Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Summary

Small-cap with more than 50 years of history and positioned as a world leader

Quality customers in the medical and defense & space industry

Double-digit organic + inorganic revenue growth

Progressive EBITDA and EBIT margin expansion

Insiders hold >50% of shares

Next year P/E valuation at 21x

The Stock

Market: Euronext Paris

Ticker: LBIRD

Market Cap: ~€414M

Liquidity: Illiquid

Dividend: No

1. The Company

Is one of the world’s leading specialist in lasers with 50 years experience developing different laser technology created through the business combination between the Keopsys and Quantel Groups in October 2017. With more than 1000 employees and offices in Europe, North America, China, Japan and Australia; Lumibird has the mission to popularise this technology with more than 60 years of history.

Therefore, Lumibird objective is industrialising laser production to achieve the widest access to laser technology and reach large production volumes and innovation.

Innovation, to design increasingly high-performance lasers that are aligned with end users’ constraints and industrialisation to adjust capacity to strong demand from the markets and produce at competitive costs.

2. Products

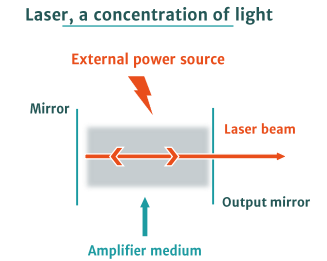

Laser technology has been around since the 60s of the last century and since then it has not stopped evolving and finding new applications up to the present day. The company has also been able to adapt during its 50 years of existence to these continuous changes in the market and demand.

Lumibird is positioned as a leader in different types of high-tech lasers, in particular Solid-stated lasers, Diode lasers and Fiber lasers. These market segments require constant investment in R&D, innovation and industrialisation and some of the best-selling products require high manual specialisation to be produced.

In the context of the high-tech laser market, it is often the case that there is more demand than production capacity.

The company specialises in two main application groups:

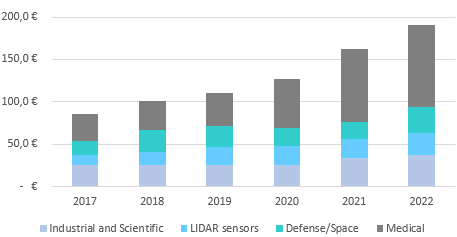

Photonics which in turn is divided into different application areas:

Industrial & Scientific includes products for laboratory experimentation tools, industrial production tools, flat screen repairs, etc.

Defense & Space for the development of different governmental and international agencies including space exploration. And, on the other hand, the development of components for the defence industry for the guiding and telemetry lasers used on fighter aircraft.

LIDAR sensors for the autonomous vehicle industry, drones, wind turbines and other military applications. These same sensors can also be used for 3D scanning and pollutant detection.

Medical specialising in ophthalmology equipment and laser-based treatment

of the 4 major causes of blindness: macular degeneration, glaucoma, diabetic retinopathy and cataract.

3. Industrial and commercial organisation

As we said earlier the Group seeks to industrialise production in order to generate competitive advantage and thus gain market share.

To this end, the company organises its production with a mix of suppliers (at least two supplier per purchasing category) and the core part of production, assembly, design and know-how is carried out on the company's premises. No supplier represents more than 5% of the material purchases and the top 5 suppliers represent less than 10% of the amount of the Group's purchases.

The company activities are spread over 7 sites:

Lumibird’ headquarters (Keopsys industries) and 2 sites for R&D, manufacturing and maintenance in France

2 sites Quantel USA

Site of Optotek in Slovenia

Site of Ellex medical in Australia

3.1 Sales

The sales force is divided in two teams, Photonics and Medical.

The Photonics division is concentrated in France and also has subsidiaries in Germany, Japan, China and USA.

The Medical division has subsidiaries in USA, France, Japan, Australia, Poland and Nordics and sells directly to practices, hospitals and clinics. This division also has an extensive network of distributors that covers more than 100 countries.

85% of sales take place outside France and the top 5 export destinations are USA, China, Germany, South Korea and Swiss.

No direct or indirect client represents more than 15% of the turnover and the 5 largest customers represents less than 15% of turnover. Payment terms normally are between 30 to 90 days.

3.2 Major contracts

Although we do not know the percentage of recurrent sales, the Group holds 3 major contracts that represents the levels of quality and notoriety in the market as a key-player.

