Next 15 Group plc (UK:NFG)

Growth consultancy specialist

Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Key inputs

Interesting opportunity at 5x PE 2027.

The stock has plummeted due to a profit warning.

Possibility of doubling at the current price.

Growth is expected to return in 2027.

Company overview

Next 15 is a technology and data-driven growth consultancy operating as a network of specialised consultancies designed to help companies grow.

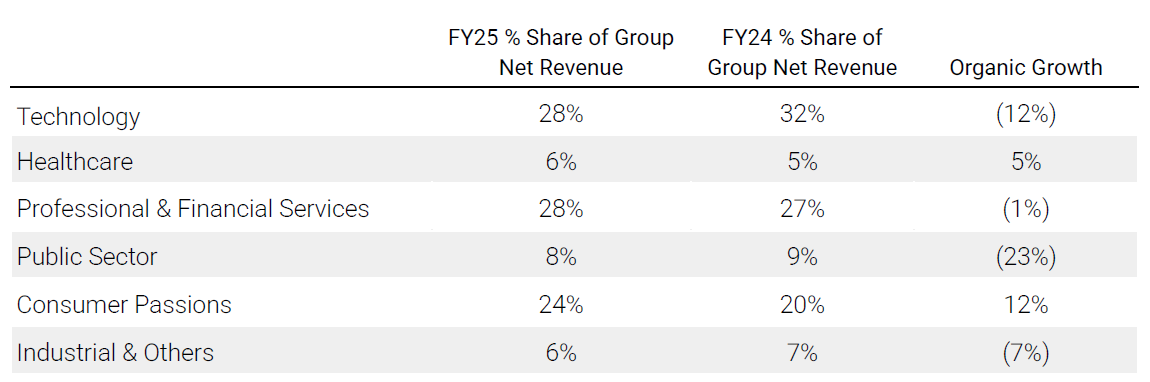

Next 15 operates in 16 countries, primarily focusing on high-growth markets such as technology, healthcare, financial services, consumer passions, and the public sector in the UK and US.

The company was incorporated in 1981 and is headquartered in London, the United Kingdom.

Business model

Next 15 helps companies identify and capitalise on untapped growth opportunities. Rather than being a one-stop shop, it functions through a loosely coupled network of highly specialised consultancies. This decentralised model fosters entrepreneurship, creativity and innovation within its various brands.

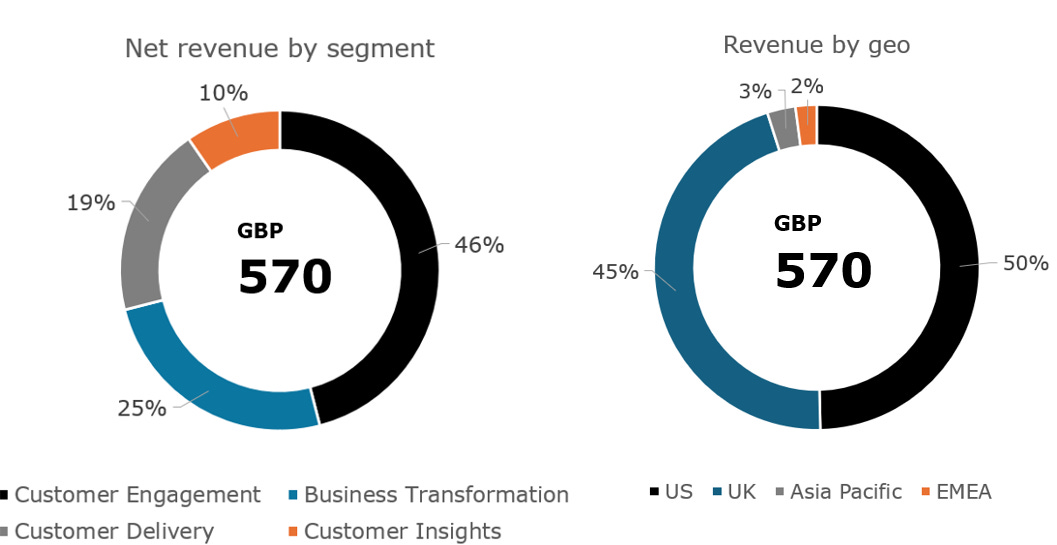

Its business model is built around delivering value through four main growth consulting capabilities, which can be used individually or in combination to solve client problems.

