REV Group Inc (US:REVG)

Emergency vehicle specialist

Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Key data

Near-term catalysts to extract value in 2025.

Pricing power and sticky demand.

Divestments and adjustments to product and production mix to raise share value rapidly.

Company overview

REV Group design and manufacture vehicles and related aftermarket parts and services for two segments: Specialty Vehicles and Recreational Vehicles (RV).

The company was incorporated in 2007 and is based in Brookfield, Wisconsin.

Products and services

The company serves a diverse client base, primarily in the United States; for municipalities and government agencies and commercial and industrial end-users.

It specialises in two main segments:

Specialty Vehicles, customised vehicle solutions for applications including essential needs for public services (ambulances and fire-fighting equipment) and commercial infrastructure (terminal trucks and industrial sweepers).

Recreational Vehicles, manufactures a variety of RVs from Class B vans to Class A motorhomes; from premium to luxury.

The company's brands are prestigious and recognised in the market, with up to 50 years of history.

In terms of services, the company has its own network of facilities where customers can receive RTC services such as maintenance, damage repair and rebuilding services.

Through its own distribution network and independent distributors, the company also sells spare parts throughout the country.

Business model

REV's business model is split into two distinct strategies, as the segments in which it operates cannot really follow the same strategy, although they share some common elements.

In the special vehicles segment, REV works closely with local government technicians to meet their needs.

If we put on the hat of a fleet manager, the main objective is to manage a complex reality with limited resources. This means standardising the fleet, adapting technical features to real needs, staying within budget and effectively managing the replacement of old units with new ones.

To achieve all this you can only go with the best and once you are at that point you will not want to change your fleet for another competitor. The technical side will struggle to always get the best performance, while the budget is something they will really worry about, especially when it comes to public service fleets.

The company estimates that it has about 70,000 active units among all its customers with a very high retention rate. If we add to this the fact that the company controls between 20% and 30% of the Specialty market, we could say that we are dealing with a monopolistic case where market consolidation has been achieved.

On the other hand, we have a different strategy in the Recreational Vehicles segment, which we would say is more typical of a consumer market. Here, the end customer is a consumer who tends to return to the brand if the experience has been good, although they do not have the same loyalty as in the first segment of Specialty Vehicles.

It is important in this segment to have a good reputation as a brand so that the distributor feels motivated to promote your product more and it becomes a positive spiral.

In both segments, REV sells its products through independent distributors, although in certain cases it may sell directly to end users.

Market trend

In the United States, the ambulance market service is estimated to be worth $18 billion in 2024, growing at a CAGR of 10% to 2032.

This market is segmented into ground, air and water ambulance services. On the other hand, the market is divided into advanced care services and basic care services, the latter being more focused on transporting people who do not require urgent on-the-spot treatment.

The main catalysts for this continued double-digit growth are an ageing population with increasing life expectancy, coupled with the continued growth of large cities and the need for greater service coverage.

In terms of the fire fighting vehicle market, the US market is estimated at around $1.5 billion, with more modest annual growth of 2-3% CAGR. The main growth drivers are urban development in cities, population growth in cities and taller buildings requiring more aerial vehicles. On the other hand, airport growth and regulatory requirements are also increasing demand.

On the other side of the coin, the RV segment has a US size of $20 billion in 2024, with growth of 8% CAGR over the next few years.

This segment is undergoing a real revolution as lifestyles change towards more sustainable and enjoyable outdoor activities, where the more traditional older generations have improved their quality of life (they still have plenty of energy!) and the Millennials and Generation X are growing rapidly as a novelty.

However, this market is discretionary and depends on people's mood to make a purchase. The purchase of an RV is the second largest purchase in a person's life, so the buying process is slower and also affects the health of the economy.

Growth strategy

For many years, the company has been committed to consolidating the market in which it operates. This has now reached a stage where the company has a leading position, being the first, second or third player in each market niche.

Once the company has achieved this consolidation strategy, the time has come to dispose of those businesses that are no longer of interest. Following this strategy, the following moves have been made:

Divest non-core businesses for future growth. Recently, REV sold its entire bus line, which it considered less interesting for the future.

Consolidation of production centres, reducing the number of centres from 22 to 17 and eliminating production centres in Brazil and China.

