Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Key data

Special situation where the market may not have recognised the true value of the spin-off.

Founding family with more than 40% of the shares.

Business protected against inflation and high interest rates.

Double-digit growth and opportunity to improve margins.

Company overview

Pluxee is a digital platform that provides employee benefits and engagement solutions like meal, food, gift, mobility, training, and wellness benefits; and other products and services.

The company is a spin-off of Sodexo and has been listed on the stock exchange since February 2024 and is based in Issy-les-Moulineaux, France.

Products and services

Pluxee provides its users with a digital platform, accessible through its portal and app, that guides them towards a positive consumer experience.

Within the platform you can consult and consume all kinds of products, such as the classic meal & food, but also gifts, gyms, nurseries, etc., with the focus on making life easier for the end user.

The sub-category with the highest sales is Food & Meal, while the geographical area with the highest growth is Rest of the World, such as Turkey, India and Israel.

In Latin America, Brazil is particularly important, where a major agreement was recently signed with Santander, the country's second largest bank.

Business model

Pluxee's business model is to provide attractive and innovative solutions to HR departments of companies that are focused on rewarding and strengthening the loyalty of their employees. This is increasing globally as the cost of living rises and companies want to support their employees without increasing costs.

Here is where Pluxee comes in as it offers tax-exempt benefits for companies, satisfying both the employee and company sides.

How is this achieved? By creating an ecosystem on its technology platform that connects consumers and providers of products and services (merchants). Merchants see their sales volumes increase as a result of being connected to the Pluxee network.

But how does the company make a profit? It has three ways of doing so:

Client fee, each time an employee user uses the payment method, a % is charged on the transaction.

Merchant fee, when Pluxee reimburses, a commission is charged on the total volume.

Interest income on Float, clients ask Pluxee to pre-fund the employee's account. As these amounts are not spent immediately and there is also a delay in reimburse to merchants, Pluxee has a float (money that will be spent but not immediately) on which it can earn a short-term income through interest.

Pluxee has business model with operational leverage, thanks to the fact that network scalability effect, inflation protection and high interest rates work in its favour. And with a cash conversion ratio of 70% and predictable and recurring revenues, the company is a real FCF-generating machine.

Market trend

The total employee benefits and engagement market is estimated to be worth €1,000 billion with growth rates of 7-9% CAGR.

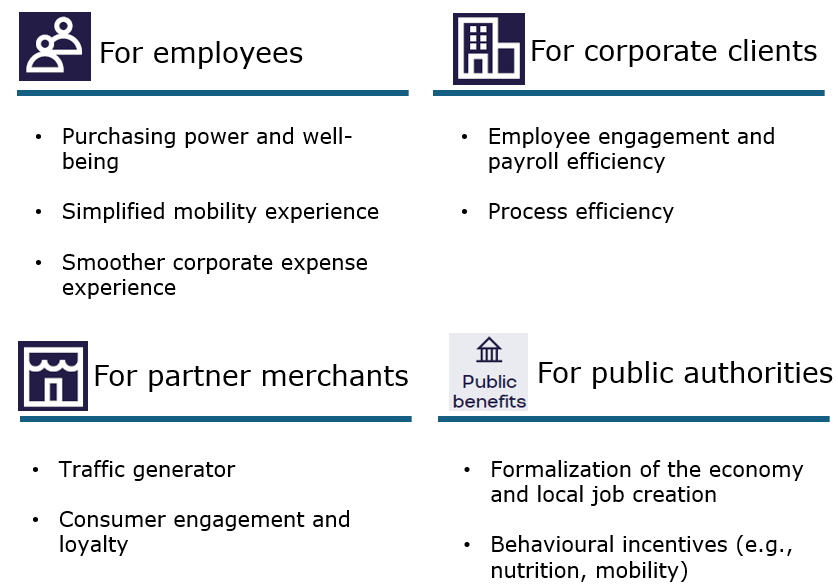

This market is beneficial to all concerned, because capitalism ultimately organises labour in the most productive way.

On the one hand, the workers are happy because they have benefits that help them to be more comfortable, at the same time, the companies spend less resources and favour the emotional salary and mental peace of their workers, supported by the regulations of the countries.

Finally, merchants receive a higher volume of higher quality business because customers tend to be forced to be loyal, as these resources can only be spent in the ecosystem created by the companies.

In addition to country regulations, which tend to favour this market, there are also growth population, urbanisation, changing consumption habits (less cooking and more eating out) and economic development.

Competition

In this huge market that spans so many geographies and is expanding all over the world, there is no dominant company, so the market is fragmented into a few global players and many small local players.