Customer Engagement: services include optimising brand reputation, building mission-critical digital assets such as e-commerce platforms, apps and websites, creating connections with customers to drive sales and interactions, and managing reputations and crises.

Business Transformation: Next 15 helps clients to redesign their business models, create new ventures, build corporate venture funds, optimise private equity portfolios, prepare companies for public markets and redesign public services for the digital era.

Customer Delivery: this segment specialises in optimising customer delivery through digital platforms, such as sales. This involves demand generation, account-centric marketing, retail media centre design, build and operation, media buying and planning, e-commerce, search engine optimisation (SEO), social media management and lead generation.

Customer Insight: uses data and analytics to generate insights, conduct primary market research, track opinions about brands and politics, predict customer behaviours and manage large-scale datasets for clients.

Next 15's revenue primarily comes from commission and fees earned, which are recognised when a performance obligation is satisfied, typically over time as services are rendered.

The company works with over 3,900 clients, including many of the world's most important companies, such as Google, Facebook, Amazon, Microsoft, Procter & Gamble, American Express, Salesforce, Pepsi, Genentech and the World Health Organization.

Although a significant portion of its revenue still comes from the technology sector, contributions from consumer goods, healthcare, and professional and financial services are increasing.

TAM

Next 15's growth strategy is anchored in four interconnected growth consulting segments: Customer Insight, Customer Engagement, Customer Delivery, and Business Transformation. Each segment targets a substantial and growing portion of the global consulting market, representing a significant total addressable market (TAM) for the company. As of 2023, these markets were valued as follows:

Customer Engagement

Market Size & Growth: This market was approximately £422.69 billion in 2023, with an anticipated CAGR of 14% from 2023 to 2028.

Key Sub-segments: Customer experience (£10.51 billion, CAGR 15%) and content, communications and creative (£412.18 billion, CAGR 13%).

Brands: Includes MHP Group (integrated communications), M Booth, Archetype, Outcast, and Marker Collective.

Business Transformation

Market Size & Growth: The largest segment, an immense £1,294.18 billion market in 2023, with a CAGR of 11% projected through 2028.

Key Sub-segments: Strategy consulting (including ESG & People Change Management) (£158.69 billion, CAGR 6.3%), digital transformation (£41.80 billion, CAGR 13%), big data and analytics (£107.63 billion, CAGR 13%), and other (including supply chain/logistics, legal, HR advisory, finance, tax) (£986.05 billion, CAGR 9%).

Brands: Blueshirt Group (capital markets advisory), and Transform (public sector digital transformation).

Customer Delivery

Market Size & Growth: Represented a significant £146.44 billion in 2023, expected to grow at a CAGR of 15.6% through 2028.

Key Sub-segments: E-commerce implementation (£6.73 billion, CAGR 18%), Search Engine Optimisation (SEO) (£58.93 billion, CAGR 18%), media buying and planning (£62.19 billion, CAGR 4.6%), social media management (£16.16 billion, CAGR 23%), and lead generation solutions (£2.43 billion, CAGR 14%).

Brands: Key players include Agent3 (account-based marketing, demand generation) and Shopper Media Group (SMG) (connected commerce marketing). SMG is expanding into the large US market.

Customer Insight

Market Size & Growth: Valued at an estimated £187.48 billion in 2023, this market is projected to grow at 15% from 2023 to 2028.

Key Sub-segments: Market research (£66.14 billion, CAGR 4.0%), data management (£15.61 billion, CAGR 17.4%), data analytics and implementation (£34.02 billion, CAGR 27.1%), and Customer Relationship Management (CRM) implementation (£71.71 billion, CAGR 12.6%).

Brands: Examples include Savanta (market research, data insights) and Planning-inc (data platform, customer data platform). The company sees Savanta as having a massive opportunity from an AI perspective due to its data expertise.

Growth strategy

Next 15 has strategically transformed itself into a leading growth consultancy, moving beyond its roots as a communications group to become a multifaceted entity focused on driving client success through data and technology. This evolution is central to its ambitious goal of becoming a dominant force at the intersection of management consulting, systems integration, and digital marketing.

Next 15 employs a multi-faceted strategy to capitalize on market opportunities:

• Decentralized, Specialist Model: at its core, Next 15 operates as a loosely coupled network of highly specialised consultancies. This entrepreneurial model empowers individual brand leaders with significant autonomy, allowing them to respond quickly to market needs and fostering innovation at the customer interface. The central Group provides strategic guidance, shared services, and the strength of its balance sheet for M&A. This structure is seen as a biggest strength in navigating economic cycles.