The Megajoule laser is a contract with a long history for the group when in June 2005 they were selected by the Commissariat for Atomic Energy and Alternative Energies (CEA) to produce part of the project equipment. The objective of the facility is to serve as a simulator of thermo-nuclear reactions. This massive laser is located in Bordeaux and together with its American equivalent -the NIF- is the most powerful in the world.

The study and production phases were spread over the period 2007 – 2022 and represented to Group a turnover of more than €60M. Currently, the Megajoule contract is finishing although the company is still carrying out some maintenance work for the project.

The second contract of interest is with Thales, a large French multinational specialising in defense, space and security equipment. Thales' main shareholders are the French government and the Dassault family.

Lumibird supplies the guidance lasers used for equipping fighter aircraft Rafale. This supply is part of a long-term contract that began with a study phase in 1999. Since then, the Group has been working on the development and supply of the new laser and rangefinder laser. Latest news the production contract will be extended over a period of 10 to 20 years for a total of several tens of millions of euros.

Finally, the third long-term relationship is Airbus ESA. At the end of 2018, Airbus entrusted the Group with the production of diode-pumped laser amplifiers as part of the ATLID program. A new program is being discussed with Leonardo and Airbus.

4. Laser market

By 2025, the entire laser market is estimated to have a volume of $25B with annual growth rate of 9.6% according to Strategies Unlimited report.

The laser market is divided into very specific market niches and no single company is able to dominate a large part of it. The sectors where the company aims to dominate have double-digit growth for many years to come.

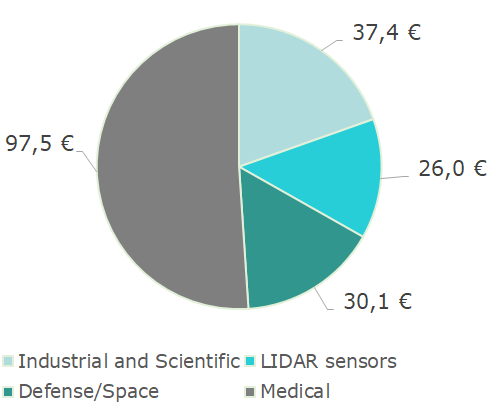

The Group has focused on 3 key sectors. While LIDAR and Defence & Space have very high future growth rates, the Medical sector is slower growing and a more mature market.

Different studies suggest that the LIDAR market will grow at a 30-40% CAGR and a market value of $5B and for the Defence & Space is estimated to grow slightly less at a 22% CAGR and a market value of $4.5B by 2025. The major drivers in these sectors are:

Autonomous mobility

Wind industry

Product development and new applications in the field of Defence & Space

On the Medical side, moderate growth of single mid-digit is estimated by the company and a market volume of $0,6M. Here growth drivers are more predictable:

Aging population trends

Increased access to healthcare

Evolution of treatments for pathologies (less invasive, IA, etc).

In 2022, Lumibird had a turnover of only $191M, so it is safe to say that Lumibird still has many years to conquer new markets.

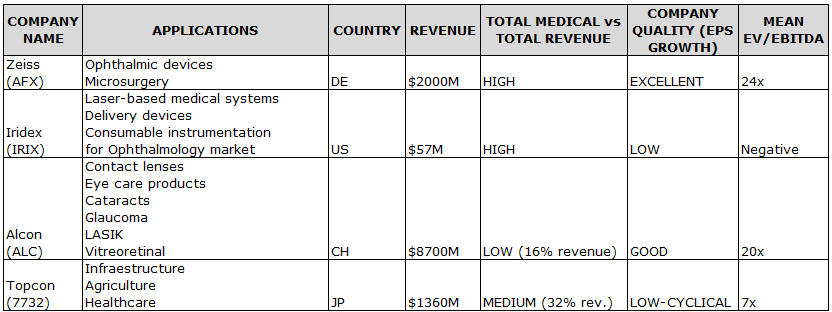

5. Competitors

The laser market is fragmented into different companies without there being one or several companies that dominate the entire market. However, we can state that some companies are leaders in their respective market niches.

According to the group's estimates, it has a leading position in the fiber LIDAR segment with a market share of 5-25% worldwide, while in the field of pulsed nanosecond lasers it depends very much on products, applications and countries without having an exact figure. In Medical ophthalmology division if we exclude USA and Japan the company has a market share of 10 - 20% depending on the product.

5.1 LIDAR

The following list of listed competitors can be extracted. None of them are of excellent quality as a company, nor are they oriented towards LIDAR. In general, its turnover with the sale of laser LIDAR technology is very low, with low growth and little development.

