NCAB Group AB (SE:NCAB)

Leading advance printed circuit board trader

Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Summary

Organic growth and M&A - 16% YoY

Gigantic market to conquer - TAM $25B

The highest quality and best positioned company to consolidate a fragmented market - 50 companies to acquire target

Management team aligned with shareholders - 20% of the shares

Stock

Ticker: NCAB

Market Cap: SEK 11,000 M

Liquidity: liquid

Dividend: yes

Company

NCAB is a worldwide leading supplier of printed circuit board (PCB) headquartered in Sweden. Founded in 1993, NCAB has a local presence in 16 countries in Europe, Asia and North America and serves a wide range of customers in different sectors such as: industry, automotive, telecom, medical, power, defence, datacom, aerospace and railway. Its sales in 2022 were more than SEK 4,400 M. The company is able to serve 45 countries with 615 employees using a network of suppliers with 31 factories in different parts of the world.

PCBs are bespoke platforms for electronic components connected via conductive tracks, pads and other features etched from layers of copper. PCBs vary in size and complexity and are custom made for each end-product. In almost all types of electronic equipment you can find a PCB. PCB represents a small share (1-3%) of the total value of the end-product.

Its core business is to provide its customers with a complete PCB distribution service acting as a single point of contact for its customers (PCB buyers and producers), taking full responsibility of the entire distribution chain, including supplier selection, quality control, production monitoring, price optimisation, engineering and design support and assistance, control of manufacturing files, logistics and storage solutions, delivery and order management. As an advanced PCB trader, NCAB serves a fundamental aggregation role between supply and demand on the market.

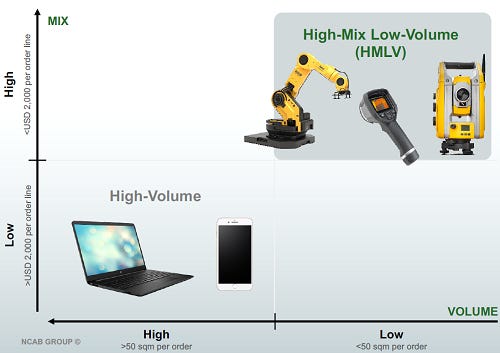

The market can be divided into High-Volume and high-mix low-volume (HMLV). Intuitively you can imagine that the High-Volume segment is where the large PCB production for mass-market products such as mobile phones or laptops is, while HMLV focuses on higher value-added / technical products.

Of course NCAB is specialised in the HMLV which is characterised by:

Higher product value

Higher quality demand

Higher technical complexity

Less price pressure

Harder to buy direct by the customer

In contrast, we would have High-Volume, which would be the exact opposite of the above definition. A market of no interest to NCAB.

The company's sales come primarily through two channels:

HMLV production: almost all turnover comes from here. They do it all with suppliers mostly in China and deliver to the customer in about 4-5 weeks.

Prototypes and other services: is a much smaller volume but they can charge up to 10x that of a normal service. It is done with suppliers in the USA / Europe and delivery is almost immediate (a matter of ).

Market trend

In 2022, the global printed circuit market was worth $82 billion and is expected to grow at a rate of 4% (CAGR) until 2027. The growth of the global printed circuit market is supported by solid growth vectors such as the acceleration of digitalisation and digital transition, the deployment of major new technologies (5G, e-mobility, connected objects, artificial intelligence, batteries, etc.), the energy transition, the increase in demand for consumer electronic goods or the increase in demand for equipment from emerging and developing countries.

As previously stated the PCB market can be divided into two main segments covering different customer needs: High-volume and HMLV. Approximately 70% of the market would be High-Volume. In the graph above we can see that the total HMLV market is $25 billion and as we can see it is mainly produced in Asia while the final consumption is more spread around the world.

NCAB has its largest market share in Europe with 7.5% of the total, followed by the Americas with 1.9%, while in Asia its market share is close to 0%. This gives us the idea that the market is highly fragmented and represents a huge opportunity for further growth for many years to come. In some northern European countries, NCAB is the leading company in terms of turnover.