• Deep Investment in Data and Technology: Next 15 is driven by data and technology, investing heavily in these areas across all its offerings. They prioritize new data analytics techniques and tools, understanding that growth is no longer just about marketing but about using data to predict customer needs and technology to craft engagement.

• AI as a Transformative Force: AI is considered "electricity" for Next 15, powering everything they do and representing the biggest shift their business will face. They approach AI through three lenses: Efficiency (doing existing work faster), Effectiveness (doing existing work better), and Innovation (new products and services). Next 15 Labs is a central function dedicated to early-stage R&D on AI-based approaches valuable for multiple brands, developing tools like automated due diligence, AI-powered retail media planning, and an AI operating system for brands. This includes developing synthetic data/personas and AI-powered campaign planning.

• Strategic Acquisition Strategy: the company has a disciplined approach to M&A, focusing on acquiring businesses that strengthen existing capabilities or add new ones in high-growth areas, particularly in the UK and US. They prefer bolt-on acquisitions at attractive multiples to enhance existing brands. While major acquisitions are less likely in the near term, the strategy is to buy to build capabilities, whether through smaller additions to existing brands or new standalone entities.

• Productization of Services: Next 15 is actively pursuing productization, converting its intellectual property into software products to automate work for clients and create new, more predictable, and higher-margin revenue streams, reducing dependence on hourly billing.

• Geographic Focus: the primary focus for expansion remains the UK and US markets, with opportunities also identified in regions like EMEA and APAC. Consolidation of brands into hub offices in major cities like London, New York, and San Francisco is also fostering collaboration.

In conclusion, Next 15's growth strategy is built on a foundation of deep specialization, a decentralized entrepreneurial model, and aggressive adoption of data and AI technologies. By continuously evolving its offerings, making strategic acquisitions, and embedding sustainability across its operations, Next 15 is positioning itself to not only achieve its ambitious growth targets but also to define the future of growth consultancy in a rapidly changing global landscape.

Management

Tim Dyson has played a pivotal role in Next 15's history, joining the group straight from Loughborough University in 1984 and becoming Chief Executive Officer in 1992 (at age 31).

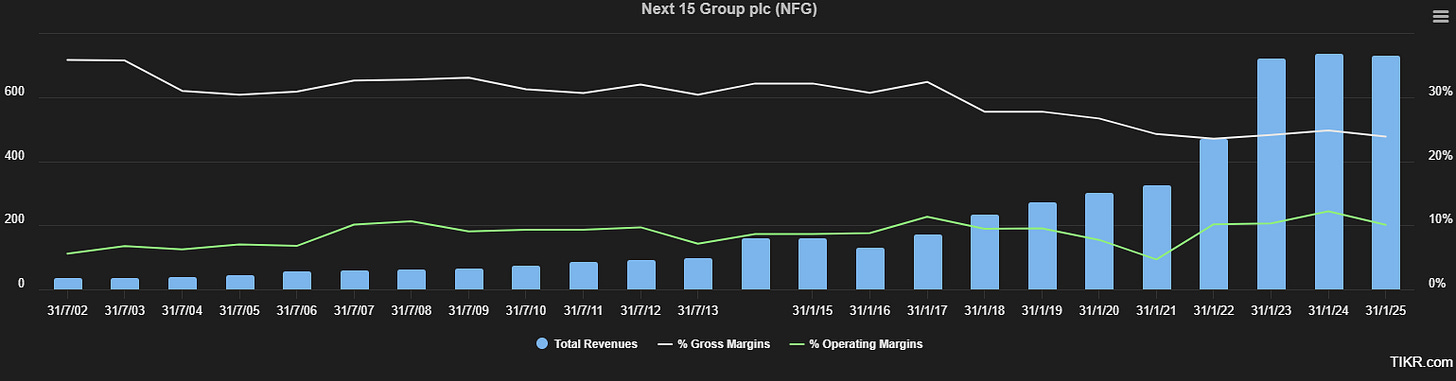

He is the true genius who took Next 15 from a turnover of £35 million in 2002 to over £700 million in 2025, transforming the company from a traditional communications marketing agency into a business offering expertise focused on its clients' growth.

Unfortunately, Tim Dyson will no longer be the CEO of Next 15 as he is retiring. He currently holds approximately 5% of Next 15 shares.

Investment thesis

As the graph shows, Next 15's revenues have always grown (the change in fiscal year in 2016 caused the 'decline' in revenue), although its gross margin has declined.