Divestiture of distribution and strengthening of the independent distribution network.

Through these measures, the company aims to increase its profitability and eliminate parts of the business that hinder this objective. On the other hand, given its dominant positions in all the market niches in which it operates (particularly fire and ambulance), the company will apply a policy of progressive price review, as it has achieved with power pricing.

Let us not forget that in the fire and rescue sector, the company has a captive demand with partly customised needs, which makes it difficult for the competition to take a share of the pie.

Competitive advantage

Largest manufacturer by unit volume of fire and emergency vehicles, there are still some smaller independent brands in the market. As a leader brand, it can take advantage of the operational synergies of its production plants and has brand power, as these vehicles have a long history of units in circulation and new sales.

Long-term customer relationships, fleet managers need to simplify their management by going to the manufacturer that works best for them. This is the case with REV, which has a long installed base. Once a brand is massively installed, it is difficult to change and it takes a long time to replace it with another brand. The key is to be able to constantly adapt to customer needs and translate them into the product through innovation and technology. This can only be achieved by market leaders, who tend to be better than the rest of the competition.

Well-known and leading brands in the RV sector.

Management

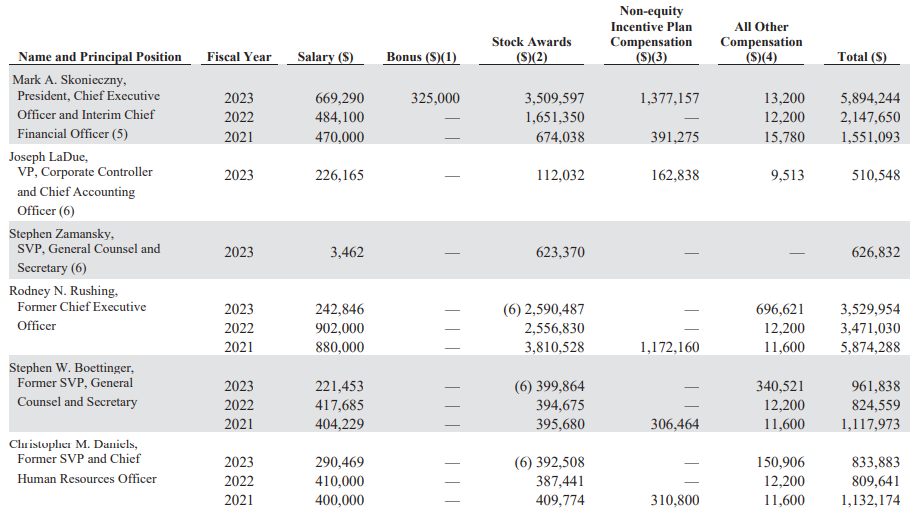

The executive officers receive handsome salaries and stock-option program.

However, management has a policy of returning capital to shareholders through share buy-backs and dividends, which would partly offset the high benefits for management.

There is not much else to highlight here; the CEO has been with the company since 2020.

What can go wrong?

Although the result of the concentration in large cities leads to higher home values and new housing starts create an increasing tax base and greater demand for essential services provided by governmental agencies. Local tax revenues are an important source of funding for fire and emergency response departments in addition to Federal grant money and other state and locally raised funding.

On the other hand, the equity side is more discretionary and depends on consumer sentiment and the cycle. As with the sale of the bus segment, it would be interesting to divest this part to focus on the higher value segment.

Final takeaways

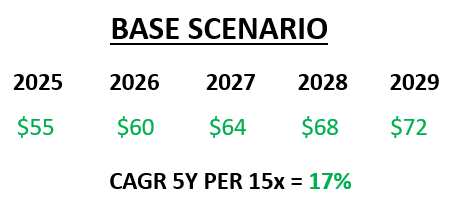

Interesting idea of an example of an investment that rather than a company to keep in the portfolio, I see it as a company to extract a value with a 2025 objective and then sell it off from there. It has interesting catalysts, almost a turnaround; with cost adjustments in between, sale of less attractive divisions and taking advantage of potentially strong demand in the coming years combined with pricing power.

See you next time and don't forget to comment or like if it has added value for you.

Really interesting, thank you for the work. 👌