checked the opinions of end users on the internet regarding some of Johns Lyng's offices and it is surprising to see the poor opinion they have of the company.

Shouldn't Johns Lyng also consider the opinion of the end user? How might this affect the company's relationship with insurers in the long term if it were to shed its apparently bad reputation on the networks?

It seems to be nothing new and I would feel more comfortable if the company did something about it.

Final takeaways

I like Johns Lyng very much, it is a quality company with a very clear strategy to grow organically and inorganically with a unique entrepreneurial and growth culture.

In addition, its growth plans in the US make it easy to believe that the company can continue to grow in double digits for many years. Because of its unique characteristics, the company has historically grown at 10-15% organically plus acquisitions.

The business model is absolutely asset-light, with virtually all capex invested in vehicles. By gradually increasing its workload, it can easily grow its EBITDA on a sustainable basis due to its operating leverage.

The management is also aligned with the interests of the shareholders, although there is one point that I do not like so much, and that is that it tends to make aggressive dilutions over time.

This is probably the thing I like least about the company, but no stock is perfect.

The Hermit substack Special Guest

I would like to share Alejandro Yela's Substack - The Hermit with you.

I think you might find it interesting due to the high quality of the author's content.

I encourage you to check it out!

As always, I am very grateful to those who read and support my blog.

Regards and see you soon!

💎 Thanks for sharing, this company is really interesting !

Thank you for the excellent analysis of a company I didn't know.

Very interesting company. What is the reason for the strong drop this year?