While Gross Margin is unclear why this is the case, given the large number of acquisitions made in recent years (26), we can see that EBIT has increased, revealing that the management team is keeping costs under control.

The company has paid dividends and repurchased shares in recent years. There is a certain alignment with shareholders, although it is not particularly spectacular.

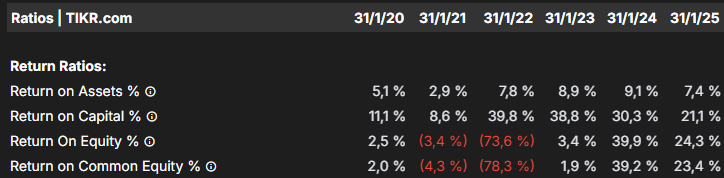

The ratios are somewhat unstable, as the company has made impairments in 2021 and in 2022 had to make a significant adjustment due to an earn-out, which I will discuss later.

With regard to debt, they always seek to remain below 1.5x EBITDA. This is very good and indicates conservative management.

In short, it is a quality business, although, in my opinion, there are better companies on the market.

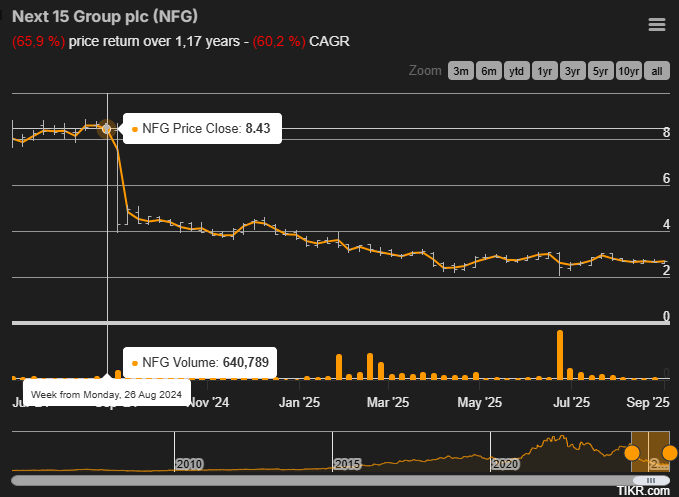

And now comes the best feature of Next 15 today. The company plummeted 50% in a single day in September 2024! Opportunity?

One of its acquisitions in 2020 went really badly. This is an example of the risks that companies face when pursuing an M&A strategy.

Mach49 acquisition milestones:

Sep 2020: Mach49 acquired by Next 15. Initial consideration: approx. $2 million in cash, with $3.7 million deferred, and a total deal value of $18 million

Feb 2022: Mach49 signed a five-year contract worth $400 million with Saudi Arabia Public Investment Fund (PIF). This contract significantly boosted Mach49’s projected earnings, triggering a large increase in earn-out liability.

Sep 2024: Mach49’s major contract would not be renewed after its initial three-year term. The contract was set to end on December 31, 2024, undermining Mach49’s future revenue and reducing the basis for earn-out payments

Jun 2025: While assessing the final earn-out, Next 15 uncovered potential serious misconduct at Mach49. Three senior executives were terminated.

Aug 2025: Shutdown of Mach49 announced.

Stopped all further earn-out payments.

Filed counterclaims to recover previously paid amounts.

Initiated arbitration with Mach49’s former shareholders.

Reported the misconduct to law enforcement.

But wait, there's more...

Jan 2025: Peter Harris, CFO of Next 15, announced his decision to step down from his role and from the Board, after serving for 11 years.

Jun 2025: Tim Dyson announced he would step down as CEO and from the Board. He will be succeeded by Sam Knights, CEO of Shopper Media Group, after serving for 33 years.

