Nick Scali (AU:NCK)

Designer Sofa & Furniture specialist

Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Key data

Dividend yield 5% (and growing).

Son of the founder at the helm with 8% of the company.

EPS growth of 10%.

The best company in its sector.

Company with pricing and branding power.

Company overview

Nick Scali supplies and retails household furniture and related accessories in Australia, New Zealand and the United Kingdom.

Established in 1962, Nick Scali is based in North Ryde, Australia and was listed on the ASX in 2004.

Business model

To simplify... It is a B2C retail business.

On the manufacturing side, the business model focuses on optimising the production and movement of goods. Nick Scali manufactures furniture - mainly sofas - with Asian manufacturers and imports it in large containers to his warehouses and distribution centres.

Once the material has been produced and distributed, it needs to be made available to the general public. To do this, Nick Scali has an extensive network of physical stores.

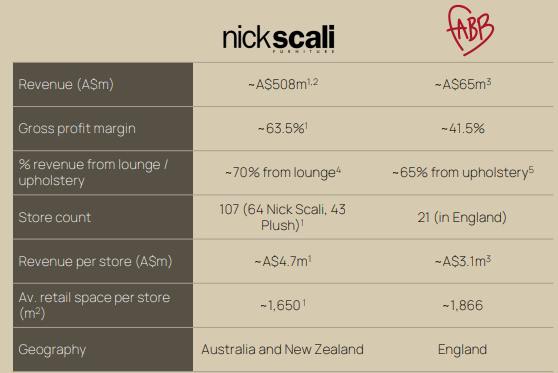

The company has 108 stores in Australia and New Zealand and 21 stores in the UK under the Nick Scali, Plush and Fabb brands. Approximately 9 of these stores are company-owned. In addition, the company has an online channel which it is developing and which currently accounts very few sales.

One of the characteristics of this business is that people like to see and try out furniture in their spare time, and it is curious that 70% of the company's sales are made at weekends, making it difficult to attract and retain good store managers.

Market trend

The home furniture market is expected to reach a volume of USD 800 billion by 2030, growing at a CAGR of 5%. Very good indeed!

The market is growing faster than the world's population thanks to new consumer trends. People are investing more of their disposable income in the comfort of their homes, attracted by new designs and ever-changing lifestyles.

Consumers are looking to spend more and more frequently on furniture.

In Asia in particular, where a significant proportion of the population has moved into the middle class, there is a strong movement as a result of all these developments.

On the other hand, trends such as rural-urban migration, environmentally sustainable products, customisation and online retailing are rapidly evolving the market.

The part of the house where families spend the most time is the living room. This is not surprising as much of the time spent entertaining is spent in this area of the house. What's more, when you have guests in the house, they tend to visit this area, so we want to give the best impression of ourselves.

Competition

It is a highly fragmented market where international and local companies compete fiercely.

The top 10 companies in terms of global sales account for only 10% of the market. There is therefore no single company that truly dominates the market.

Ikea would be the company with the highest sales, with a market share of around 4% of the total. (By the way, Williams Sonoma ($WSM) is the highest-quality listed company in this ranking. Good fundamentals).

In addition, many of the small businesses that do operate are poorly managed or in economic difficulty, unable to compete on cost because they lack economies of scale. However, they are able to survive because they are able to adapt to local tastes in a way that large companies cannot.

The founder's son and current CEO - Anthony Scali - explains that his Italian-born father started out selling televisions, but quickly realised that the big opportunity was in TV furniture.

So he set up a business selling furniture tailored to the tastes of his fellow Italians with more classical tastes. At the time (60 years ago), this was what set him apart from the competition.

Higher up in the comparison we can see that Nick Scali is a company with fundamentals that are superior to other typical companies in the market. It is very difficult to find comparable that do the same thing because each company has a different business model.

Nick Scali's model is a winner.

