Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Key data

Founders at the helm with majority shareholding.

With sufficient scale to compete in remote areas and become a partner supplier to its customers.

Double-digit growth.

High customer retention and switching costs.

Company overview

Tasmea Limited, established in 1992, is a leading provider of engineering and maintenance services throughout Australia. The company offers a wide range of products and services, including fixed plant maintenance, electrical, mechanical and civil maintenance, and specialised skilled services.

Tasmea is headquartered in Jandakot, Western Australia.

Products and services

Tasmea specialises in four types of services:

Electrical, a range of industrial electrical services including electrical

preventive, programmed and reactive maintenance, emergency repairs, fault finding, regulatory compliance, electrical upgrades for brownfield and greenfield projects, and high voltage testing and commissioning.

Mechanical, a range of services including fixed plant mechanical shutdowns, emergency breakdowns, sustaining capital upgrades, rope access access services, lifting and rigging maintenance, blasting and painting, drill rig and blasting

painting, drill rig and blast equipment maintenance and overhaul, precision machining, specialist fabrication, installation and programmed maintenance services.

Civil, programmed and emergency mine maintenance, including civil

and concrete services, civil engineering, liquid waste management and

and plant maintenance.

Water & fluid, a range of services including geosynthetic containment

(liners and covers) and biogas collection, lubrication solutions, maintenance and repair of lubrication solutions, maintenance and repair of automatic lubrication systems and distribution of solutions, primarily for stainless steel and copper products.

Business model

The company provides highly specialised and critical services to its customers, particularly in the mining, resources and energy sectors. These services are essential to the smooth operation and longevity of critical assets. Tasmea's focus on fixed asset maintenance, emergency response and programmed maintenance ensures that its customers' operations run efficiently and with minimal downtime.

The company has a strong presence in remote locations across Australia where demand for specialised services is high. Its ability to mobilise and deploy skilled teams to these challenging environments is a key driver of its success.

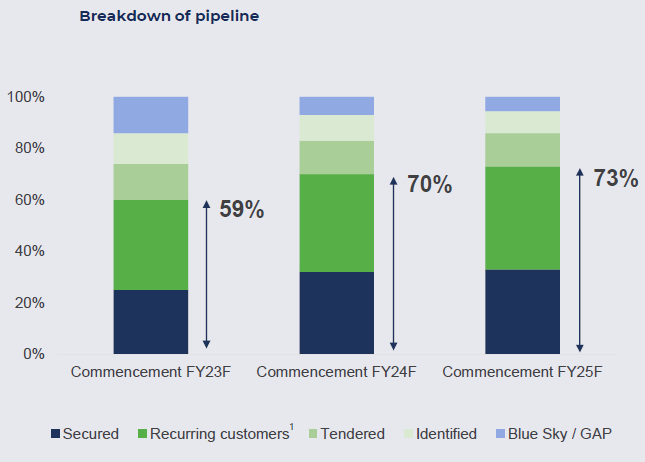

These characteristics of the business make its revenues predictable and recurring, as evidenced by an expected 73% recurrence rate next year. It also has long-term relationships with most of its customers, in some cases more than 40 years.

In order to generate income, the company signs medium and long-term contracts that specify the price per hour of work and materials. In some cases, there is not always such an agreement; the company then makes a proposal to the client for the work.

The interesting thing about maintenance companies is that they have two types of work: planned and corrective.

Planned maintenance is maintenance that can be scheduled, for example, to overhaul machinery from time to time. Here the income that the company will receive is tighter as it can be planned. But in corrective maintenance where e.g. a machine breaks down, the company can actually invoice whatever it wants, because it is impossible to have a price agreement for absolutely all scenarios and parts. Here the company earns a lot of money.

Finally, the company aims to position itself as the preferred provider to its customers in each market in which it operates, offering a range of specialised services and locations that few competitors can match.

Market trend

The total addressable market for the company is approximately $22.4 billion by 2028, although the company estimates that it can target $8.6 billion at current capacity.

Clients are looking to outsource these specialised services to third parties as it is proven to be more efficient than maintaining in-house teams in a particularly difficult territory such as remote parts of Australia.

The main growth drivers for maintenance services industry are:

Increased maintenance requirements, there is an expectation of increased maintenance requirements for existing assets in the mining and resources, and oil and gas sectors. This is driven by ageing infrastructure and the need to maintain operational efficiency. In addition, machinery technology is becoming increasingly sophisticated, which translates into the need for regular upgrades and recurrent maintenance that requires specific skills.

Private and public infrastructure investment, in both private and public infrastructure is expected to increase, which in turn will increase the demand for maintenance services.

Oil and Gas sector, maintenance services requirements are forecast to reach $3.7 billion in 2024, with a positive outlook and a CAGR of 4.1% over the next four years. This growth is driven by the demand for the commodity and the increasing maintenance requirements of recently built oil and gas infrastructure and facilities.

Power and renewable energy sector, demand for maintenance services is expected to grow, driven by the transition to renewable energy sources. Although renewable generators such as solar and wind are less maintenance intensive, they put additional pressure on transmission networks.

Defence infrastructure sector, spending is forecast to reach $0.7 billion in 2024, with a projected CAGR of 1.3% to 2028. This growth is driven by the government's ongoing maintenance requirements to keep existing infrastructure in good working order.