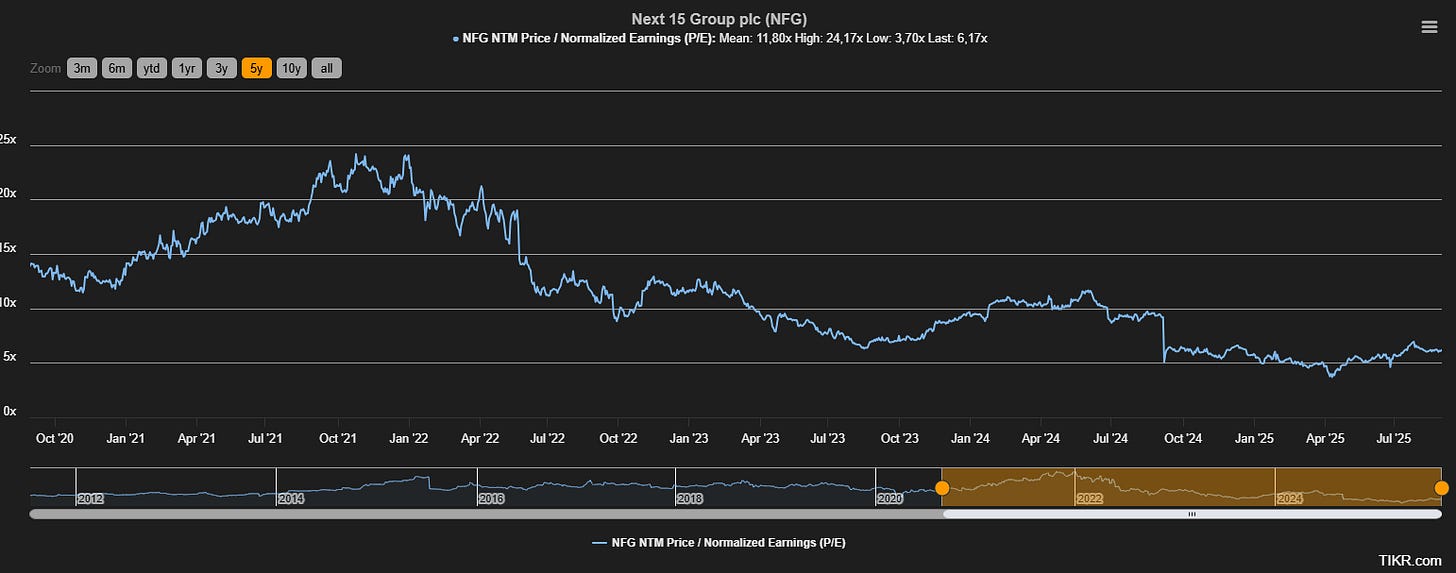

If there is one thing the market dislikes, it is uncertainty. Here, we have a huge amount of uncertainty, which is why the market is valuing it at half of what it should be worth and is being conservative in its projections.

Are there any positive signs? Of course there are.

Firstly, the board has decided not to collect their bonuses. Good.

Secondly, by the end of the 2025 financial year, Next15 had paid Mach49 $127 million in earn-outs, with a further $91 million to be paid over the next three years. Therefore, they have saved $91 million, and they could save a further $100 million if they win the legal battle. In the worst-case scenario, Next15 loses the case and is forced to pay the $91 million it has already committed to.

Thirdly, the company is willing to consider any solution that offers the best value for shareholders. This could even involve selling to a fund or private equity. This would be an interesting option at this point, as it could fetch a premium in the coming months if the sale were to be completed soon. Who knows?

Fourthly, the company has announced that it is considering selling some of its brands. This has not happened before and could be a positive step given the change of direction. For now, however, these are just rumours and no further details are known.

They say that bad news always comes in pairs. This has certainly been the case for Next15. However, let us remain positive.

The company is expected to return to growth by 2027, which would be a key milestone. With so many unanswered questions, the price is depressed, but the company's quality remains high. The market now values it as if it were going to disappear within the next five years, but that is not going to happen.

My target price for 2027 is £5, which is approximately 100% higher than the current price.

As always, it has been a pleasure. I would like to thank all my readers for taking the time to read my work.

Bonus track: British investor Richard Griffiths recently invested £5 million in Next15. I haven't been able to find much information about him, but it's interesting to see which professional investors are getting involved. If you know anything about him, please leave a comment!

One more angle - and the reason I hold a position - SABA capital are currently 0.85% short, and that short is a little underwater by my calculations. I wonder if this is partly why Griffiths has got involved. He is doing a similar thing at NCC. He actually took his stock at peak fear, when the shorts should have covered. If NFG can publish some positive news, SABA are going to be in trouble. Citadel are closing now, probably before results, leaving just Saba. I caveat this with SABA are not your usual outfit, they have not closed any shorts they are in so far this year. Its like they are hedged short for the long term. We saw from the investment trust saga they are not afraid of a bloody nose. I guess all their positions may net out as a winner but I think NFG and a few others they will lose. I will post my own article about other Saba shorts soon. Thanks for your article, I have been in NFG a good 6 months.

interesting idea, thanks