One of the most important market trends is the production of both HV and HMLV is increasingly being centralised in Asia where European and American producers are seeing their production capacities reduced mainly due to competitiveness issues. In Europe and America there is a tendency to maintain higher value-added productions such as prototypes and other services.

Competition

NCAB's competence are summarised in the comparative table above. In addition to these companies, NCAB also has to compete with Asian producers that sell directly to customers, small traders and local companies in each country.

NCAB's direct competitors are ICAPE (France), Fineline (Germany) and Palpilot (USA). The company comparable to NCAB is ICAPE because it can provide a more global service with a presence in many countries, whereas Fineline and Palpilot are more focused on the USA and Europe respectively.

The good news is that ICAPE is a publicly traded company so a lot of information is available. In fact reading the IPOs of NCAB and ICAPE you can find a lot of similarities with the business model and even mentions the other in its reports and investor calls.

A numerical analysis of both companies shows that NCAB is of higher quality. To begin with, it is the company with the highest PCB turnover (ICAPE has 10% of the business which is different from PCB), the EBITDA margin is 300 basis points better than NCAB and the difference in EBIT margin is much wider. Regarding ROE, they could be at the same level, although ICAPE does not manage to keep it stable, so it would be less predictable. Finally ROCE (adding acquisitions) is at a similar level, a little more favourable for NCAB. Finally, Net debt / EBITDA indicator, both are below 2x.

Both companies have the same ambition, to be the consolidators of a fragmented market, which is why their M&A policy is so important. It is the fastest way to reach more customers. NCAB in a recent call explained that winning a customer can take years of work whereas M&A is faster but also time consuming. When NCAB buys a business, approximately 10% of the customers are already existing customers of the company, which gives us an idea of how big this market is.

Strategy

The company has a strategic plan to 2026, which is as follows:

Double its turnover by 2026 using 50% organic / 50% external growth

EBITA SEK 1 billion

Net debt / EBITDA ratio <2x

Dividend payout 50%

How does the company plan to double its turnover in just 3 years? First and foremost, it is about gaining market share in existing markets and new customers, which is why the company makes great efforts to win customers in the countries where it already has a presence.

In this mature market, the manufacturers, especially in China, are gradually consolidating the market, which means that smaller customers will find it difficult to gain access to the best factories. There are approximately 2,700 different companies capable of printing PCBs. Another point to note is that European and North American customers are gradually losing their local suppliers and are "forced" to contract NCAB's services.

It actually makes sense - why would a company that produces sophisticated equipment want to invest in and manage the PCB supply chain for a component that accounts for no more than 3% of the final cost of the product? This is where companies like NCAB come into play, they have the best expertise, they have the best technicians and engineers, they have assured production quotas in the best and most sophisticated factories in Asia and elsewhere on the planet resulting in a competitive fault-free PCB.

And therein lies the company's core value of managing its customers' supply chain with the lowest Total Cost in the market. This means charging a higher price in exchange for the best product reliability in the market. Trust and reliability is something to pay more for.

Secondly, in order to achieve its objectives, the company must expand into new markets. The market is highly fragmented and there are numerous companies that can be acquired through M&A strategies. The idea is to acquire these businesses at good prices, incorporate them into the NCAB network and then get those valuable customers. Once a customer is part of NCAB it is very difficult to change supplier because there is not so much availability in the market and at the end of the day in an HMLV market what matters most is the reliability of the final product. Once NCAB proves its quality to the customer it is difficult to change.

The company's track-record is not very long in making acquisitions but it seems to be doing well. Since the IPO in 2018 to date there have been a total of 13 acquisitions which would give an average of 2.6 acquisitions per year.

