Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Summary

Excellent track record. The share price has multiplied by 20x

Forward 5Y EPS growth 20%

Predictable business and pricing power

Huge market to conquer

Stock

Ticker: SNL

Market Cap: AUD 590 M

Liquidity: illiquid

Dividend: yes

Company

Supply Network is an Australian company that sells truck and bus parts in Australia-New Zealand under the Multispares brand. The company was incorporated 1986.

Actually the company does a lot more selling a range of services including parts interpreting, procurement, supply management and problem solving.

The company provides a critical service that its customers cannot do without: “A reliable fleet means reliable service and income”. The company mainly serves two types of B2B customers:

Truck / bus fleet companies: bus (coach), waste, bulk haul, general freight and other groups. This sophisticated customer group is looking for an approach to operational cost reduction and risk management.

Independent truck workshop: In contrast, small repair businesses are faced with all sorts of problems that their customers expect to be fixed, sometimes in an urgent and unplanned manner.

Generally speaking, customers in this market are looking for availability, a wide range of references, speed of delivery, advice and ease of installation of the spare part.

To be able to provide this service, the company has created a powerful distribution network around the country that is constantly improving thanks to the reinvestment of its profits.

To conclude the introduction to the company, I would like to show some activity indicators.

20,000 customer accounts.

3,000 transactions per day.

12,000 items sales per day.

500 e-orders per day.

60 delivery vehicles.

Largest customer <4% total revenue.

Revenues: 85% Truck / 15% Bus.

Trends and market

The addressable market of the company covers all replacement parts and associated technologies (aftermarket parts) for road registered 4+ Tonne GVM Commercial Vehicles (CV4+). Only in Australia approximately 200,000 people employed in the trucking sector with more than 500,000 registered vehicles (light + heavy truck).

According to the company's reports, the truck and bus market in Australia-New Zealand has the following characteristics:

High and increasing average vehicle age.

Constantly evolving technologies.

Increasing vehicle (and parts) complexity.

Substantial segmentation and related vehicle diversity.

Competition between CV4+ operators in all segments.

No significant trend towards fleet consolidation.

One of the characteristics of this market is that there is a wide variety of vehicle makes and models in the country and, on the other hand, between geographic areas there may be a very specific type of model for very specific activities. Furthermore, a truck can have around 30,000 individual parts (from a tiny screw to a wheel) and a standard combustion engine around 2,000. Even the same model truck from year to year can change its references!

All of this makes the Australia-New Zealand market a complex market that is not easy to navigate.

Depends on the source you consult the average age of the Australian heavy vehicle fleet is approximately 10-15 years. If we compare it with the countries with the best ratios (Europe) the average is reduced to 6 - 9 years.

Some of the reasons for the ageing of the truck fleet are as follows:

(a) The new models are heavier and therefore less capacity can be carried, reducing the profit for the operator on each trip;

(b) It also happens that in Western Europe or USA older trucks are sold into Eastern Europe, Africa or South America but Australia has no viable retirement plan (alternative second market) for older trucks or

(c) It seems that there is no replacement culture, but rather a "fix it up", "keep it going" culture.

What about the electrification of the truck fleet? In Australia 19% of total emissions are produced by the Transport sector and 38% of these are specific to road freight. It seems that there should be a lot of interest in making changes but the truth is that there are numerous barriers to change. This is not only the case in Australia-New Zealand but also in most other countries.

The most likely scenario 20 to 30 years from now is that there will be a coexistence between different technologies and engines adding even more complexity to the market.

It is interesting to know that 70% of the trucking operators in Australia has only 1 single truck in their operations located in small businesses. Therefore, the client side is very fragmented.