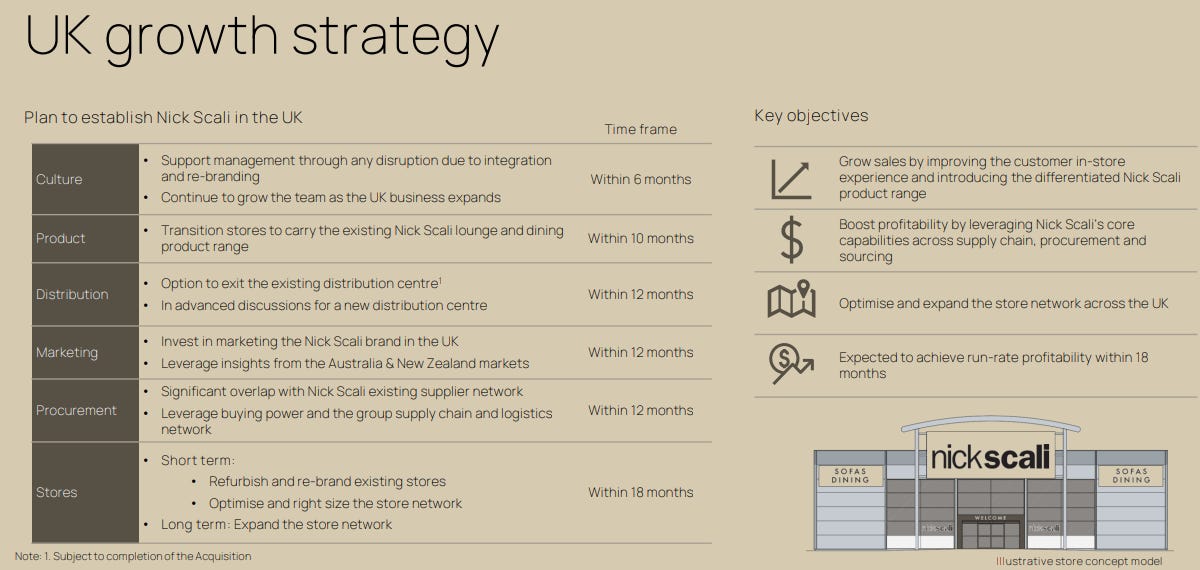

Growth strategy

Nick Scali's ambition is to continue to grow organically and naturally by opening new stores in interesting locations where potential customers are passing through.

The latest data provides guidance for new store openings in the long term, ranging from 108 stores in Australia and New Zealand to a maximum target of 186 stores. This includes the future growth of new stores in the UK, although the company is still in the process of converting existing showrooms.

Opening new shops is a delicate and time consuming process.

In fact, we can see from the table below that in normal years the organic growth of new stores is between 0 and 7%. The company is very cautious on this point, as it wants to grow but not make any mistakes, even though it could grow faster.

This store growth is key to the business because to survive in this market you need scale. With economies of scale comes greater bargaining power with your manufacturers in Asia and greater optimisation of shipping costs. This is why with the acquisition of Plush, the company will be able to increase its EBITDA margin to 34-39% from 2021

Finally, another lever that is working well is online sales. Since the 2020 crisis, this sales channel has developed with double-digit growth in sales year after year. It currently represents a small proportion of sales (~6%), but the outlook is promising.

M&A

Nick Scali has completed two major M&A transactions in recent years.

Plush, the re-conquest of the sofa in Australia

The first deal was Plush for $102.5 million in November 2021, an experienced sofa retailer in Australia.

Nick Scali's advantage over his competitors is the robustness of his business model, and he demonstrates this by acquiring his competitors, who are worse managed, and significantly improving them.

The plan with Plush was:

Supply chain optimisation through consolidation of shipping suppliers and use of Nick Scali's onshore distribution network.

Leverage dual brands to accelerate store roll-out.

Simplify and streamline the new organisation.

Improving gross margin by replacing 50% of the range with new models and a wider price range, and using Nick Scali's existing panel of suppliers to improve volume buying and economies of scale.

The result is that between 2022 and 2023 Plush manages to improve its gross margin from pre-acquisition 54.8% to 62.7% and $20 million in cost savings from synergies.

Spectacular result considering the size of the acquisition and the company's low experience with this type of transaction.

Fabb, entry into the UK market

Anthony Scali (current CEO) says that when he travels he meets people from all over the furniture world. Eventually he realised that the UK market was not so different from the Australian market and wondered if he could extend his business model there.