5.2 Defense & Space

The Defence & Space market does look very different from the previous one with good quality European companies. Clearly in this niche market competitors have more resources, compete on products with more similar functionality, have the ability to invest more money in R&D and its clients are governments and defense companies.

From the list, the company with the highest quality is Safra. Interestingly, Safra and Lumibird jointly own the military laser technology specialist Cilas. It is therefore interesting to know that both competitors are jointly involved in projects aligning their common interests as business partners.

Additionally, should also be mentioned the company Jenoptik, which is in the process of industrial reorganisation to become a Photonics specialist. It is a larger but much lower quality company seeking low-double digit revenue growth and target EBITDA of 18%.

5.3 Medical

In the medical division there are two major market players, Zeiss and Alcon. Both companies are focused on the ophthalmic market and have a high reputation.

In contrast, there are a number of weak or low-quality competitors.

6. Growth strategy

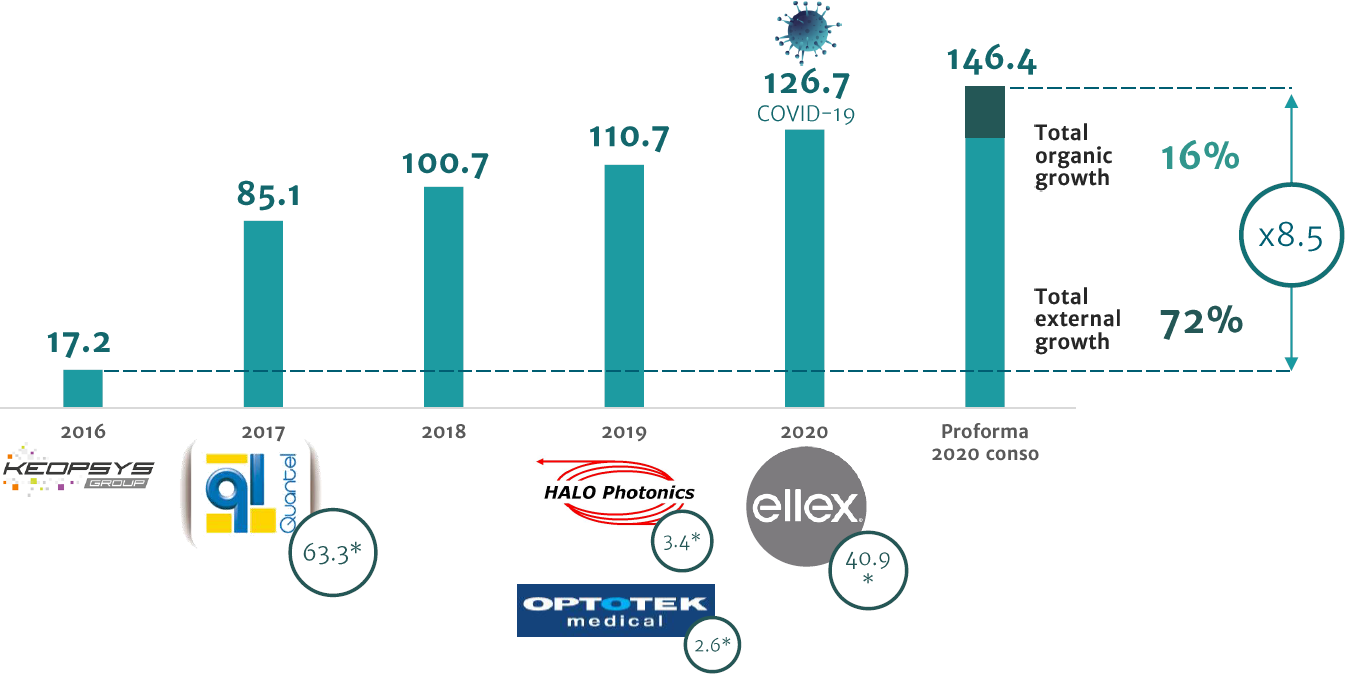

Since the merger between the two founding companies Keopsys and Quantel in 2017, the Group has not stopped growing and achieving its objectives. The company has a 2021-2023 plan with three growth main drivers: organic, EBITDA margin improvements and M&A operations.