Market size and competition

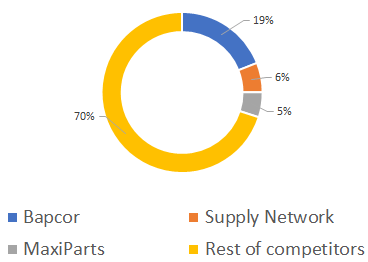

I have estimated the aftermarket for truck parts to be approximately AUD 4,2 billion (the total market for commercial vehicle parts would be about AUD 25 billion). The supplier market is highly fragmented, with three companies dominating the market with a total market share of 30%. Approximately the truck parts market will grow at 6-8% CAGR in the coming years and the online channel up to 12% CAGR.

On the other hand, the growth of economic activity linked to the target market is closely linked to GDP growth, according to the company.

Fortunately for us, the three main companies (Bapcor, MaxiParts and Supply Network) are all listed on the stock exchange, making our research work easier.

Although all three companies are listed on the stock exchange, they are not fully comparable, although Supply Network and MaxiParts are currently very close.

Bapcor is a company with a revenue of more than AUD 2 billion that distributes a wider range of parts for different commercial vehicle sectors and also does B2B + B2C. This particular company in the last year grew in the truck segment a 10% with an EBITDA margin of 13%. This company has a strategy of organic growth + M&A.

Secondly, there is the interesting case of MaxiParts, which is starting from a reorganisation as a company. In its past life it did truck + trailer parts but recently sold the bad business (trailer) and is now focused only on truck. Therefore, it has become a company similar to Supply Network. However, MaxiParts has a growth strategy through acquisitions and has roughly similar revenues in the truck segment as Supply Network. In 2022, the new MaxiParts revenue grew by 14% and this year it is expected to grow by 27% (recently made a non-pure acquisition of truck parts market).

As we will see below, Supply Network does not follow the M&A strategy for growth but is purely organic growth.

Finally, we would have 70% of the market volume in the hands of hundreds of small companies scattered throughout the territory.

Strategy

The company states in its annual reports that it sees long term growth and consolidation in the market:

This long-term growth trend remains positive and, importantly, indicates substantial unrealised opportunity in our addressable market.

To recapitulate the above, the truck and bus market is complex, with a wide variety of models and manufacturers and specific uses in each area. This means that in order to compete you have to specialise and supply a large number of very specific parts in a timely manner.

The company defends its MOAT by building a distribution network to increase its scale year after year. Here are the key elements of their strategy:

Growing the Network: the company is constantly investing in increasing its distribution capacity to continue to gain scale. It is a priority to be close to its customers in order to provide the necessary support. Sometimes they invest in increasing capacity in existing locations and sometimes they continue to expand into new territories. It is important to keep the focus on solving customer problems and to establish positions where there is a high volume of truck traffic because that is where the need arises.

Develop the product catalogue: We have previously seen the complexity of the Australian-New Zealand market with a multitude of truck makes, models and increasing complexity of parts. It is key to maintain and get the right stock at all times to serve your customer. A customer wants to be able to work with all makes and models from a single supplier. The more developed the catalogue is, the more value you can bring to your customers in terms of time, cost, service and risk management. In addition, the company develops relationships with manufacturers and wholesalers in order to be able to source products at all times.

In fact one of the opportunities in the market are all the latest generation parts to improve the issue of emission reduction and efficiency. Best of all, rather than repairing, it would be to replace in accordance with the new regulations that are gradually being implemented at state level. These components are sometimes expensive and take up a lot of volume, so it is essential to develop stock capacity (in line with the first point).

This niche market is complex in nature but the location of Australia-New Zealand is relatively isolated from the rest of the world so it is in the company's DNA to work with complex supply chains. Proof of this is that during 2020 sales grew by 10%, improving EBITDA and EBIT.

Customer focus business: the company works to keep the customer forever. It is very important for them to be able to listen to the customer with their new needs on new parts. The customer values above all things service and a powerful distribution system.

IT system: key, of course, is investment in new warehousing technologies, efficient control of warehouse movements and reduction of transaction per piece. Operational efficiency is essential to make the whole thing work. The company is also investing in facilitating online transactions with its customers and making it even easier to purchase spare parts.

