YouGov plc (UK:YOU)

Fast-growing market research company

Robin research covers small and medium-sized companies with an attractive risk/reward profile mainly in Europe and North America.

Disclaimer: this is neither a buy and sell recommendation nor private advice. Investing in companies carries a risk of permanent loss of capital. Before investing in a company do your own research.

Summary

Mid-term revenue growth 20%

Organic growth and acquisitions

The co-founder holds 7% of the shares

Expansion of operating margin from 17 to 25% in the medium term

Company overview

YouGov is an online research data and analytics technology company that helps brands, media owners and government agencies to explore, plan, activate and track their marketing activities better.

The company is co-founded in 2000 by Stephan Shakespeare and Nadhim Zahawi and is headquartered in London, the United Kingdom.

What it does?

The company collects, measures and analyses data, opinions and behaviours that it extracts from its proprietary online research panels.

An online research panel is a sample of persons who have agreed to complete surveys via the Internet.

Nowadays, with the rise of the Internet, social networks and the invasion of devices in our daily lives, collecting the opinions of groups of people online is the fastest, cheapest and easiest way to obtain results. Of course, it is not without risks such as fraud.

With all this data, the company analyses, selects, sorts and makes the results available to the client. These results can also be cross-referenced with other data from the people on the panel to enrich the studies or to periodically monitor how the trend is changing, for example.

Key products and services

The company is constantly developing new products and services. Here we will talk about the most representative ones without being an exhaustive list:

Data Products: provides syndicated data products under subscription basis.

YouGov BrandIndex: subscription service to track and analyse brand perception.

YouGov Safe: provides consumer online behavioural data.

YouGov Profiles: profile database of consumer metrics.

Syndicated data products (SDP) it is a form of secondary research that allows organisations to find insights into products, services, industries, competitors, and markets through existing information and sources.

Research

Data services: is the division of online surveys, quick responses and low cost for the client. Here the client has two options: 1) YouGov Surveys a self-service tool for the client or 2) YouGov Omnibus where researches are used to start the study.

Custom research: qualitative and quantitative deep-dive studies tailored by sector including specialists in the field.

CPS: household purchase data in Europe. It is a recent acquisition and the largest YouGov has made so far. With this acquisition, customers will be offered every single step of the shopper journey – from what they buy and where, to why and how they make their purchases.

Business model

The business model is summarised in the fact that companies need to know what people think in order to make their marketing campaigns more efficient, get a better return and make money. For a company, especially in B2C, it is vital to know what their customers think about them, about the competition, about their products, what needs are not being met and to monitor the brand.

Companies need to generate notoriety and brand image and the only way to know if their actions are on the right track is to ask people.

Therefore, YouGov's business is to provide timely, reliable, cost-efficient and accurate information to help its customers make decisions. To achieve this, the company has created a platform or ecosystem with the aim of solving all its customers' problems at the same point.

On the other side, we have the key piece to make the machinery work, the research panel. It is essential to take care of the panel and make it grow, as it is the source of data that will ensure the quality of the information that you will later sell to your end customers.

In the end, what is needed in this market is a constant flow of data, lots of data, which can then be exploited through technology. The company defines it as "living data".

YouGov operates globally and is present on all continents.

The USA is particularly strategic as it is the region of the world with the largest budget dedicated to the established research market where the company mainly operates.

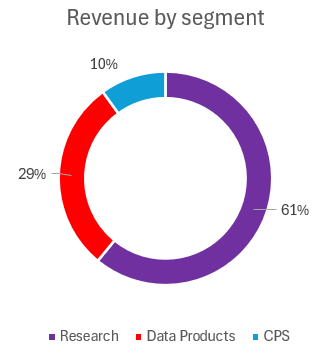

If we look at the categories in which the company makes the most money, Research generates the most volume, followed by Data Products. Data products is very interesting as it doubles the profit margin over Research and also works on a recurring subscription basis guaranteeing a constant cash flow to the company.

CPS is in the process of integration and optimisation and we are likely to see good news in the near future about its performance.

Finally, we note that the company is well diversified across sectors, thus spreading customer risk. It is interesting to note that it concentrates a large number of customers from the technology sector.

Market trend

The global market research industry is valued at $129 billion. A market that in recent years has moved from telephone calls and face-to-face interviews to managing everything digitally and online. It has therefore undergone a drastic change in recent years.

As times have changed, the pie has gotten bigger and what was a classic volume of more customised surveys and market research has transformed into a greater demand for technology, syndicated data and the ability to conduct autonomous client research.

In the most core Established research part, we observe that the United States has a huge presence, followed by the rest of the countries. Growth is moderate but higher than population growth.

On the other hand, if we look at the rest of the pie, we will see double-digit growth with a high technological component. In the end what the customer wants is to be able to get information, in a fast, credible and enriched way and to track market trends as they change over time.

In addition, customers request information in real time and at a low price. This can be provided by artificial intelligence. In fact, artificial intelligence is an emerging opportunity for this market, as one of the pillars for it to work properly is to obtain a large amount of data, structured and reviewed.

Competition

YouGov is mainly active in the Established research market. In this market we can find the main companies listed. These companies sometimes still do old business via telephone or face-to-face sessions whereas YouGov is 100% online.

