Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Key data

Company led by founders

Management with more than 42% of the shares

Organic growth and M&A of >20%

Giant digital transformation market

Company overview

Nagarro is pure-play digital engineering specialists which provides customised solutions to its customers such as digital product engineering, e-commerce, customer experience services, AI and ML-based solutions, cloud, IoT solutions and consulting on next-generation ERP.

The company was founded in 2020 as a spin-off from Allgeier SE, based in Munich, Germany.

Business model

Nagarro generates revenue primarily by providing IT service engineering to its clients. They believe in the agile way of working, where small groups of people work milestone by milestone. The work processes are shorter, but the end result is more efficient.

There are different ways of obtaining revenue from customers, either fixed price, framework agreement (fixed price and quantity to be defined) or by milestones.

To deliver its services, Nagarro needs very few physical things (basically offices and computers) and a lot of human potential. One of the keys to the business is attracting the best human capital, retaining them and making sure they are happy.

In this sector, it is very common for software experts and engineers to move between companies at a very fast pace (even for months at a time) in search of better conditions.

Nagarro's customer base consists of blue-chip company profiles spread across different sectors.

The company is present in a total of 68 countries located mainly in Europe, North America, Asia and Australia.

It has no geographical, industry or customer dependencies and is well diversified in all these areas, making it a resilient business model.

To win new customers, the company participates in various tenders, conducts demonstrations and case studies, attends events, is recommended by a partner or (what works best) by word of mouth.

In this business, credibility is what sells; proving that you are good at a reasonable cost. Once a client has completed a number of projects and is satisfied, they are likely to call you back because the systems and solutions you have created depend on someone to maintain and develop them.

Market trend

According to IDC, the Digital Experience Transformation (DX) market will be worth $4 trillion by 2027. This represents a CAGR of 20% year-on-year.

The numbers are impressive, and this is not surprising as the entire economy is going digital. Businesses need to invest and transform the way they engage with customers, and take advantage of huge productivity benefits such as AI and robotics.

The value proposition for companies that spend here is clear: I do a project and I get a little bit more return on my operations.

It's not really an expense, it's an investment and that's how they sell it to their customers.

The segments that are investing the most in digital transformation are financial services, automotive and manufacturing. These are highly competitive sectors. If one company in these sectors invests and succeeds in winning customers, the competitor has no choice but to invest in transformation projects as well if it does not want to be left out of the market.

In fact, this market has gone from being discretionary to non-discretionary; companies may stop spending for one or two years, but in the third year they will have to spend to continue to grow or maintain their systems.

A company can no longer function without systems!

Competition

It is an extraordinarily fragmented market as it is also very large in size. No single company is able to have a significant share of the total market.

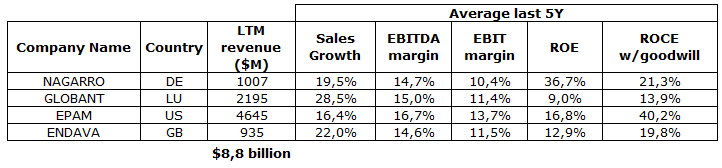

Let's compare Nagarro with the most similar listed companies: Endava, Globant and Epam.

Between these 4 companies alone we account for almost $8.8 billion of a giant but representative market of roughly similar size. If we look at the numbers we can see that Nagarro has some aspects to improve, such as growth and margins, although it is on the right track. It is worth mentioning that during the last two years the sector has come to a standstill.

The average growth of these companies is 20% year on year and the record holder is Globant, which has grown by 28% year on year over the last 10 years. In terms of EBITDA, these companies are around 15%, which is a sign that competition in the sector is intense.

Growth strategy

Fundamentally the company grows by gaining new customers, by increasing the volume of business with existing customers (there is room for improvement here) and finally through M&A which is a way of gaining access to new customers, technologies and markets.

Each year it makes a few small, strategically planned acquisitions. With these small acquisitions it manages to avoid much of the risk that is actually involved in M&A, such as making the mistake of taking on too much debt.

Competitive advantage

Culture, is undoubtedly Nagarro's biggest advantage. It is still a small organisation that is going global and is able to operate with virtually no hierarchical structures. In fact, many of its employees are also entrepreneurs with a mindset of total customer satisfaction and an agile way of working.

Engineers, most come from India. This is a competitive advantage over other companies in the sector as it is essential to keep an eye on the cost of your main resource. However, it is an advantage that may disappear over time as other competitors may tend to follow the same strategy.

Management

Management owns approximately 42% of the company.

Nagarro's largest shareholder is the CEO of Allgeier, Mr Carl Georg Dürschmidt and his family with 21.6%, followed by Vikram Sehgal (co-founder) and his family, Manas Human (co-founder) and Detlef Dinsel.

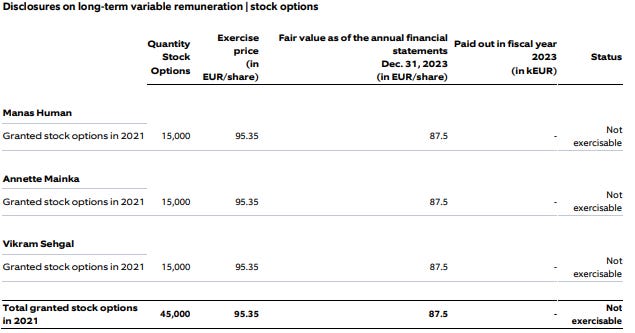

The total remuneration of the Board of Directors for 2023 shows a salary of around €230,000 each; which we consider to be fair. The Board also has a stock option of around €4 million, which can be exercised from January 2024.

We can say that the company does not abuse the shareholder and that the management team is aligned with the shareholders.

What can go wrong?

The biggest risk I see is people management.

With teams of people working directly with clients on transformation projects, you need to motivate them and have the right attitude towards them.

At the end of the day, one of the great advantages of this sector is that if the client is happy with a team, they will tend to use them again and again; as long as they can, because it doesn't make sense to change vendors for every project you have to do, there's really a cost of change and inefficiency. So there is some sticky demand.

Therefore, Nagarro's culture and image has to be impeccable and sensitive enough to ensure that its engineers -mostly in India- are happy.

On the other hand, it is a fast growing market with a lot of competition but there are periods (like the current one) when growth can stagnate as investments can be postponed. In later years, however, all that pent-up demand tends to be released and that is when these companies return to double-digit growth.

Final takeaways

In a base scenario, I have assumed that Nagarro will achieve 20% growth over the next 5 years and an EBIT margin of 10%. I have assumed that the company will make a 1% share buyback during that time.

A pessimistic scenario seems less likely to me given the company's track record. Although it has only been listed since 2020, it has a track record within Allgeier of many more years of growth rates above 20%. My feeling is that this rate can be improved.

In an optimistic scenario, which I think is the most likely, Nagarro can grow by 25% and achieve an EBIT margin of 12% from 2026. The company also wants to list strategically in the United States and has a long-term goal of growing to $10 billion in revenues.

Without a doubt, a very interesting sector with quality companies and clear growth drivers thanks to digitalisation and transformation for many years to come.

I hope you liked it and don't forget to comment your opinions! Greetings to everyone!

Amazing! You should check this guy out: https://andbank.es/boutiquehub/azagala/

You’re going to love his portfolio