That's when the plan to conquer new territories began to take shape. In 2024, the acquisition of Fabb and entry into the UK market was announced.

The price paid by Nick Scali is approximately 3x EBITDA for a loss-making business and it is estimated that he will need to reinvest approximately $43 million to bring the business to an optimal condition. The deal keeps Fabb's current management in place.

In my opinion the transaction is a good deal for both sides. On the one hand, Nick Scali accelerates access to a new market and, on the other hand, Fabb (a money-losing business) has a new opportunity to revive and become a reference in the UK market.

This could be a win-win situation.

The chart above shows a comparison of the two businesses. Note the difference in gross margin and the opportunity to take Fabb to a similar level to Nick Scali. The is plenty room for improvement!

Competitive advantage

The greatest competitive advantage is the brand as customers perceive company products to be more premium than they actually are. This allows the company to increase the price of its products.

This is one of the most complex competitive advantages to achieve and maintain over time which in turn protects from aggressive price competition.

On the other hand, the management team is very good because they have created an incredible business model in a very mature sector.

They know how to optimise costs and how to optimise sales. They know the key on the sales side is people, and they take care of that.

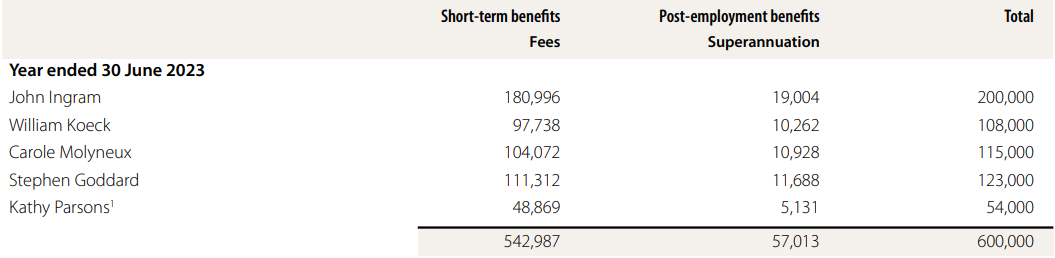

Management

Anthony Scali is the Managing Director & Chief Executive Officer and son of the founder. He owns more than 6.4 million shares in the company, which at the current market price represents some $59 million in equity.

Last year it received a total of $1.5 million as total salary, so we can say that the board is aligned with the interests of the shareholders. The decisions he makes (for better or worse) also have an impact on his family wealth.

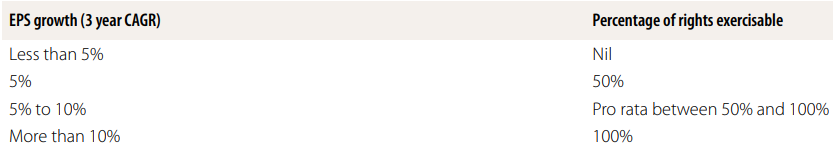

The company also relies on a short, medium and long-term performance culture to remunerate the management team and its employees.

This also benefits the shareholder.

Risks

The main risk would be supply chain problems, as its main manufacturers are in China and Vietnam, which could have geopolitical implications in the coming years.

On the other hand, companies with a short track record of acquiring other companies could be at risk, but frankly, given that the businesses it is buying are at rock bottom prices, it is hard to see how it could fail there.

Final takeaways

I like Nick Scali a lot; the best company in its sector, still small, with conservative but bold growth, with many levers to pull for improvement.

It is a simple case, easy to understand, with a clear strategy for the future.

Anthony Scali said that two of his sons have been working in the company for years, so the future of the company founded by his grandfather has good prospects for further progress.

Finally, I would like to highlight something that I think is remarkable: in the following chart you can see the company's earnings growth from 2005 to 2023. It is incredible, but it is only in two years that growth has fallen to 2% and then recovered aggressively! This suggests that the company is resilient to any economic cycle and has real MOAT, as many of its competitors simply disappear.

I hope you enjoyed reading! Don't forget to leave your comment. See you soon!

This post is dedicated to the user Reubs K who suggested me to write about this company. Thank you!