We can say that competitors are following a similar strategy which consists of:

Buy competitors

Undertake share buybacks

Repaying debt

The sector is therefore undergoing a real revolution in terms of market consolidation and transformation. The combined turnover of these four companies adds up to $12bn and the total Established research market is $44 bn. In other words, the four largest companies only have 26% of the total.

If we look at revenue growth, YouGov is the best performer with a steady double-digit growth rate. Really impressive. On the other hand, if we analyse ROE, they are all more or less in the same range, and where YouGov stands out is in ROCE, which includes acquisitions. Finally, last year's EBITDA margins also stand out and would rank second.

Mid-term growth strategy

The company has an established growth plan with very concrete numbers:

Turnover of at least $850 m.

Operating Profit Margin of 25%.

This means achieving more than double the current turnover and improving margins from the current 17% to 25% within 4 to 5 years.

Is it feasible? The company has had two further growth plans in recent years. Both promises were exceeded, so we can say that the company keeps its promises.

To achieve this, it will be based on:

Panel quality: this is indispensable. The great fear of the clients is to get false answers and fraud as they would be contaminating the valuable answers and with that a bad result. Thanks to technology this can be improved. In the case of YouGov, it only uses its own panel of 26 m panellists where it has absolute control over the quality. This by nature has to attract new customers and strengthen the relationship with existing ones.

Product innovation: being a 100% online business, the company must invest in R&D in order not to fall behind its competitors. This seems to be a strength of YouGov as it has managed to grow in double digits for many years with small acquisitions. The idea is to adapt the YouGov platform to the new self-service trends that companies are demanding as one of its strengths.

Commercial rigour: although working with a wide variety of customers, the company has found that 80% of the time they are only working with a single division of that company. The idea is to extend and gain more budget from other divisions. On the other hand, to continue to increase and attract new clients to their platform.

USA expansion: we have previously noted that the USA is the strongest market in terms of Established research. Moreover, a significant percentage of YouGov's clients have operations there. Although this may be a risk due to high exposure to a single market, it also has a higher growth component than in other markets.

M&A: of course, continue to add competitors to the YouGov network as a means to reach new customers as quickly as possible and to cross-sell products.

Competitive advantage

The company identifies with the following points for building its MOAT:

Zero-party panellist relationship

Brand reputation and relationship

Product and technology innovation

Largest research network

The truth is that all of them convince me to prevent new competitors from appearing on the market. I am less convinced when it comes to competition from existing competitors.

In my view, management is the key element of this company. If you want to call it corporate culture, that's fine with me too.

I think the initial vision back then in 2000 was so right that they always knew where they were going. This growth, this M&A activity, this expansion of margins and this gain in market share is unmatched by any other company in the market.

Management

The company has Stephan Shakespeare as co-founder and non-Executive Chair. He has been developing the business for more than 20 years. The Shakespeare family owns approximately 7% of all shares in the company, about $100 m at the current share price.

Managers have a fixed salary of around 570 - $440k per annum plus incentives. The most important part for them is the bonus linked to the company's operating margin growth and the 3Y target of CAGR growth of the company's EPS.

Note in the chart above that if the company does not achieve growth of at least 17.5% CAGR in 3Y, they miss out on this lucrative part of the bonus.

So I would say that the incentives that the company has put in place for its management are aligned with the interests of the shareholders.

Risks

The biggest risks are reputation and loss of confidence in the data provided by the company. Companies need to carry out studies, surveys, etc. on a recurring basis, as this is essential to be able to sell. If the information is not valid, the client may lose sales and even lose reputation if they orientate their products incorrectly. Therefore, it is a critical and indispensable service in the market.

The other risk that concerns me is the issue of procurement. That the company could make an acquisition that is too large and with debt. This would be problematic and a point to watch. So far this has never happened.

Final takeaways

YouGov is an amazing business; it has a very interesting growth model. From its inception it was clear that it had to be online and this vision is what has made it succeed by always investing in the development of its platform.

I like numbers more than words. What a pleasure it is to see this table, the only, the only time in a series of about 20 years was in 2010 where it decreased by (0.2%). Of these about 20 years in 13 years it has grown by double digits. I don't know many businesses of this size with such stable growth.

The development of the FCF is equally impressive, less constant but with more pronounced growth. A money-making machine.

It is also an asset-light business, although in the future it will need to increase R&D to further develop its technology. However, this helps it to be increasingly difficult to beat by existing or new competitors.

I hope you enjoyed the article. If so, leave a like or a comment and don't forget to subscribe! See you next time!

You can easily find it in the company's FY reports. Search for "Number of shares".

I also use Tikr which in this case is correct.

The latest FY23 data are 109.6 (basic) and 112.1 (diluted).

Good analysis. Have followed yougov for a bit and now opened a mid sized position at my end. Average price of 403p. To me it seems that CPS was not a great acquisition. They paid >300m for the business and seems like the revenue is below 135m that they said in the initial strategic rationale announcement and the operating profit would show multiple well into double digits. The research and data products on an operating profit basis have both struggled and the CEO is now gone. I am now down 15%, not helped recently by RNS saying "low single digit" growth which I think means that underlying profitability is still going down. Overall, think the business is fairly priced so will hold onto see how it develops over the next 12-24 months. Any latest thoughts from you as you have clearly done a deep dive into the company?