Organic and M&A growth: the company has been pursuing the same organic growth strategy for the past 10 years as in the near future. And if it has worked for 10 years, it will probably continue to do well for another 10 years. The company's ROIC is an impressive 30% so no external acquisitions have taken place over the last few years and they are only focused on growing organically.

Competitive advantages

The company has created competitive advantages that are difficult to match:

Network effect: the company constantly invests in operational and distribution improvements as a cornerstone to absorb its growth. In addition to an extensive catalogue thanks to long-standing relationships with suppliers and customers. As their network grows, they have more capacity to purchase parts, which in turn improves their bargaining power with suppliers. On the customer side, they will increasingly trust their management because of this capacity to obtain new parts at a price in accordance with the service received.

According to the company, no competitor can match the depth and breadth of its product range, efficient distribution and detailed catalogue.

Corporate culture: one of the company's strengths is decentralised day-to-day management in a local way with a strong regional focus.

In its 2020 report the company stated:

The Pandemic has required organisations to adapt to a changed environment, particularly geographically dispersed companies like Multispares. With travel severely restricted, the last 6 months have shown the value of our regional leadership structure wherein local teams under local management take full responsibility for local customer relationships and service standards. The very challenging international and economic backdrop has also reconfirmed the advantages of a well-integrated supply chain from source to point of fitment, allowing quick decisions to maintain supply with minimal risk.

In the same 2020 report, the company also explains that thanks to this decentralised structure, the head office was able to continue to focus on growth and even opened new centres during the same year, demonstrating the company's antifragility.

Management: in my opinion is very good and perfectly aligned with the interests of the shareholders. Their vision is very clear and seems to be easy. They are not very promotional and you can hardly find detailed information about the company's operations.

It is important to note that the CEO has been in the position since 2010 and the management owns >30% of the shares. Management salaries are adequate without abusing the shareholder.

Pricing power: the company reports that it is not the cheapest and that it is easy for it to pass on price volatility to its customers. This condition is very important for the future in an inflationary scenario.

Risks

All investments have risk although in this case it is more difficult to identify.

Probably the biggest risk is the loss of customer confidence and brand image and that its competitors will take away the company's future market share.

In the crisis of 2008 and 2020, if we look at the numbers, the turnover continued to grow, so it is a company that provides a critical service to its customers.

Final takeaways

I believe that the company can grow in the next 5 years at a rate of 20% since it occupies a privileged position over its competitors. MaxiParts should be followed closely but at the moment it has little history, only competing in the CV4+ category.

You can keep your EBIT margin at 15% thanks to the feature of passing costs on to your customers. Customers in this sector are "very happy" to pay more as long as their truck gets back up and running quickly. It is a characteristic of a critical market where price is not the main driver for the client.

Approximately according to this base scenario, we could obtain a return of 16% CAGR over a 5-year period, and we would have to add the dividend that it currently pays, which is currently 2% but has the capacity to continue increasing it progressively. So we could have between 18 - 20% CAGR over 5 years if we add the dividends.

In a low growth scenario (I don't think it will stop growing, since 2008 it has done so every year without exception) we would have a very low return and perhaps little capital loss. It would rather be an opportunity cost of using that money in another stock.

It will be very interesting to see in 5 years the competitive position of each of the three main companies in the sector. They really will be able to steal more market share from small businesses. Perhaps in 5 years between Supply Network, Bapcor and MaxiParts they can take a market share of 35 - 40% and in the next 5 years absorb up to 50% of the market becoming an unregulated oligopoly where three companies dominate the rest and with barriers to entry due to scale that are difficult to overcome. To see it we only have to wait 10 years!

I hope it has been an inspiration, a learning experience or just a good read. For those of you who are starting out, this company seems to me to be a good example because it is simple to understand, if you look at the numbers you will see that they are very clean and understandable.

See you soon and thanks for reading!

Good company

Also analyzed here in February

https://galicianinvestor.substack.com/p/supply-network-ltd