It takes approximately 12-18 months for the company to integrate a new business. The most important part is to present the new project to existing customers in order to retain as many as possible. One of the positive points is that NCAB keeps the management of its procurement decentralised to allow customer contact and relationships to remain as before, but the new acquisitions also benefit from the greater knowledge and access to much more powerful production and manufacturing facilities that the NCAB network has at its disposal. And this is where the magic happens to be able to buy a business at 6x EBITA, but to make it efficient to reach a theoretical purchase price some time later as if it were 4x.

On the other hand, NCAB currently has some 50 companies on its radar and is particularly interested in starting to make acquisitions in Asia. The companies that NCAB is looking to acquire are small and medium-sized family-owned companies.

Competitive advantage

The company's main competitive advantage is that only NCAB is able to offer a global PCB supply chain management service at the lowest total cost to its customers. On top of that it offers its customers one of the most reliable supply chains with a very low PCB failure rate. All this is achieved with a good organisation and team. One of the keys to this business model is the physical presence in the factories in China and an exhaustive control of production to guarantee that everything works.

How does it achieve this? Being an asset light business, having pricing power and does not compete on price, a significant part of its workforce is close to the factories in China and the rest spread out locally close to its customers, working to the highest product quality, etc.

Probably the company's strongest point is its ability to select and retain and select the best factories in Asia. In addition, they work with a total of 31 manufacturers while ICAPE (their strongest competitor) works with more than twice as many factories, thus losing the power of order concentration and strength.

The key is to gather as much volume as possible in order to have a significant turnover power with the factories. This in turn makes NCAB more attractive to potential new factories as well as new customers. By attracting the most sophisticated clients and manufacturers, NCAB can also access the latest, most complex technologies with greater added value.

Supply chain management, product quality and reliability are the drivers desired by the customer.

Risks

I don't see any sector specific risks. I would perhaps miss a bit more of a track record of M&A and management history to understand their management style.

In this type of serial acquirer, the biggest danger I see is that the company makes a very large acquisition with debt and the deal goes wrong. I think there is a low probability of this happening as the management team makes it clear that they are looking to make small acquisitions between €4-10m of revenue. Really low risk.

Final takeaways

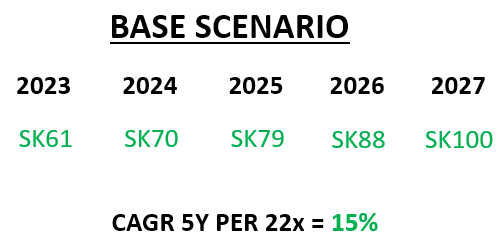

Will NCAB be a good investment? If the company implements its plans according to the guideance they have provided, we would be looking at a 5-year double-digit investment.

So let's be optimistic! NCAB's model is asset light (Capex only consumes 2% of Net income!), have a good breeding ground in the market to continue acquiring companies to their model and to continue expanding in the countries where they have a presence, I think the management is a good team and they have extensive experience in PCB (at Market Day 2023 you can find out part of the address at the presentation); the management team own about 20% of the company's shares creating alignment with shareholders; have MOAT by managing the best PCB HMLV supply chain in the market; trust and credibility of their customers, the market to be conquered is gigantic in some regions of the world the company's market share is 0%!

I believe that the plans presented by the management are credible. Time will tell whether they succeed or not.

I hope you enjoyed the reading and thank you for reading me! Feel free to leave your comments!

Super interesting company! Thanks so much for the detailed write up.

Thanks for the write up.

1. why did the stock price decline from 80 to 53SEK?

2. how cyclical is the business? and do you have data about their main customers? (interested to understand if they are leveraged to a particular industry(s) such as auto, PC etc)

3. looking at the val, i.e. at 53SEK and EPS 2.23 (as at 2022 FY) it is trading around 22-25x PE. do you have insights or forecast on EPS for 2023 (or 2024) - do they normally provide earnings guidance?

4. are growth mainly organics or driven by acquisitions?

5. I note your comments that the business is asset light, however they have been buying competitors / factories. Trying to understand what happens after they acquire a new business? ie. do they shut down ops and then move manuf to Asia/outsource to Asia? therefore they only buy the client list?