On the other hand, the demand for and production of commodities such as iron ore, copper and gold is expected to increase by 2028, with a corresponding increase in the use of machinery critical to their extraction.

Growth strategy

The company is building its future growth on several pillars.

These pillars include, of course, improving customer relationships, attracting new customers and expanding into adjacent services that its customers value. However, I would like to highlight the following:

Integrated services provider, Tasmea's target customers are leading companies in different sectors and these customers want to have peace of mind with their suppliers. If there is one supplier with sufficient scale to be able to perform all the specialised maintenance services, they stand a good chance of getting the whole pie. Of course, it will have to be cost competitive so that the customer does not want to chop up some of these services to smaller local companies.

Remote areas, this feature undoubtedly differentiates Tasmea from other maintenance companies, as Tasmea seeks to be a supplier with a captive client. Once the customer gets used to working with Tasmea and sees that it solves their problems by centralising everything in a single provider, it is difficult for them to be motivated to make changes.

M&A, the company's objective is to make small strategic acquisitions to gain new customers, new territories or new services. The profile of the company to be acquired is one that is not too large and small enough for private equity to enter.

Competitive advantage

I would mainly highlight two:

Total Cost of Ownership, the company offers something very valuable that few companies can, which is to optimise the total cost of ownership for the customer by offering a wide range of services and geographies through a single point of contact. Tasmea has a large network of professionals (internal and external) that is difficult to replicate.

Imagine a large company like Siemens having to constantly identify, manage and plan with smaller companies for different types of services and locations. This is a very high cost for the customer, who wants to be left alone and manage the maintenance of his installations in a comfortable and optimal way.

Switching costs, Tasmea has historically been able to retain its customers for a long time, and retention rates are increasing. This is logical given the company's focus on operating in remote areas where the choice of suppliers is limited. It should be remembered that when it comes to large and complex customers, less professional companies will not be able to work with them. If Tasmea is able to become the preferred maintenance provider for these companies, it will be very difficult to lose this customer.

On the other hand, entry to new competitors may seem easy, as any specialist can approach companies and offer his or her services.

What is not so easy is accepting the value proposition of a competitor that is unknown and has no relationship with the customer, as it requires resources and scale that are difficult for companies like Tasmea to match.

As Tasmea acquires the best competing companies, it will also eliminate existing competitors, and once it has an interesting market share, there is likely to be no way back for new companies to compete.

Management

Established in 1999, it still has its original founders. Because it is an exceptional business, the original founders retain a high percentage of shares in the portfolio.

While this is no guarantee of success, it does provide a layer of security for our interests.

Both founders have a salary of around $800k per year plus some in-kind benefits.

Compared to the equity interests they own, they are aligned with the interests of their shareholders.

It is interesting to note that in their medium to long term plan they have ambitious targets to reach an EBIT of $110 million by 2028, to be remunerated in the form of shares (the founders are not involved here). The current EBIT is $55 million.

Risks

I think there are several risks to the business.

The first is that Tasmea is really a turnaround from a construction-based company with fixed contracts to a business model of recurring revenue and providing a critical service to the customer. This is all well and good, but it leaves us with a track record limited to six years.

Secondly, more than a risk; it is my long-term concern. The basis of Tasmea's thesis is that as it specialises in certain technical services and remote areas this creates a kind of monopolistic environment that Tasmea can exploit.

This is working for them in Australia but what if they wanted to expand into the US or Canada?

Five years from now I am not worried because they have a lot of land to continue to grow aggressively but after that it will be difficult to continue to grow at this rate.

I wish I could speed up the time to see how they do in 10 years time!

Its best comparable

Mader is a company dedicated to the preventive and corrective maintenance of heavy equipment for mining companies. Recently, it has expanded its business model to include other types of maintenance in Australia and the US.

Although they do not maintain exactly the same machinery, both companies rely on people, vehicles and tools to carry out their work. In addition, their main customers are mining companies. An important detail is that Mader has grown organically, while Tasmea has grown more through acquisitions.

Comparing the fundamentals of both companies we can see that their EBITDA has some pressure on prices; they have competition in the market. However, their ROE and ROCE are considerably good, indicating a well-managed businesses which generates attractive returns for shareholders.

Tasmea has been growing at a CAGR of 20% in the last six years and is expected to grow at least until 2028, according to the company.

Its net debt/EBITDA ratio, it is below <1 and is generating FCF in the range of 15-20 million to partially fund new acquisitions.

Tasmea capex during 2024 accounted for around 50% of the cash from operations for machinery and vehicles. This point is important to monitor to ensure that the company has FCF available for further acquisitions.

Final takeaways

It is currently trading at $2.58 on a forward PE of 13x and I think it could double in three years. Also, if the company continues to perform well, we could have a case here for another 10 years of double-digit growth.

For the first 5 years I am looking at around 20% and an EBIT margin of 13%. In the next 5 years, I think the growth will have to be resumed, as it will be more difficult to make relevant acquisitions as it is now.

The weak points of the thesis are the company's low stock market track record and its capex %, which is not ideal for the type of stock I like. It is also necessary to monitor the level of share dilution, which could be initially high and then diminish as the company gains access to better financing and FCF.

As always, I like this type of stock where the founders remain in charge and own a large number of shares as an extra layer of security. .

If you like it, click on the button to subscribe and receive notifications of new future posts.

Best regards and see you soon!

Great company at a fair price :)