Organic growth: the company expects to grow organically by 8-10% due to the inertia of the business itself. Considering that more than half of the revenue comes from the lower growth Medical segment, it makes sense. It should be remembered that laser technology is experiencing a second youth helped by the decrease in costs but also in the consumption and size of laser equipment.

Some of the competitors also affirm this.

EBITDA margin: improve the company's profitability by raising the EBITDA margin to the range of 20-25%. The laser industry has traditionally been very manual and low industrialisation. Lumibird wants to revolutionise this by industrialising production and being able to produce as much product as there is market demand. In fact, the group says that one of its main aims is to continue to invest in R&D to increase its production capacity, as demand is now outstripping demand.

Another important point is the vertical integration that the company wants to achieve. From the production of the most core and strategic components to the distribution of the products directly to the end customers.

Linked to the above, the third point that the group wants to promote is external growth through the acquisition of competitors: product manufacturers, laser system manufacturers or commercial distributors.

Let’s take a closer look of the external growth companies:

Halo Photonics (2019): is a British company specialising in the design and manufacture of Lidar instruments to measure wind with a substantial amount of business in Canada. With this purchase, the Group expands its market reach and helps to increase Halo's production capacity.

The Group paid for this division around 3.5x sales.

Optotek (2019): is a Slovenian longstanding partner of the Group which specialises in the development of laser and optic solutions for medical applications. With the acquisition the Group expand the offering and establish in new markets in Central Europe.

The company paid 2x sales for Optotek.

Ellex (2019): the company agreed with the Australian company Ellex Medical to acquire Ellex’s laser and ultrasound business to create a world leader for laser and ultrasound technologies for the diagnosis and treatment of ocular diseases.

The assets acquired include the Ellex brand, the R&D and production site in Adelaide and the commercial subsidiaries based in Australia, Japan, the US, France and Germany.

The merger of the two companies completes the product offering and geographic coverage with Ellex in Japan and the US and Quantel in Europe. Also it helps to achieve a scale effect which strengthen their joint R&D capabilities.

Lumibird paid 1,5x sales for Ellex.

EssMed (2020): specialised in distributing high-quality medical devices for ophthalmology with presence in Sweden, Finland and Norway. Revenue of €2M.

Saab defense laser rangefinder business (2021): located in Sweden and with a turnover of €10M the acquisition helps the Group to increase its presence to new European customers in the field of lasers and rangefinders, short to long range. The two companies have been collaborating for 15 years.

Innoptics (2022): is a very small company (only a revenue of €300k) that reinforces low-cost laser development projects as well as its defense & space projects.

7. Investment case and takeaways

Lumibird is a unique company.

Despite being in a market with relative competition and some regulated products, it operates with determination and a clear focus. The company aims to grow by 8-10% organically (market to 2025 to grow at around 9.6% CAGR) although it always delivers a little more than it promises. During 2022, it achieved organic growth of 12% (18% taking into account the effect of exchange rates).

The company would therefore be gaining market share from other competitors.

From external growth point of view Lumibird aims to industrialise and vertically integrate the market in order to achieve the knowledge and further development of the products in-house and at the same time reduce production costs. Recent acquisitions have been focused on broadening the product range, extending geographic coverage, expanding access to new customers and controlling the direct sales network.

With this mix of growth strategy, the company has managed to grow by an average of 17% from 2018 to 2022.

On the other hand, the normalised EBITDA magnitude has managed to bring it from 12% in 2018 to 17% in 2022 in only four years. The company's target is to achieve an EBITDA margin of 20-25% by 2023.

If we take a look at the directive it is highly aligned with growing the EPS of the stock. The company does not pay a dividend, the founder (Marc le Flohic) owns >50% of the shares and his remuneration is below €1M. We can consider that there is an alignment with shareholders in search of the greatest possible growth for the company.

Sum up and final takeaways:

Management aligned. Insiders owns >50% of the company

Resilient to crisis

Predictable revenues

Revenue growth ~17% YoY for many years

Low Debt Net/EBITDA ratio <1x

Some of the competitors are actually partners (e.g. Safra)

ROCE 20%

ROE 9%

EPS growth ~10 - 20% in a 5 years base scenario

Company MOAT:

Clear work plan: internal (8-10%)/external growth in LIDAR, Defense & Space and Medical and EBITDA margin 20-25%.

Industrialisation to reduce costs and increase sales. Vertical integration to control the entire supply chain.

Positioned in high-growth sectors with long-standing relationships with customers

Involved in research projects with governmental agencies

Thank you for reading me!

great. good quality company.