Of course, many of these companies are listed on the stock exchange, so let's make a comparison between them to get an idea of whether Pluxee has an advantage over the rest by reading its fundamentals.

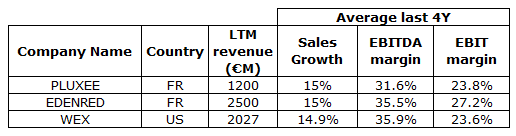

It is true that this type of comparison is complicated because Edenred and Wex offer a wider range of services than Pluxee, and Pluxee has little track record as an independent company, having only gone public a few months ago.

However, we can see that Pluxee has room for improvement in EBITDA as it has not yet reached the scale of Edenred and Wex: the Network Effect.

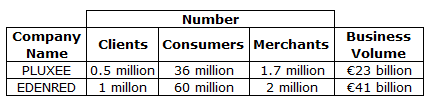

In the table above we can see why Edenred has a higher EBITDA margin, as it makes better use of its operating leverage from Pluxee.

Another striking fact is that the number of merchants is almost the same as the number of companies. This is because Pluxee focuses more on SMEs than on large customers, where there is more competition and penetration rates are lower.

Growth strategy

Added value for Pluxee network users, to adapt to new customer needs by offering new products and services. The key is to expand your merchant network as much as possible, because there is no point in spending money if you do not have a wide network in your target markets.

Use the operational leverage of the technology platform, by continuously improving, the customer's journey experience is made more attractive. This in turn will increase the consumption of goods and services within the platform, and merchants will be more motivated to continue supporting the Pluxee network.

Focus on the SME segment, although it is more expensive to have many SME clients than larger, as it takes more time and effort to get many small ones onboard, it is a market segment neglected by other large competitors. It is estimated that the SME segment has the lowest market penetration, so the opportunity for Pluxee to grow here will be greater.

M&A strategy, aimed at acquiring new services, new technology, entering new geographies faster and eliminating competition.

Competitive advantage

Spin-off of Sodexo, this is what makes Pluxee different: on the one hand, it is a new company with an agile structure to take advantage of market growth and, on the other, its starting point is not from scratch as it already has technology, investments made and previous client relationships when it was integrated into Sodexo.

Pluxee wants to focus on the segment with the lowest customer penetration, such as SMEs. This is not possible for its competitors of a certain size because their structures are not adapted to it.

Pluxee has an established network of users, customers and merchants, as well as relationships with the governments where it operates. A smaller competitor has to invest a lot of effort in building this network and scale to be competitive in the market.

Management

The Bellon family owns more than 40% of Pluxee; to the current price a market value is around €1.4 billion.

The Bellon family is best known for founding Sodexo, a leading food services and facilities management company.

The Bellon family has a wealth of around €5 billion being a prominent family in France.

What can go wrong?

The moat of company is to maintain a wide network of merchants where users can spend money. If the company fails here then its customers will be motivated to switch service providers. The network effect prevents new competitors from taking market share from the company, but it can also compete with incumbents.

On the other hand, one of the big motivations for companies to contract Pluxee's services is the tax advantages for their customers granted by the government. Although governments develop positive regulation for business; a reversal here could be disastrous for the growth of the sector.

Final takeaways

Pluxee is interesting because it is a special situation trading at an EV/EBITDA multiple of 4x.

I believe it should be trading at a multiple of 10x because it has components that differentiate it from other competitors, a huge market that will continue to grow, a business-friendly regulatory environment and an inflation-proof business model.

The company has grown impressively in recent years thanks to high inflation and high interest rates. Now, the company is expected to grow less as inflation and interest rates are expected to stabilise. If inflation and interest rates return to high levels, this would benefit the company, which would return to high double-digit growth.

For this model I have assumed that the company grows by 10% with an EBITDA margin improvement of 100 bps. However, the company thinks that it can improve somewhat more, especially in the EBITDA margin, up to 250 bps in FY2026.

Hope you enjoyed this special situation and see you next time!

Don't hesitate to leave your comments!

Pluxee is one of my largest positions (largest by initial investment) and I believe it offers a great opportunity without much cyclical risk and a straight forward growth story. However I'd push back on 4x EV/EBITDA. You can debate what the enterprise value of Pluxee should be. Their net cash calculation includes float, which in my opinion should be excluded. I get to around 7x EV/EBITDA using a net debt position, still a bargain for a business expected to grow EBITDA >10% in an oligopoly.

Thanks for this write up. I recently wrote up this stock from the standpoint of the controversies currently swirling around it. It’s free, so hopefully I can leave the link here. Just looking for feedback basically. https://mostlycharts.substack.com/p/high-conviction-idea-bountiful-benefits